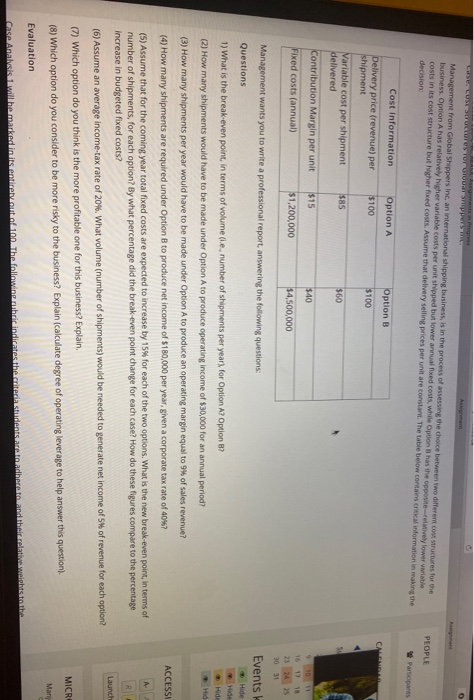

SECUESCLUSTOF Omppu Management from Global Shippers Inc, an international shipping business, is in the process of assessing the choice between two different cost structures for the business. Option A has relatively higher variable costs per unit shipped but lower arfoed costs, while Option has the oppositely lower variatie costs in its cost structure but higher fixed costs. Assume that delivery selling prices per unit are constant. The table below contact information in making the decision PEOPLE Participants Option A Option B CANA $100 $100 Cost Information Delivery price (revenue) per shipment Variable cost per shipment delivered $85 $60 s Contribution Margin per unit $15 $40 10 11 12 13 Fixed costs (annual) $1,200,000 $4,500,000 30 31 Management wants you to write a professional report answering the following questions: Questions Events Hide Hide Hide Hid 1) What is the break-even point, in terms of volume (ie, number of shipments per year), for Option A? Option B? ACCESSI . (2) How many shipments would have to be made under Option A to produce operating income of $30,000 for an annual period? (3) How many shipments per year would have to be made under Option A to produce an operating margin equal to 9 of sales revenue? (4) How many shipments are required under Option B to produce net income of $180,000 per year, given a corporate tax rate of 40%? (5) Assume that for the coming year total fixed costs are expected to increase by 15% for each of the two options. What is the new break-even point, in terms of number of shipments, for each option? By what percentage did the break-even point change for each case? How do these figures compare to the percentage Increase in budgeted fixed costs? (6) Assume an average income tax rate of 20%. What volume (number of shipments) would be needed to generate net income of 5% of revenue for each option? (7) Which option do you think is the more profitable one for this business? Explain. (8) Which option do you consider to be more risky to the business? Explain (calculate degree of operating leverage to help answer this question). B Launch MICRO Man Evaluation Case Analisis will be marked in its entirely out of 100. The following rubric indicates the criteria students are made to and the relativitate