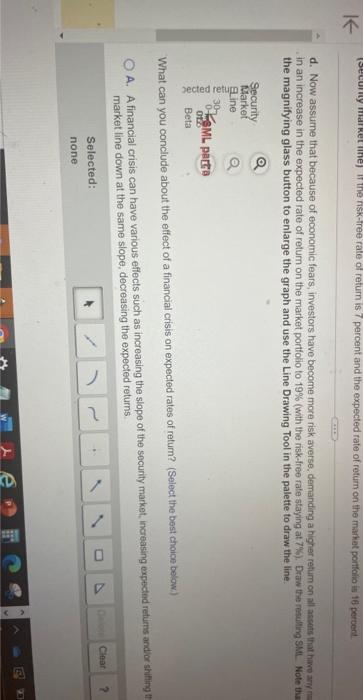

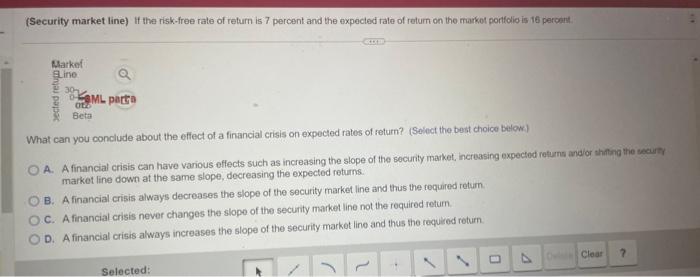

(Security market line) if the risk-free rate of retum is 7 percont and the expected rate of retum on the markef portfolio is 10 peccert a. Graph the security market line (SML). Also, calculate and laber the market risk premium on the graph b. Using your graph from question a, identify the expecied rates of return on a poitfolio with a beta of 0.55 and a bets of f.62, rospoctively and the expected rate of relum on the market portiolio drops to 12 percont. Draw the resiling socurtic markot line d. Now assume that because of economic fears, investors have become more isk averse, dermanding a higher return on all assots that tuve any nis. This recuits nin an increase in the expected rate of return on the market portfolio to 19 percent (with the tisk.tioe rate equal to 7 persenti. Draw the reouting sMr. What can you conclude about the effect of a firancial cisis on expected rates of return? a. Assume the riskctiee rate is 7 percent and the exoected retum on the market ooitiolo is 16 corcent. The markel tisk oremisim is percents Draw the security market line on the graph below. Note that you can elick the magrifying glass butfoe to eniarge the graph and usa the Line Drawng Tool in the palette to draw the line. b. Using your graph from question a, the expected rales of retum on a parthoio weh a beta d 0.55 if Using your graph from quostion a the expected rates of return on a portlolio with a beta of 1.62 is enlarge the graph and use the Line Drawing Tool in the palette to draw the line. d. Now asstame that because of economic fears, investors have become thore risk averse, demanding a higher rehum on all assetis that hiwe ant ming in an increase in the expected rate of return on the market portfolio to 19% (with the risk-free rate staying at 7 the). Draw the retiting Skit Note thin the magnifying glass button to enlarge the graph and use the Line Drawing Tool in the palette to draw the line What can you conclude about the effect of a financial crisis on expected rates of return? (Select the best choice below) A. A financial crisis can have various effects such as increasing the slope of the security market, increasing expectid returns andior shifing ti morket line rimwn at the same slope, decreasing the expected returns (Security market line) If the risk-free rate of return is 7 percent and the expecied rale of retum on the markot portfolio is 16 percint What can you conclude about the effect of a financial crisis on expected rates of return? (Select the best choice below.) A. A financial crisis can have various offects such as increasing the slope of the security market, increasing expected returns andior thiting the securef market line down at the same slope, decreasing the expected returns. B. A financial crisis always decreases the slope of the security market line and thus the fequired return. C. A financial crisis never changes the slope of the security market line not the required return. D. A financial crisis always increases the slope of the security market line and thus the required roturn. (Security market line) if the risk-free rate of retum is 7 percont and the expected rate of retum on the markef portfolio is 10 peccert a. Graph the security market line (SML). Also, calculate and laber the market risk premium on the graph b. Using your graph from question a, identify the expecied rates of return on a poitfolio with a beta of 0.55 and a bets of f.62, rospoctively and the expected rate of relum on the market portiolio drops to 12 percont. Draw the resiling socurtic markot line d. Now assume that because of economic fears, investors have become more isk averse, dermanding a higher return on all assots that tuve any nis. This recuits nin an increase in the expected rate of return on the market portfolio to 19 percent (with the tisk.tioe rate equal to 7 persenti. Draw the reouting sMr. What can you conclude about the effect of a firancial cisis on expected rates of return? a. Assume the riskctiee rate is 7 percent and the exoected retum on the market ooitiolo is 16 corcent. The markel tisk oremisim is percents Draw the security market line on the graph below. Note that you can elick the magrifying glass butfoe to eniarge the graph and usa the Line Drawng Tool in the palette to draw the line. b. Using your graph from question a, the expected rales of retum on a parthoio weh a beta d 0.55 if Using your graph from quostion a the expected rates of return on a portlolio with a beta of 1.62 is enlarge the graph and use the Line Drawing Tool in the palette to draw the line. d. Now asstame that because of economic fears, investors have become thore risk averse, demanding a higher rehum on all assetis that hiwe ant ming in an increase in the expected rate of return on the market portfolio to 19% (with the risk-free rate staying at 7 the). Draw the retiting Skit Note thin the magnifying glass button to enlarge the graph and use the Line Drawing Tool in the palette to draw the line What can you conclude about the effect of a financial crisis on expected rates of return? (Select the best choice below) A. A financial crisis can have various effects such as increasing the slope of the security market, increasing expectid returns andior shifing ti morket line rimwn at the same slope, decreasing the expected returns (Security market line) If the risk-free rate of return is 7 percent and the expecied rale of retum on the markot portfolio is 16 percint What can you conclude about the effect of a financial crisis on expected rates of return? (Select the best choice below.) A. A financial crisis can have various offects such as increasing the slope of the security market, increasing expected returns andior thiting the securef market line down at the same slope, decreasing the expected returns. B. A financial crisis always decreases the slope of the security market line and thus the fequired return. C. A financial crisis never changes the slope of the security market line not the required return. D. A financial crisis always increases the slope of the security market line and thus the required roturn