Answered step by step

Verified Expert Solution

Question

1 Approved Answer

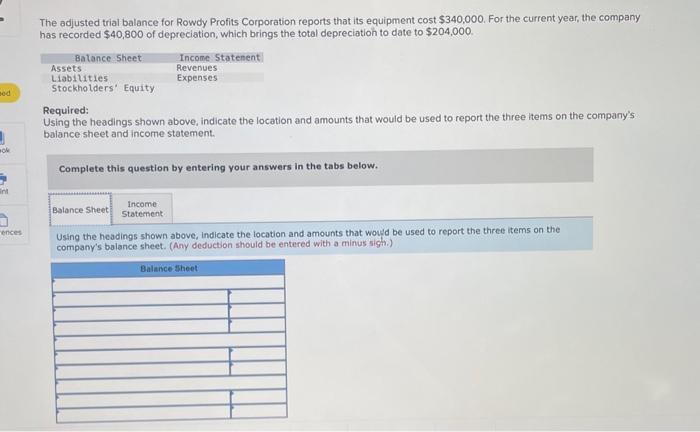

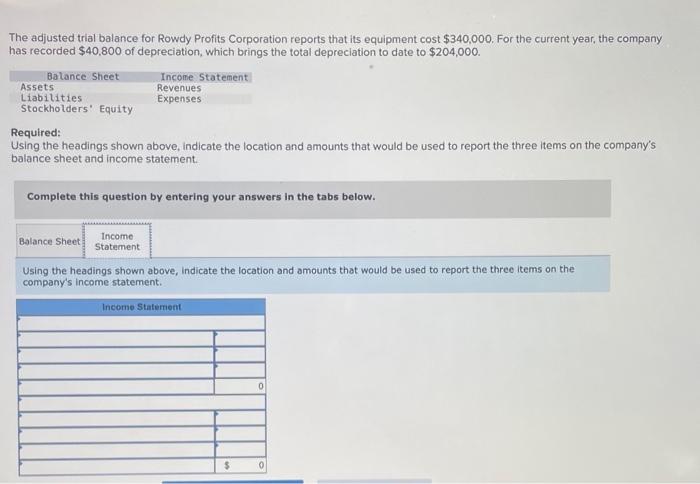

sed J mok int ences The adjusted trial balance for Rowdy Profits Corporation reports that its equipment cost $340,000. For the current year, the

sed J mok int ences The adjusted trial balance for Rowdy Profits Corporation reports that its equipment cost $340,000. For the current year, the company has recorded $40,800 of depreciation, which brings the total depreciation to date to $204,000. Balance Sheet Assets Liabilities Stockholders' Equity Required: Using the headings shown above, indicate the location and amounts that would be used to report the three items on the company's balance sheet and income statement. Income Statement Revenues Expenses Complete this question by entering your answers in the tabs below. Balance Sheet Income Statement. Using the headings shown above, Indicate the location and amounts that would be used to report the three items on the company's balance sheet. (Any deduction should be entered with a minus sigh.) Balance Sheet The adjusted trial balance for Rowdy Profits Corporation reports that its equipment cost $340,000. For the current year, the company has recorded $40,800 of depreciation, which brings the total depreciation to date to $204,000. Balance Sheet Assets Liabilities Stockholders' Equity Income Statement Revenues Expenses Required: Using the headings shown above, indicate the location and amounts that would be used to report the three items on the company's balance sheet and income statement. Complete this question by entering your answers in the tabs below. Income. Statement Balance Sheet Using the headings shown above, indicate the location and amounts that would be used to report the three items on the company's income statement. Income Statement $ 0 0

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Step 12 Step 1 Balance sheet is the financial statement which show the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started