Question

Security Incident Response and Recovery Question: How would you improve the companys business continuity plan in order to prevent or at very least minimize the

Security Incident Response and Recovery

Question: How would you improve the companys business continuity plan in order to prevent or at very least minimize the downtime/interruption of COGs claims processing?

Description : Executing a tabletop scenario

Execute the tabletop exercise from the point of view of the organization. They can make reasonable assumptions. The goal is for your organization to get back to a stable operating situation following the incident.

Participants in the group must assume one of the following roles:

IT Manager Focus on the IT systems to support the business

Execute tabletop exercise from the point of view of the above role. You must write 1/2 to 1 page from the perspective of this role on how you would handle the incident. the response must be coordinated with SOG business operations.

Evaluation Criteria

tabletop execution from the perspective of the IT Manager Focus on the IT systems to support the business

COMPANY DESCRIPTION

General Overview

Primary business and operations

COG GENERAL INSURANCE INC. (COG) is a provider of health, dental, home and automobile insurance to over 150,000 Canadian customers in located Ontario, Quebec and Atlantic Canada. Their customer call center and computer-based operations, including 850 employees, are headquartered in Halifax, Nova Scotia. COG also maintains a small number of regional offices and independent agents throughout its customer territory. COG does not have a formal business continuity plan but has been diligent in ensuring that backups of their key systems are taken, with copies sent offsite. An informal agreement with the building owner of their Quebec City location would permit them to quickly, and temporarily expand their office space if required. Additionally, COG makes use of Microsoft 365 for their email, SharePoint file storage, and calling/collaboration via Teams.

Client profile

COGs clients are predominantly institutional group plan members (i.e. company or other group insurance) as well as direct retail customers. COG has recently expanded to providing automobile and property insurance to small and medium businesses.

Suppliers and Partners

COGs principal business suppliers include:

Institutional partners (as a source of group plan members)

Banks and other financial partners

Law firms

Private investigators

3rd-party specialists (engineers, forensic specialists, doctors/medical experts, etc.)

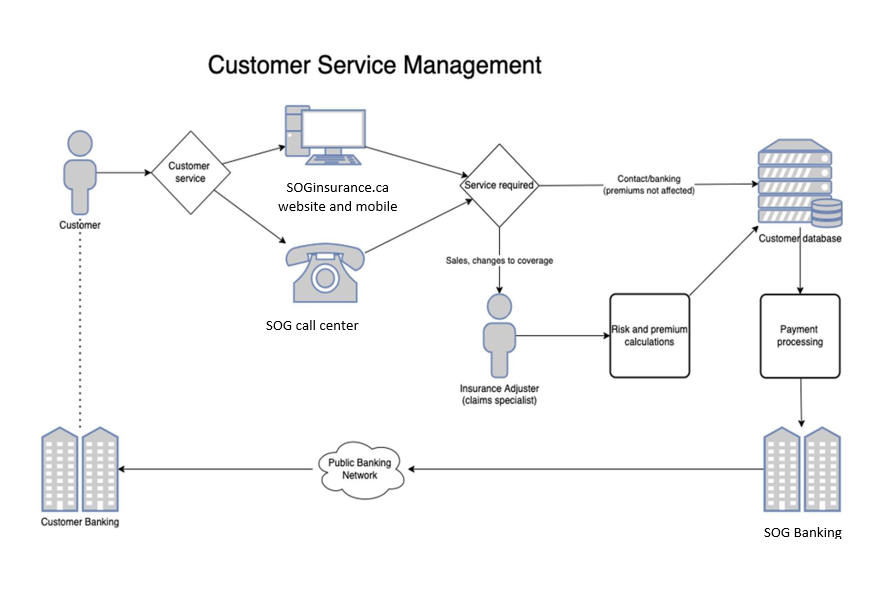

Key Business Processes: Customer Service Management (non-claims)

Clients can contact COG Customer Service through the 1-888-NEED-COG customer call center during regular business hours (Monday to Friday, 8:00am to 9:00pm), or by using either the COGinsurance.ca web portal or COGs mobile application (available on iPhone and Android) available 24 hours per day, 365 days per year.

COG Customer Service will:

Enroll new customers, calculate premiums, setup automated banking withdrawals for payments

Perform maintenance of customer profiles as required (change of address, family details, updated banking info

Make changes to insurance products purchased and levels of coverage

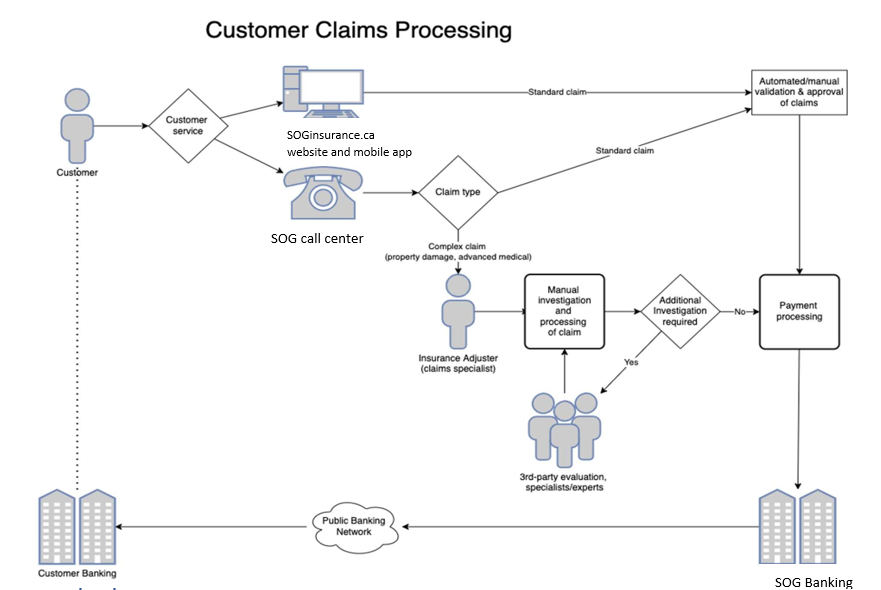

Customer claims processing

The COG Customer Claim Center is available 24 hours per day, 365 days per year by telephone at 1-888-GOT-SOGG or through the COGinsurance.ca web portal and COGs mobile application. Most standard claims, such as for prescription medications and dental fees, are processed automatically with customer reimbursements through direct deposit normally taking place within 2 to 3 business days.

Automobile, property, and complex health-related claims are redirected to a COG Customer Claims Centre agent for processing:

The agent will first perform a triage of claim, validating the customers identity, collect supporting information, and ensure that any emergency needs of the customer are addressed

The agent assigns the claim to a claims specialist (adjuster) within the appropriate department based on the type of claim

In more complex claims scenarios involving severe medical issues, extensive property damage, or any combination of claim types (e.g. a combined medical and automobile claim) the adjuster may require multiple visits with the customer and/or engage the services 3rd party specialists to properly process the claim

Upon resolution of a claim, payment is issued to the customer through electronic funds transfer (banking direct deposit). In some cases, payment is arranged directly to a lien/mortgage holder, or any 3rd party identified as the beneficiary.

Incident affecting the organization

While normally not affected by severe weather events, the 2022 tropical storm season has been particularly harsh. A category 5 storm named Hurricane Martin has moved up along the Atlantic coast and has made landfall with the eye of the storm centered on Nova Scotia. The storms +215km/h winds, combined with rain and flooding have caused widespread destruction across the Atlantic Canada. Electrical power grids and telecommunication lines have been downed with utility companies announcing that it may take 2 weeks or longer to restore services. Additionally, COGs headquarters have suffered heavy damages due to water infiltration and high winds affecting the structural integrity of their building. Engineers and architects inspections will be required to ensure that the building is safe for re-entry.

As most COG employees working from the Halifax headquarters also live directly in the region, they too have been negatively affected by the storm. More than half of the employees are unable to leave their homes due to damages (home, automobile), and the majority do not have electricity, phone/cellular, or internet services at this time. Local authorities have declared a state of emergency. COG is the largest provider of home and automobile insurance in the region and as telecommunication services are restored, they are expected to receive an unprecedented number of claims during the coming days.

Cilctamar Cansina Manamamant Customer Claims Processing Cilctamar Cansina Manamamant Customer Claims ProcessingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started