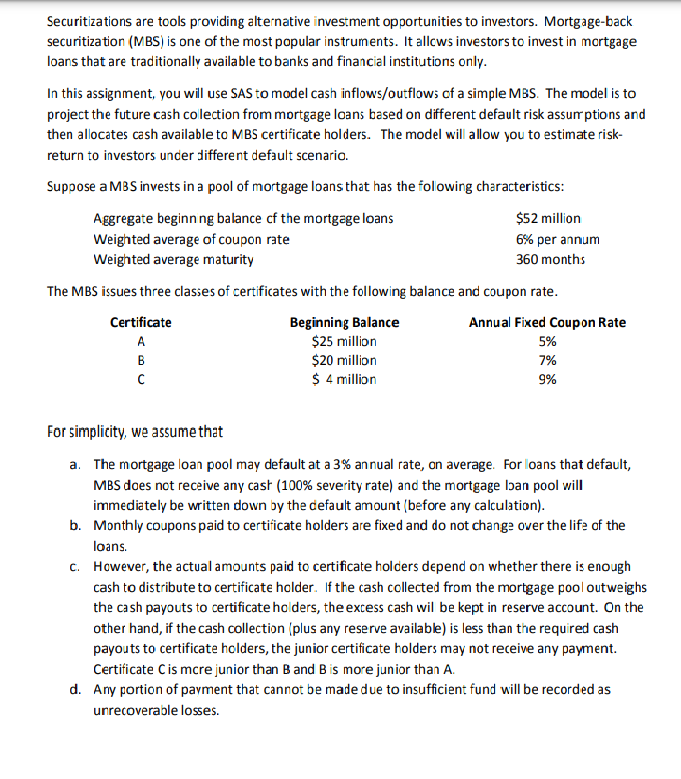

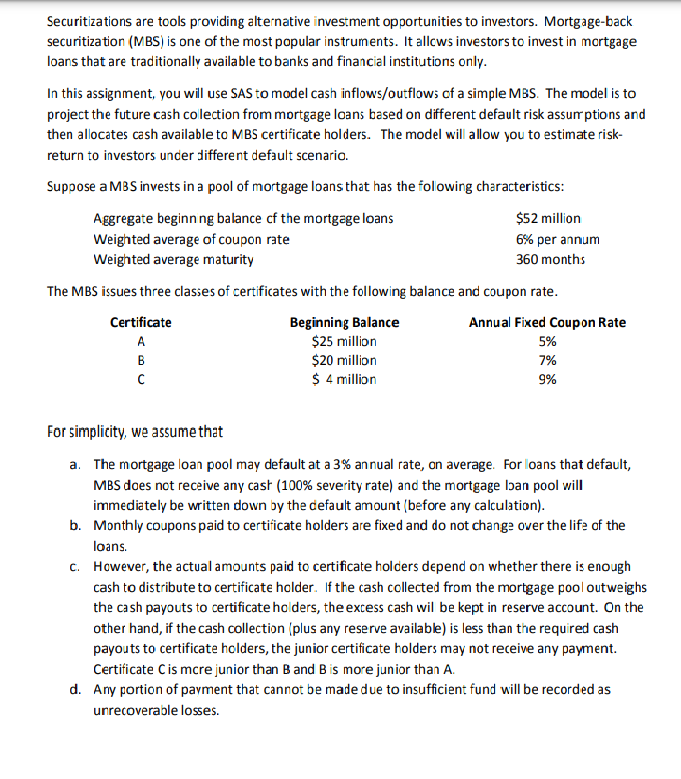

Securitizations are tools providing alternative investment opportunities to investors. Mortgage-back securitization (MBS) is one of the most popular instruments. It allows investors to invest in mortgage loans that are traditionally available to banks and financial institutions only. In this assignment, you will use SAS to model cash inflows/outflows of a simple MBS. The model is to project the future cash collection from mortgage loans based on different default risk assumptions and then allocates cash available to MBS certificate holders. The model will allow you to estimate risk- return to investors under different default scenario. Suppose a MBS invests in a pool of mortgage loans that has the following characteristics: Aggregate beginning balance of the mortgage loans Weighted average of coupon rate $52 million 6% per annum 360 months Weighted average maturity The MBS issues three classes of certificates with the following balance and coupon rate. Beginning Balance $25 million $20 million $ 4 million Certificate A B Annual Fixed Coupon Rate 5% 7% 9% For simplicity, we assume that a. The mortgage loan pool may default at a 3% annual rate, on average. For loans that default, MBS does not receive any cash (100% severity rate) and the mortgage ban pool will immediately be written down by the default amount (before any calculation). b. Monthly coupons paid to certificate holders are fixed and do not change over the life of the loans. c. However, the actual amounts paid to certificate holders depend on whether there is enough cash to distribute to certificate holder. If the cash collected from the mortgage pool outweighs the cash payouts to certificate holders, the excess cash wil be kept in reserve account. On the other hand, if the cash collection (plus any reserve available) is less than the required cash payouts to certificate holders, the junior certificate holders may not receive any payment. Certificate C is mcre junior than B and B is more junior than A. d. Any portion of payment that cannot be made due to insufficient fund will be recorded as unrecoverable losses. Securitizations are tools providing alternative investment opportunities to investors. Mortgage-back securitization (MBS) is one of the most popular instruments. It allows investors to invest in mortgage loans that are traditionally available to banks and financial institutions only. In this assignment, you will use SAS to model cash inflows/outflows of a simple MBS. The model is to project the future cash collection from mortgage loans based on different default risk assumptions and then allocates cash available to MBS certificate holders. The model will allow you to estimate risk- return to investors under different default scenario. Suppose a MBS invests in a pool of mortgage loans that has the following characteristics: Aggregate beginning balance of the mortgage loans Weighted average of coupon rate $52 million 6% per annum 360 months Weighted average maturity The MBS issues three classes of certificates with the following balance and coupon rate. Beginning Balance $25 million $20 million $ 4 million Certificate A B Annual Fixed Coupon Rate 5% 7% 9% For simplicity, we assume that a. The mortgage loan pool may default at a 3% annual rate, on average. For loans that default, MBS does not receive any cash (100% severity rate) and the mortgage ban pool will immediately be written down by the default amount (before any calculation). b. Monthly coupons paid to certificate holders are fixed and do not change over the life of the loans. c. However, the actual amounts paid to certificate holders depend on whether there is enough cash to distribute to certificate holder. If the cash collected from the mortgage pool outweighs the cash payouts to certificate holders, the excess cash wil be kept in reserve account. On the other hand, if the cash collection (plus any reserve available) is less than the required cash payouts to certificate holders, the junior certificate holders may not receive any payment. Certificate C is mcre junior than B and B is more junior than A. d. Any portion of payment that cannot be made due to insufficient fund will be recorded as unrecoverable losses