Answered step by step

Verified Expert Solution

Question

1 Approved Answer

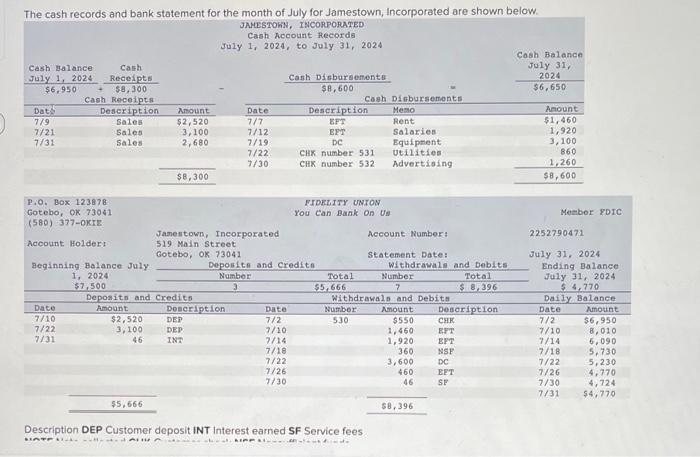

The cash records and bank statement for the month of July for Jamestown, Incorporated are shown below. JAMESTOWN, INCORPORATED Cash Account Records July 1,

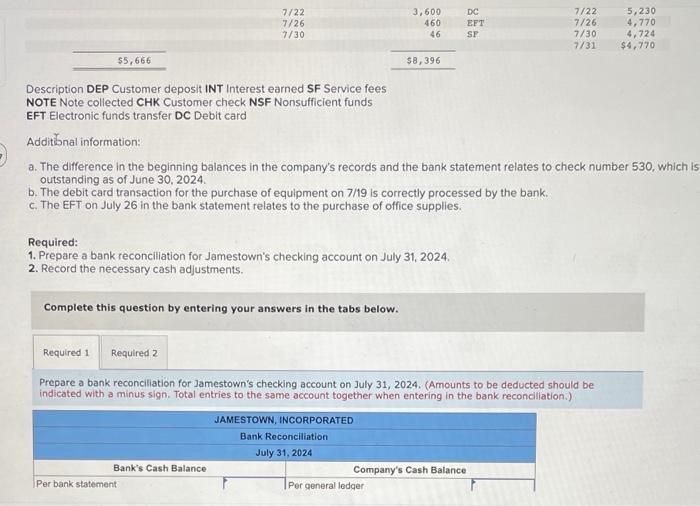

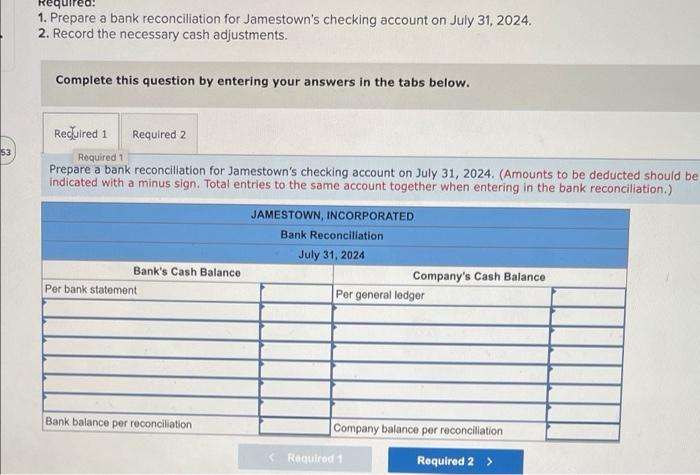

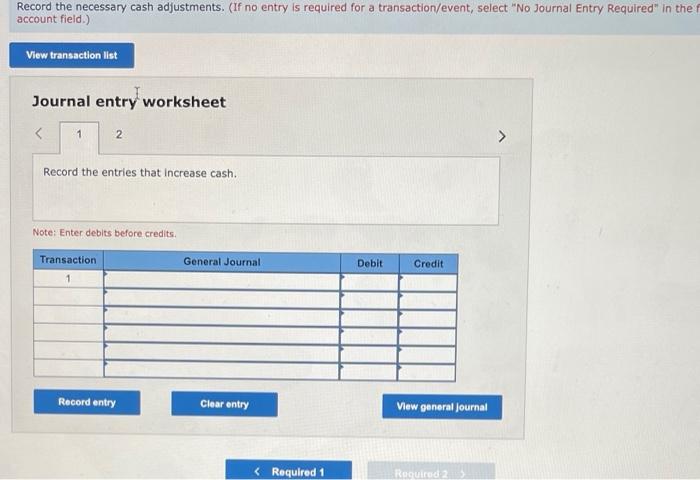

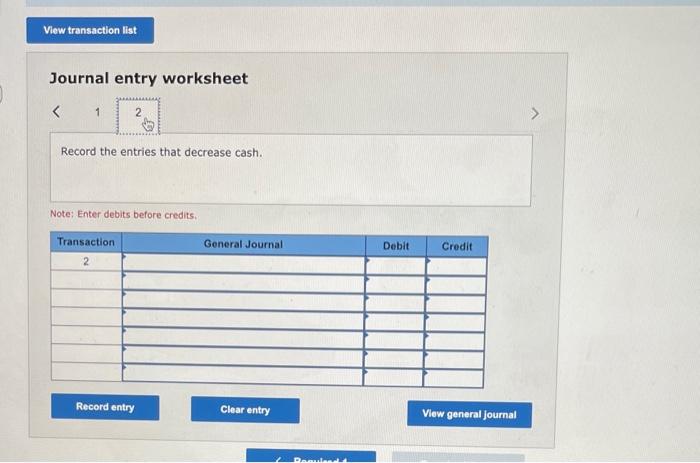

The cash records and bank statement for the month of July for Jamestown, Incorporated are shown below. JAMESTOWN, INCORPORATED Cash Account Records July 1, 2024, to July 31, 2024 Cash Balance July 1, 2024 $6,950 Dat 7/9 7/21 7/31 Cash Receipts $8,300 Cash Receipts Description Sales Sales Sales P.O. Box 123878 Gotebo, OK 73041 (580) 377-OKIE Account Holder: Beginning Balance July 1, 2024 $7,500 Date 7/10 7/22 7/31 $2,520 3,100 46 $5,666 Amount $2,520 3,100 2,680 Deposits and Credits Amount $8,300 ALIVA Jamestown, Incorporated 519 Main Street Gotebo, OK 73041 Date 7/7 7/12 7/19 Description DEP DEP INT 7/22 7/30 Date 7/2 LIPPI Cash Disbursements $8,600 Deposits and Credits Number 3 7/10 7/14 7/18 7/22 7/26 7/30 Description EFT EFT DC CHK number 531 CHK number 532 FIDELITY UNION You Can Bank On Us Total Cash Disbursements $5,666 Description DEP Customer deposit INT Interest earned SF Service fees 4x4 HATELIA Number 530 Memo Rent Salaries Equipment Utilities Advertising Account Number: Statement Date: Withdrawals and Debits Total $8,396 Withdrawals and Debits Amount $550 1,460 1,920 360 3,600 460 46 Number $8,396 Description CHK EFT EFT NSF DC EFT SP Cash Balance July 31, 2024 $6,650 Amount $1,460 1,920 3,100 860 1,260 $8,600 Member FDIC 2252790471 July 31, 2024 Ending Balance July 31, 2024 $4,770 Daily Balance Date Amount 7/2 $6,950 7/10 7/14 7/18 7/22 7/26 7/30 7/31 8,010 6,090 5,730 5,230 4,770 4,724 $4,770 $5,666 Description DEP Customer deposit INT Interest earned SF Service fees NOTE Note collected CHK Customer check NSF Nonsufficient funds EFT Electronic funds transfer DC Debit card Additional information: 7/22 7/26 7/30 Complete this question by entering your answers in the tabs below. Required: 1. Prepare a bank reconciliation for Jamestown's checking account on July 31, 2024. 2. Record the necessary cash adjustments. Bank's Cash Balance Per bank statement 3,600 460 46 a. The difference in the beginning balances in the company's records and the bank statement relates to check number 530, which is outstanding as of June 30, 2024. b. The debit card transaction for the purchase of equipment on 7/19 is correctly processed by the bank. c. The EFT on July 26 in the bank statement relates to the purchase of office supplies. $8,396 JAMESTOWN, INCORPORATED Bank Reconciliation July 31, 2024 Required 1 Required 2 Prepare a bank reconciliation for Jamestown's checking account on July 31, 2024. (Amounts to be deducted should be indicated with a minus sign. Total entries to the same account together when entering in the bank reconciliation.) DC EFT SF Per general ledger 7/22 7/26 7/30 7/31 Company's Cash Balance 5,230 4,770 4,724 $4,770 53 Required: 1. Prepare a bank reconciliation for Jamestown's checking account on July 31, 2024. 2. Record the necessary cash adjustments. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 1 Prepare a bank reconciliation for Jamestown's checking account on July 31, 2024. (Amounts to be deducted should be indicated with a minus sign. Total entries to the same account together when entering in the bank reconciliation.) Bank's Cash Balance Per bank statement Bank balance per reconciliation JAMESTOWN, INCORPORATED Bank Reconciliation. July 31, 2024 Company's Cash Balance Per general ledger Company balance per reconciliation Required 2 > < Required 1 Record the necessary cash adjustments. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the f account field.) View transaction list Journal entry worksheet < 1 2 Record the entries that increase cash. Note: Enter debits before credits. Transaction Record entry General Journal Clear entry < Required 1 Debit Credit View general journal Required 2 View transaction list Journal entry worksheet < 1 Record the entries that decrease cash. Note: Enter debits before credits. Transaction 2 Record entry General Journal Clear entry Requien Debit Credit View general journal

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started