Answered step by step

Verified Expert Solution

Question

1 Approved Answer

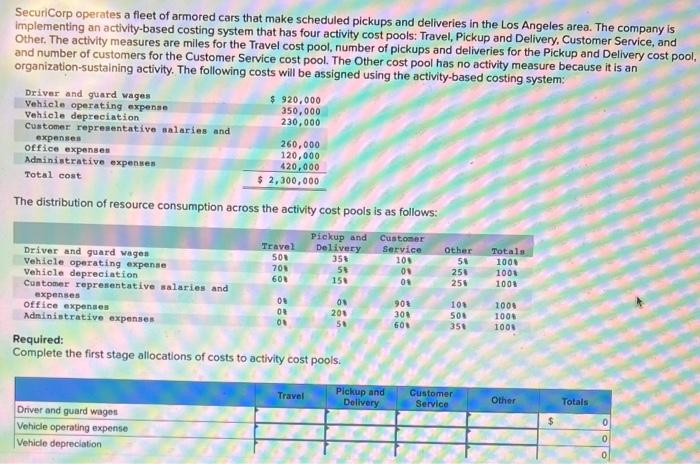

SecuriCorp operates a fleet of armored cars that make scheduled pickups and deliveries in the Los Angeles area. The company is implementing an activity-based

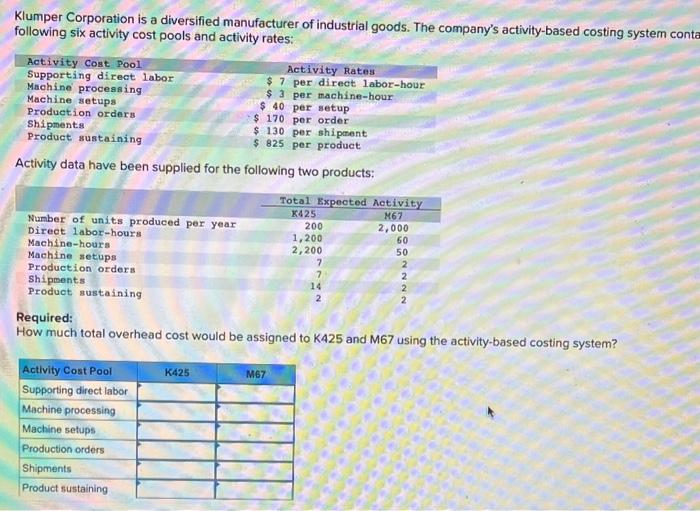

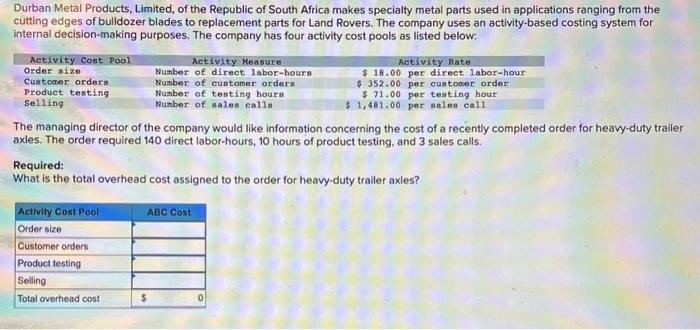

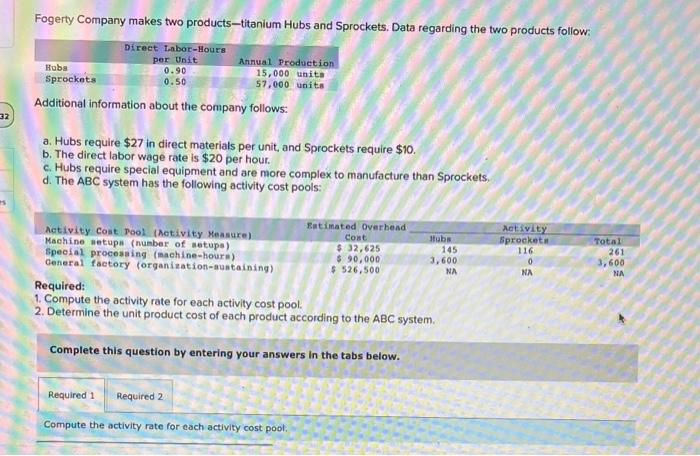

SecuriCorp operates a fleet of armored cars that make scheduled pickups and deliveries in the Los Angeles area. The company is implementing an activity-based costing system that has four activity cost pools: Travel, Pickup and Delivery, Customer Service, and Other. The activity measures are miles for the Travel cost pool, number of pickups and deliveries for the Pickup and Delivery cost pool, and number of customers for the Customer Service cost pool. The Other cost pool has no activity measure because it is an organization-sustaining activity. The following costs will be assigned using the activity-based costing system: Driver and guard wages Vehicle operating expense Vehicle depreciation Customer representative salaries and expenses office expenses 260,000 Administrative expenses 120,000 420,000 Total cost $ 2,300,000 The distribution of resource consumption across the activity cost pools is as follows: Pickup and Customer Service 10% 0% 09 Driver and guard vages Vehicle operating expense Vehicle depreciation Customer representative salaries and expenses office expenses Administrative expenses $ 920,000 350,000 230,000 Driver and guard wages Vehicle operating expense Vehicle depreciation Travel 50% 70% 60% 08 08 08 Delivery 35% 59 15% Required: Complete the first stage allocations of costs to activity cost pools. Travel ON 201 58 Pickup and Delivery 90% 30% 60% Other 58 25% 25% 10% 50% 35% Customer Service Totals: 100% 100% 100% 100% 100% 100% Other Totals OOO Klumper Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system conta following six activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Machine processing Machine setups Production orders Shipments $ 130 per shipment Product sustaining $ 825 per product Activity data have been supplied for the following two products: Number of units produced per year Direct labor-hours Machine-hours Machine setups Production orders Shipments Product sustaining Activity Rates $7 per direct labor-hour $3 per machine-hour $ 40 per setup $ 170 per order Activity Cost Pool Supporting direct labor Machine processing Machine setups Production orders Shipments Product sustaining K425 Total Expected Activity X425 M67 2,000 M67 200 1,200 2,200 7 7 14 60 50 Required: How much total overhead cost would be assigned to K425 and M67 using the activity-based costing system? 2 2 2 2 Durban Metal Products, Limited, of the Republic of South Africa makes specialty metal parts used in applications ranging from the cutting edges of bulldozer blades to replacement parts for Land Rovers. The company uses an activity-based costing system for internal decision-making purposes. The company has four activity cost pools as listed below: Activity Cost Pool Order size Customer orders Product testing Selling Activity Measure Number of direct labor-hours Number of customer orders Number of testing hours Number of sales calls The managing director of the company would like information concerning the cost of a recently completed order for heavy-duty trailer axles. The order required 140 direct labor-hours, 10 hours of product testing, and 3 sales calls. Activity Cost Pool Order size Customer orders Product testing Selling Total overhead cost Required: What is the total overhead cost assigned to the order for heavy-duty trailer axles? Activity Rate $18.00 per direct labor-hour $ 352.00 per customer order $71.00 per testing hour $ 1,481.00 per sales call ABC Cost $ 32 Fogerty Company makes two products-titanium Hubs and Sprockets. Data regarding the two products follow: Direct Labor-Hours per Unit 0.90 0.50 Annual Production 15,000 units 57,000 units Huba Sprockets Additional information about the company follows: a. Hubs require $27 in direct materials per unit, and Sprockets require $10. b. The direct labor wage rate is $20 per hour. c. Hubs require special equipment and are more complex to manufacture than Sprockets. d. The ABC system has the following activity cost pools: Activity Cost Pool (Activity Measure) Machine setups (number of setups) Special processing (machine-hours) General factory (organization-sustaining) Required 1 Estimated Overhead Cost $32,625 $90,000 $ 526,500 Required 2 Compute the activity rate for each activity cost pool. Hubs Required: 1. Compute the activity rate for each activity cost pool. 2. Determine the unit product cost of each product according to the ABC system. Complete this question by entering your answers in the tabs below. 145 3,600 NA Activity Sprockets 116 305 NA Total 261 3,600 NA

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Vehicle Operating expenses Customer representative salari...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started