Answered step by step

Verified Expert Solution

Question

1 Approved Answer

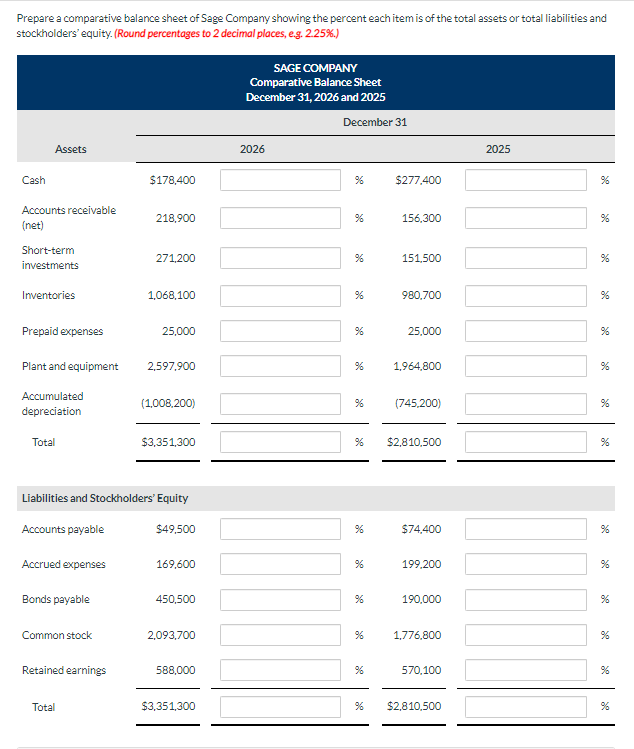

Prepare a comparative balance sheet of Sage Company showing the percent each item is of the total assets or total liabilities and stockholders' equity.

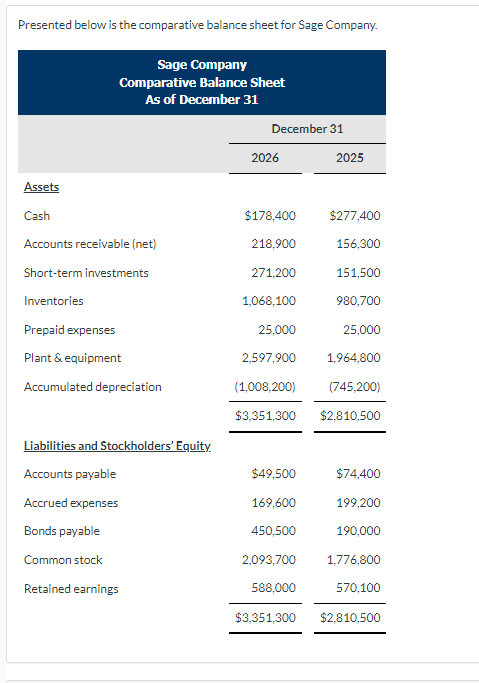

Prepare a comparative balance sheet of Sage Company showing the percent each item is of the total assets or total liabilities and stockholders' equity. (Round percentages to 2 decimal places, e.g. 2.25%.) Cash Assets Accounts receivable (net) Short-term investments Inventories Prepaid expenses Plant and equipment Accumulated depreciation Total Common stock Retained earnings $178,400 Total 218,900 271,200 1,068,100 25,000 2,597,900 Liabilities and Stockholders' Equity Accounts payable Accrued expenses Bonds payable (1,008,200) $3,351,300 $49,500 169,600 450,500 2,093,700 588,000 $3,351,300 SAGE COMPANY Comparative Balance Sheet December 31, 2026 and 2025 2026 December 31 % % % % % % % % % % % % % $277,400 156,300 151,500 980,700 25,000 1,964,800 (745,200) $2,810,500 $74,400 199,200 190,000 1,776,800 570,100 $2,810,500 2025 % % % % X % % % % % % Presented below is the comparative balance sheet for Sage Company. Sage Company Comparative Balance Sheet As of December 31 Assets Cash Accounts receivable (net) Short-term investments Inventories Prepaid expenses Plant & equipment Accumulated depreciation Liabilities and Stockholders' Equity. Accounts payable Accrued expenses Bonds payable Common stock Retained earnings December 31 2026 2025 $277,400 156,300 $178,400 218,900 271,200 151,500 1,068,100 980,700 25,000 25,000 2,597,900 1,964,800 (1,008,200) (745,200) $3,351,300 $2,810,500 $49,500 $74,400 169,600 199,200 450,500 190,000 2,093,700 1,776,800 588,000 570,100 $3,351,300 $2,810,500

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Workings for calculating the percentages for each item 2026 Cash Cash balance is 178400 Total assets are 3351300 To calculate percentage Cash balance ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started