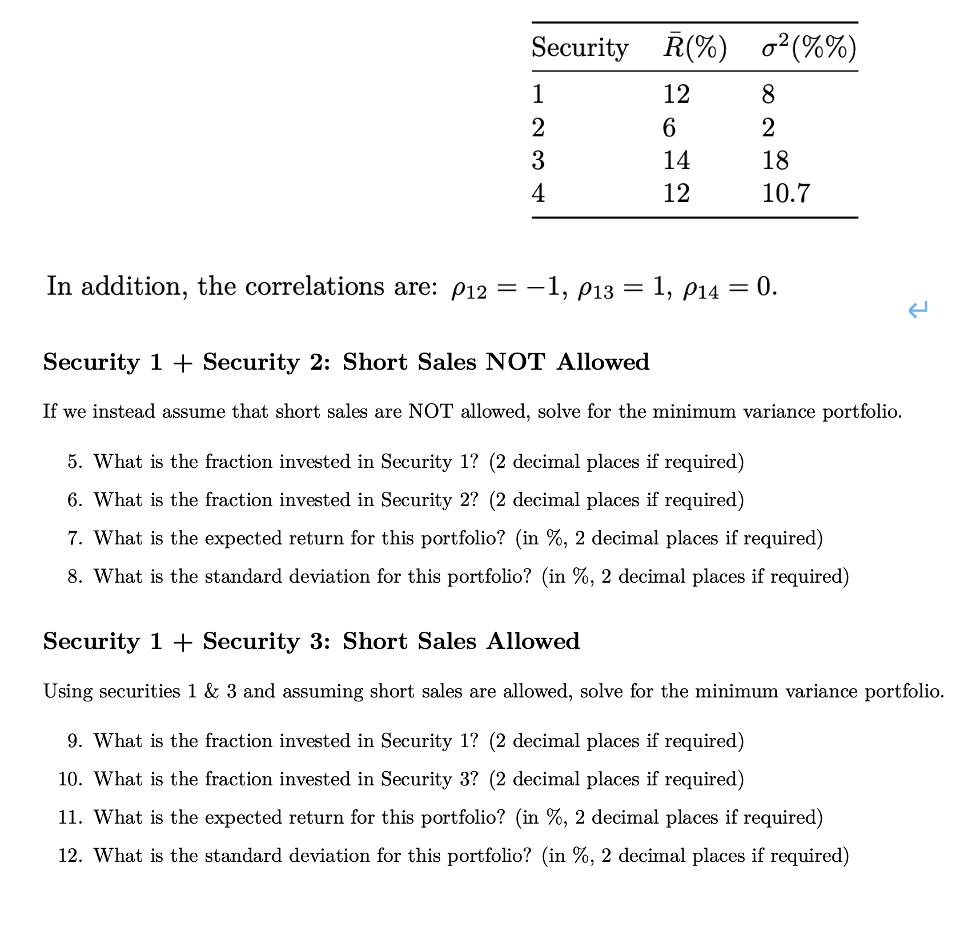

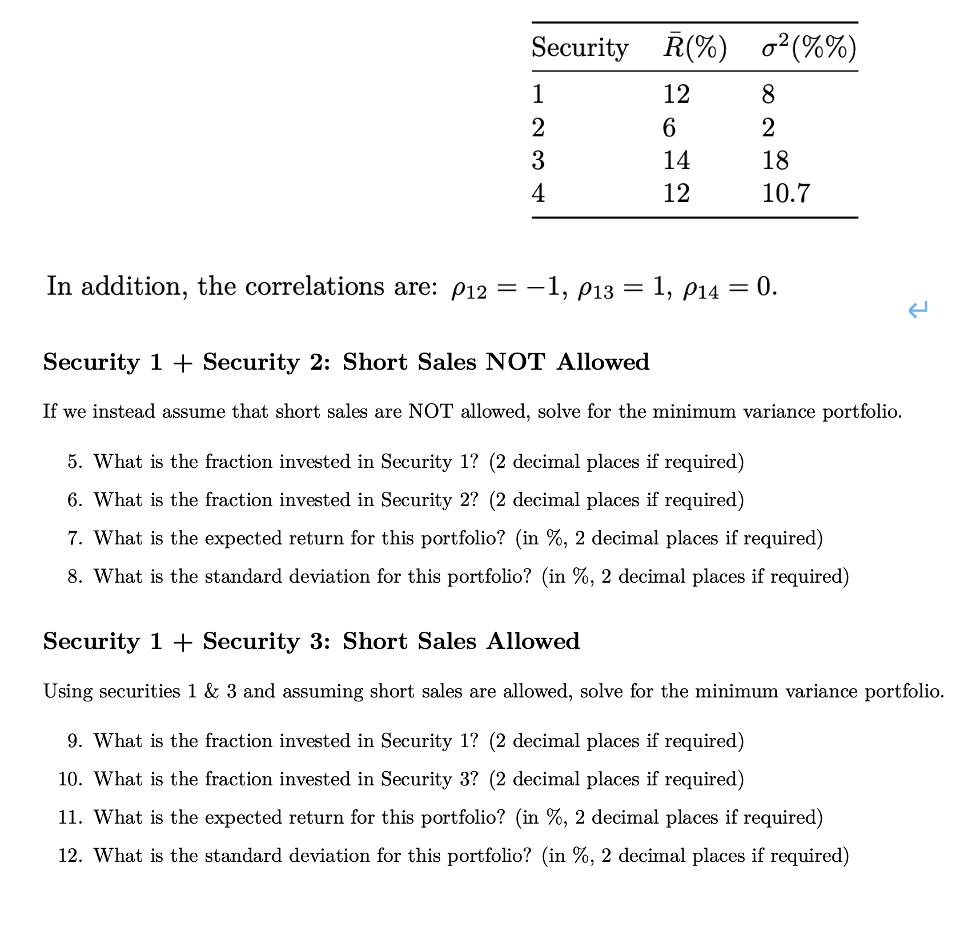

Security R(%) 1 12 2 6 3 14 4 12 In addition, the correlations are: P12 = -1, P13 1, P14 = 0. Security 1+ Security 2: Short Sales NOT Allowed If we instead assume that short sales are NOT allowed, solve for the minimum variance portfolio. 5. What is the fraction invested in Security 1? (2 decimal places if requ ed) 6. What is the fraction invested in Security 2? (2 decimal places if required) 7. What is the expected return for this portfolio? (in %, 2 decimal places if required) 8. What is the standard deviation for this portfolio? (in %, 2 decimal places if required) Security 1+ Security 3: Short Sales Allowed Using securities 1 & 3 and assuming short sales are allowed, solve for the minimum variance portfolio. 9. What is the fraction invested in Security 1? (2 decimal places if required) 10. What is the fraction invested in Security 3? (2 decimal places if required) 11. What is the expected return for this portfolio? (in %, 2 decimal places if required) 12. What is the standard deviation for this portfolio? (in %, 2 decimal places if required) 0 (%%) 8 2 18 10.7 Security R(%) 1 12 2 6 3 14 4 12 In addition, the correlations are: P12 = -1, P13 1, P14 = 0. Security 1+ Security 2: Short Sales NOT Allowed If we instead assume that short sales are NOT allowed, solve for the minimum variance portfolio. 5. What is the fraction invested in Security 1? (2 decimal places if requ ed) 6. What is the fraction invested in Security 2? (2 decimal places if required) 7. What is the expected return for this portfolio? (in %, 2 decimal places if required) 8. What is the standard deviation for this portfolio? (in %, 2 decimal places if required) Security 1+ Security 3: Short Sales Allowed Using securities 1 & 3 and assuming short sales are allowed, solve for the minimum variance portfolio. 9. What is the fraction invested in Security 1? (2 decimal places if required) 10. What is the fraction invested in Security 3? (2 decimal places if required) 11. What is the expected return for this portfolio? (in %, 2 decimal places if required) 12. What is the standard deviation for this portfolio? (in %, 2 decimal places if required) 0 (%%) 8 2 18 10.7