Answered step by step

Verified Expert Solution

Question

1 Approved Answer

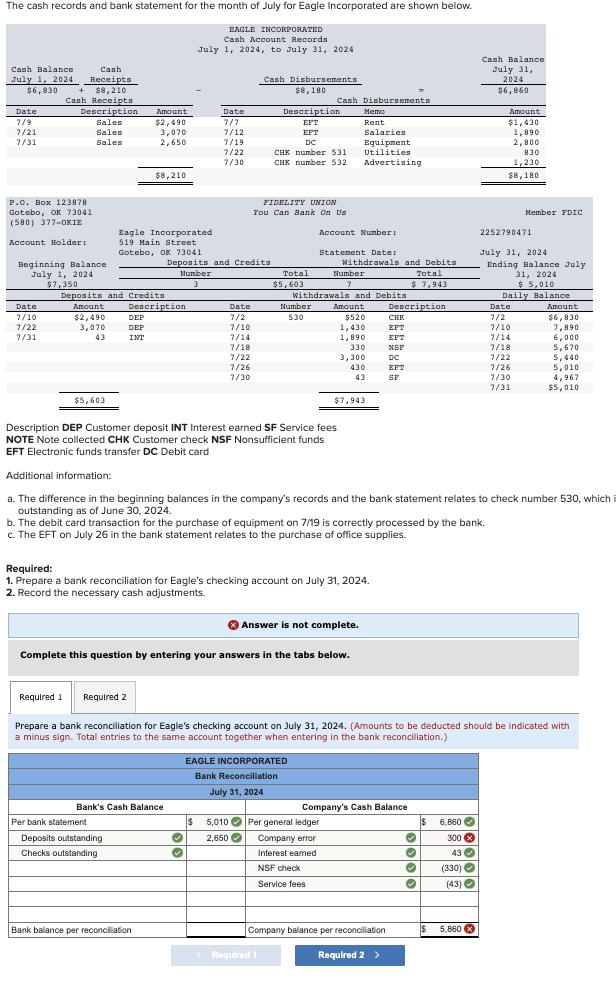

The cash records and bank statement for the month of July for Eagle Incorporated are shown below. Cash Receipts $6,830 + $8,210 Cash Receipts

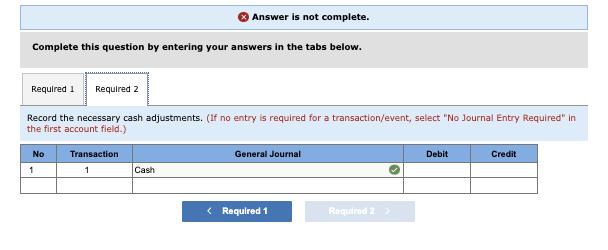

The cash records and bank statement for the month of July for Eagle Incorporated are shown below. Cash Receipts $6,830 + $8,210 Cash Receipts Cash Balance July 1, 2024 Date 7/9 7/21 7/31 P.O. Box 123878 Gotebo, OK 73041 (580) 377-OKIE Account Holder: Description Sales Sales Sales Beginning Balance July 1, 2024 $7,350 Date: 7/10 7/22 7/31 $5,603 Required 1 Deposits and Credits Amount $2,490 3,070 43 Amount $2,490 3,070 2,650 Eagle Incorporated 519 Main Street. Gotebo, OK 73041 $8,210 DEP DEP INT Required 2 Description Per bank statement Deposits outstanding Checks outstanding EAGLE INCORPORATED Cash Account Records July 1, 2024, to July 31, 2024 Bank's Cash Balance Bank balance per reconciliation Date 7/7 7/12 7/19 7/22 7/30 Deposits and Credits Number 3 Date 7/2 7/10 7/14 7/18 7/22 7/26 7/30 Cash Disbursements $8,180 $ Description EFT EFT FIDELITY UNION You Can Bank On Us DC CHK number 531 CHK number 532 Total Cash Disbursements $5,603 Number 530 Complete this question by entering your answers in the tabs below. Required 1 Required: 1. Prepare a bank reconciliation for Eagle's checking account on July 31, 2024. 2. Record the necessary cash adjustments. Account Number: Number 7 Withdrawals and Debits. EAGLE INCORPORATED Bank Reconciliation. July 31, 2024 Memo Rent Statement Date: Salaries Equipment Utilities Advertising Withdrawals and Debits Total $7,943 b. The debit card transaction for the purchase of equipment on 7/19 is correctly processed by the bank. c. The EFT on July 26 in the bank statement relates to the purchase of office supplies. Amount $520 1,430 1,890. 330 3,300 430 Answer is not complete. 5,010 Per general ledger 2,650 Company error Interest eamed NSF check Service fees 43 $7,943 Description DEP Customer deposit INT Interest earned SF Service fees NOTE Note collected CHK Customer check NSF Nonsufficient funds EFT Electronic funds transfer DC Debit card Additional information: a. The difference in the beginning balances in the company's records and the bank statement relates to check number 530, which i outstanding as of June 30, 2024. Description CHK EFT FPT EFT NSF DC EFT SF Company balance per reconciliation Prepare a bank reconciliation for Eagle's checking account on July 31, 2024. (Amounts to be deducted should be indicated with a minus sign. Total entries to the same account together when entering in the bank reconciliation.) Company's Cash Balance Required 2 > $ Cash Balance July 31, 2024 2024 $6,860 6,860 300 x 43 (330) (43) Amount $1,430 $ 5,860 x 1,890. 2,800 830 1,230 $8,180 2252790471 Member FDIC July 31, 2024 Ending Balance July 31, 2024 $ 5,010 Daily Balance Date 7/2 7/10 7/14 7/18 7/22 7/26 7/30 7/31 Amount $6,830 7,890 6,000 5,670 5,440 5,010 4,967 $5,010 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Record the necessary cash adjustments. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) No 1 Answer is not complete. Transaction 1 Cash General Journal < Required 1 Required 2 > Debit Credit

Step by Step Solution

★★★★★

3.27 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Bank Reconciliation Statement is given below Eagle Incorporated July 31 2024 Bank Cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started