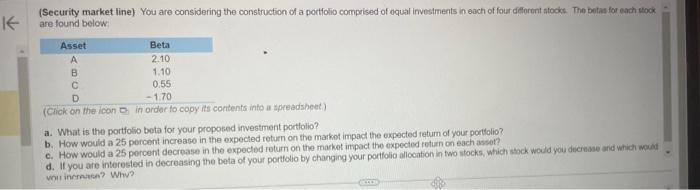

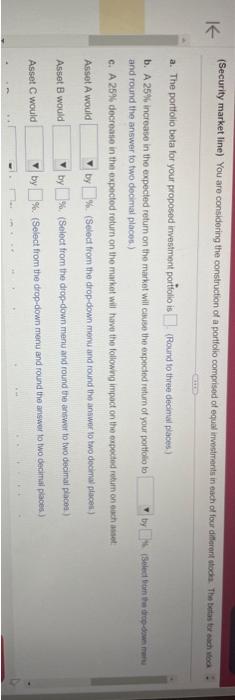

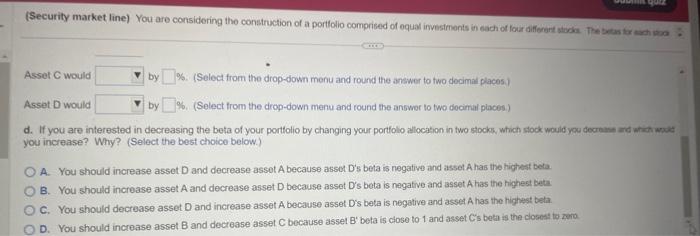

(Security market line) You are considering the construction of a portfolio comprised of dqual investments in each of four derorent stocke. The betas for each etock are found below; (Click on the icon Dh in order fo copy 2 s contents into a spreadsbeet). a. What is the portfoso beta for your proposed investment portiolio? b. How would a 25 percent increace in the expected return on the markot impact the expected return of your portolio? c. How would a 25 percent decrease in the expectod roturn on the market impact the expecied refurn on each assot? d. If you are interested in decreasing the beta of your pertiolio by changing your porffolio aliocation in two stocks, which shek would you deciesse arie which wast vinit incrntese? Whu? a. The portfolio beta for yout proposed investment portifollo is (Round to thee decmal paces) b. A 25% incroase in the expected return on the market will eisse the expecied retum of your poitlolio to and round the answer to two decimal places.) c. A 25% docrease in the expected return on the market wil have the followig impact on the expected fekin on bish asset. Assot A would by We (Select from the drop-down menu and round the answer ho two decimal places) Asset B would by \%. (Select from the dog-downmenu and found the answer to two decimal placea.) Asset C would by \%. (Select from the drop-down menu and round the answer to two desimal places.) Assel C would by \%. (Select from the drop-down menu and round the answer to two docimal placesi) Asset D would by \%. (Select from the drop-down menu and round the answer to two docimal places.) d. If you are interested in decreasing the bota of your portiolio by changing your portfolo allocation in two stocks, which stock would you docremes ard whit wyet you increase? Why? (Select the best choice below.) A. You should increase asset D and decrease asset A because assot D's beta is negative and asset A has the highint beta. B. You should increase asset A and decrease asset D because asset D's beta is nagative and asset A has the highest beta. C. You should decrease asset D and increase asset A because asset D's beta is negative and asset A has the highest beta. D. You should increase asset B and decrease asset C because assel B' beta is ciose to 1 and asset C's beta is the closest to rera