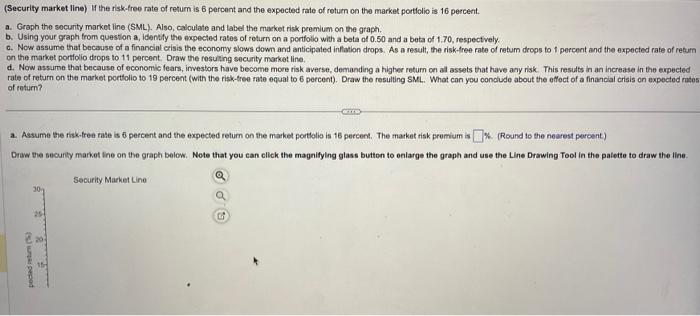

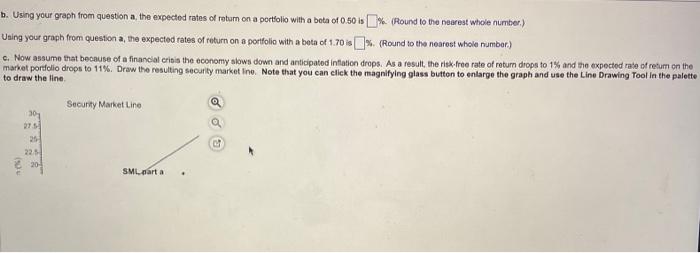

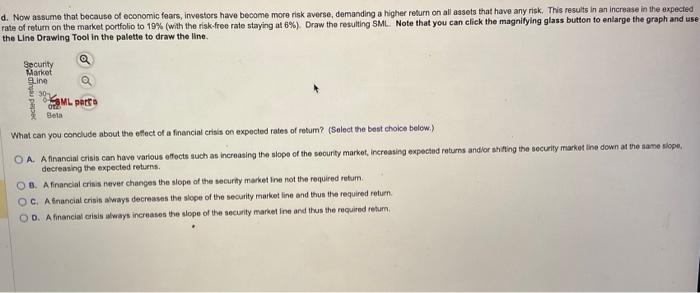

(Security market line) If the riskcfree rate of retum is 6 percent and the expocted rale of return on the market porticlio is 16 percent. a. Graph the socurity market line (SML). Also, caloulate and label the macket risk premium on the graph. b. Using your graph from question a, idently the expected rates of return on a portfolio with a beta of 0.50 and a beta of 1.70 , respectively. c. Now assume that because of a financinl crisis the econoryy slows down and anticipated inflation drops. As a result, the risk-tree rate of retum drops to 1 percent and the expected rate of retum on the market portiolio drops to 11 percent. Draw the resulting security market line. d. Now assume that because of economic fears, investors have become more risk averse, demanding a higher retum on al assets that have any risk. This results in an increase in the expected rate of return on the market portholio to 19 percent (with the risk-free rate equal to 6 percent). Draw the resulting SML. What cann you conoludo about the offoct of a financial crisis on axpoctod rate of retum? a. Assume the risk-free rate is 6 percent and the expected return on the market portholio is 16 percent. The market risk promium is Drow the securify market lne on the graph bolow. Note that you can cllck the magnifying glass button to enlarge the graph and use the Line Drawing Tool in the paiette to draw the line. b. Using your graph from question a, the expected rates of roturn on a porttolio with a bota of 0.50 is 6 . (Round to the nearest whole number.) Uaing your graph from question a, the expected rates of roturn on a portfolio with a bota of 1.70 is %. (Round to the nearest whole numbor) c. Now assume that because of a financial cribis the economy slows down and anticipatod inflation drops. As a result, the risk.froe rate of rotum drops to 1% and the expectod raie of retum on the market porfolio drogs to 11%. Draw the resulting seoulity market Ine. Note that you can click the magnifying glass button to enlarge the graph and use the Line Drawing Tool in the palette to draw the lline. d. Now assume that bocause of economic fears, invostors have become more risk averse, demanding a higher return on all assets that have any risk. This results in an increase in the expected rate of retum on the market porffolio to 19% (with the risk-free rate staying at 6% ). Draw the resulting SML. Note that you can click the magnifying glass button to enlarge the graph and use the Line Drawing Tool in the palette to draw the line. What can you conclude about the efect of a financial crisis on expected rates of recum? (Solect the best choice below.) A. Afinancial crisis can have various offocts such as increasing the slope of the socurity market, increasing expected returns andior ahiting the socurity makket the down at the same siope, decreasing the expected returns. 8. A finanoial criais never changes the slope of the securhy market ine not the required retum. c. A fnancial crisis a ways decreases the slope of the security matket line and thus the required return. D. A financial cisis aleays increases the slope of the security market ine and thus the fequired resum. (Security market line) If the riskcfree rate of retum is 6 percent and the expocted rale of return on the market porticlio is 16 percent. a. Graph the socurity market line (SML). Also, caloulate and label the macket risk premium on the graph. b. Using your graph from question a, idently the expected rates of return on a portfolio with a beta of 0.50 and a beta of 1.70 , respectively. c. Now assume that because of a financinl crisis the econoryy slows down and anticipated inflation drops. As a result, the risk-tree rate of retum drops to 1 percent and the expected rate of retum on the market portiolio drops to 11 percent. Draw the resulting security market line. d. Now assume that because of economic fears, investors have become more risk averse, demanding a higher retum on al assets that have any risk. This results in an increase in the expected rate of return on the market portholio to 19 percent (with the risk-free rate equal to 6 percent). Draw the resulting SML. What cann you conoludo about the offoct of a financial crisis on axpoctod rate of retum? a. Assume the risk-free rate is 6 percent and the expected return on the market portholio is 16 percent. The market risk promium is Drow the securify market lne on the graph bolow. Note that you can cllck the magnifying glass button to enlarge the graph and use the Line Drawing Tool in the paiette to draw the line. b. Using your graph from question a, the expected rates of roturn on a porttolio with a bota of 0.50 is 6 . (Round to the nearest whole number.) Uaing your graph from question a, the expected rates of roturn on a portfolio with a bota of 1.70 is %. (Round to the nearest whole numbor) c. Now assume that because of a financial cribis the economy slows down and anticipatod inflation drops. As a result, the risk.froe rate of rotum drops to 1% and the expectod raie of retum on the market porfolio drogs to 11%. Draw the resulting seoulity market Ine. Note that you can click the magnifying glass button to enlarge the graph and use the Line Drawing Tool in the palette to draw the lline. d. Now assume that bocause of economic fears, invostors have become more risk averse, demanding a higher return on all assets that have any risk. This results in an increase in the expected rate of retum on the market porffolio to 19% (with the risk-free rate staying at 6% ). Draw the resulting SML. Note that you can click the magnifying glass button to enlarge the graph and use the Line Drawing Tool in the palette to draw the line. What can you conclude about the efect of a financial crisis on expected rates of recum? (Solect the best choice below.) A. Afinancial crisis can have various offocts such as increasing the slope of the socurity market, increasing expected returns andior ahiting the socurity makket the down at the same siope, decreasing the expected returns. 8. A finanoial criais never changes the slope of the securhy market ine not the required retum. c. A fnancial crisis a ways decreases the slope of the security matket line and thus the required return. D. A financial cisis aleays increases the slope of the security market ine and thus the fequired resum