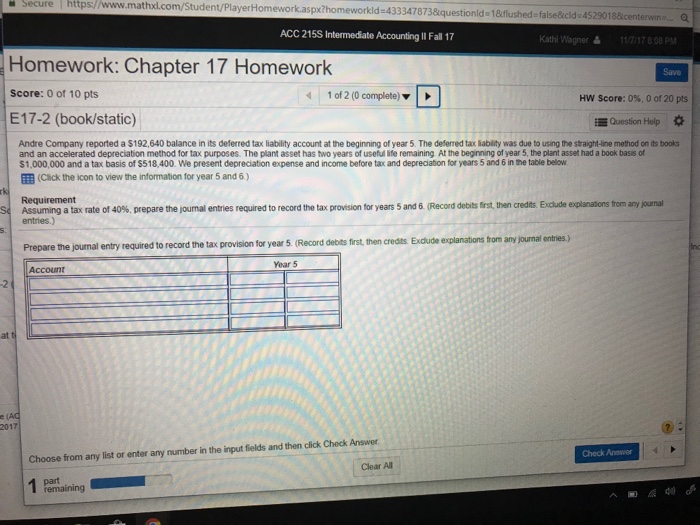

Secure https:/www.mathxd.com/Student/PlayerHomework.aspx? rkld 433347873 &question!da 1 &flushed false&cid=4529018¢en ACC 215S Intermediate Accounting ll Fall 17 Kathi Wagner Homework: Chapter 17 Homework Score: 0 of 10 pts E17-2 (book/static) Save 1012(0 complete- 4 HW Score: 0%, 0 of 20 pts Question Help * Andre Company reported a $192,640 balance in its deferred tax liability account at the beginning of year 5. The deferred tax lability was due to using the straight-line method on its books and an accelerated depreciation method for tax purposes. The plant asset has two years of useful life remaining At the beginning of year 5, the plant asset had a book basis of $1,000,000 and a tax basis of $518,400. We present depreciation expense and income before tax and depreciation for years 5 and 6 in the table below (Click the icon to view the information for year 5 and 6) on for years 5 and Record de its frst en credts. E ude explar at ns from any pornal Assuming a tax ate o 40%, prepare the entries.) mal entries requured to record he tax pro Prepare the journal entry required to record the tax provision for year 5. (Record debis frst then credts Exdude explanations from any journal entries) Year 5 Account 2 at 201 Check Anewer Choose from any list or enter any number in the input fields and then click Check Answer Clear All Secure https:/www.mathxd.com/Student/PlayerHomework.aspx? rkld 433347873 &question!da 1 &flushed false&cid=4529018¢en ACC 215S Intermediate Accounting ll Fall 17 Kathi Wagner Homework: Chapter 17 Homework Score: 0 of 10 pts E17-2 (book/static) Save 1012(0 complete- 4 HW Score: 0%, 0 of 20 pts Question Help * Andre Company reported a $192,640 balance in its deferred tax liability account at the beginning of year 5. The deferred tax lability was due to using the straight-line method on its books and an accelerated depreciation method for tax purposes. The plant asset has two years of useful life remaining At the beginning of year 5, the plant asset had a book basis of $1,000,000 and a tax basis of $518,400. We present depreciation expense and income before tax and depreciation for years 5 and 6 in the table below (Click the icon to view the information for year 5 and 6) on for years 5 and Record de its frst en credts. E ude explar at ns from any pornal Assuming a tax ate o 40%, prepare the entries.) mal entries requured to record he tax pro Prepare the journal entry required to record the tax provision for year 5. (Record debis frst then credts Exdude explanations from any journal entries) Year 5 Account 2 at 201 Check Anewer Choose from any list or enter any number in the input fields and then click Check Answer Clear All