See attached below is the percentage for income tax and final witholding tax. Thanks

Determine the income tax and final tax for a (1) Resident citizen tax payer, (2) Non-resident citizen (3) Resident alien (4) Non-resident alien engaged in trade, and (5) Non-resident alien not engaged in trade or business provided the following information:

Gross business income, Philippines 4,000,000

Gross business income, Singapore 3,000,000

Business expenses, Philippines 1,500,000

Business expenses, Singapore 1,750,000

Interest income BPI Philippines 90,000

Interest income BPI Singapore 70,000

Dividend income from a domestic Corp. 150,000

Dividend income resident foreign Corp. 75,000

Dividend income non-resident foreign Corp. 125,000

Interest income received from a depository FCDU 50,000

Philippine lotto winnings 10,000

Philippine Charity sweepstakes winnings 400,000

Singapore sweepstakes winnings 250,000

Other winnings Philippines 50,000

Prizes Robinsons Manila 9,000

Prizes SM manila 20,000

Prizes Singapore 30,000

Interest income from long-term deposit 10,000

Interest income from long-term investment (pre-terminated on 2nd year) 5,000

Share dividend from San Miguel Corp. 7,500

Interest income from loans receivable 10,000

Royalty income from franchise 100,000

Royalty income from books 50,000

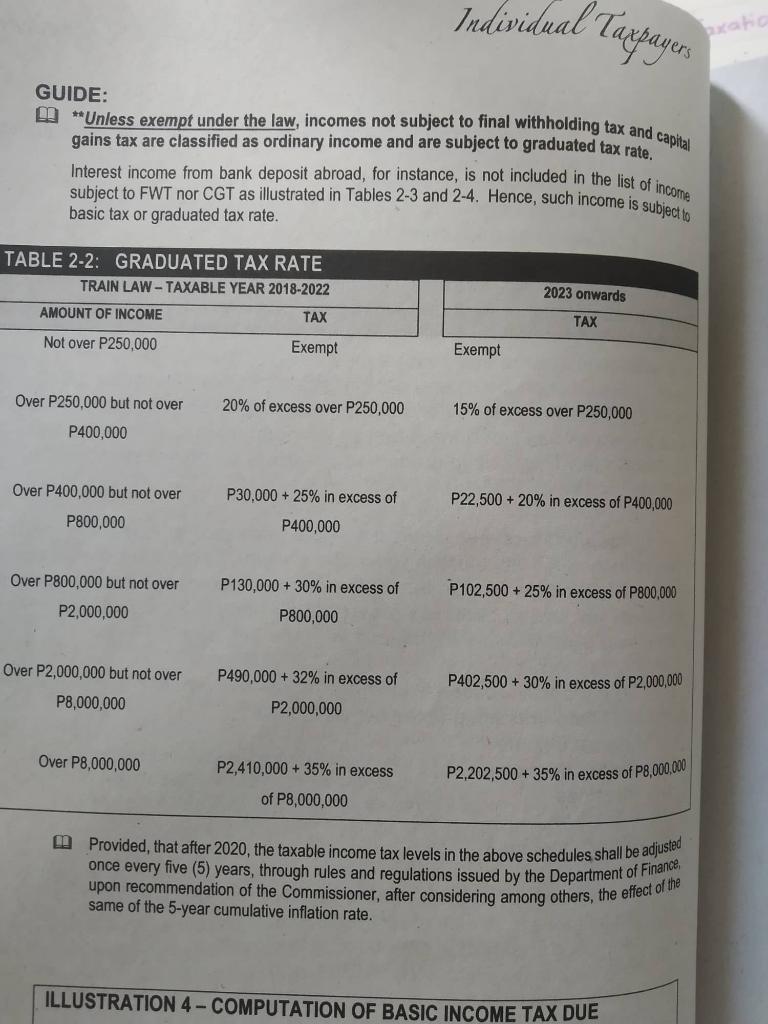

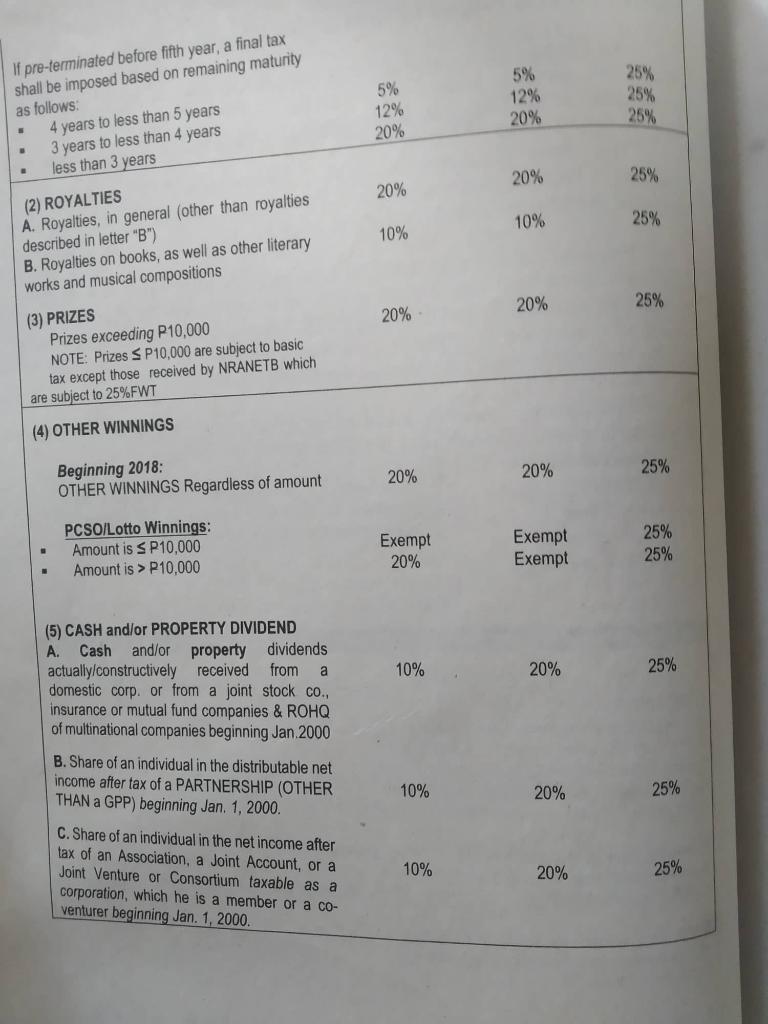

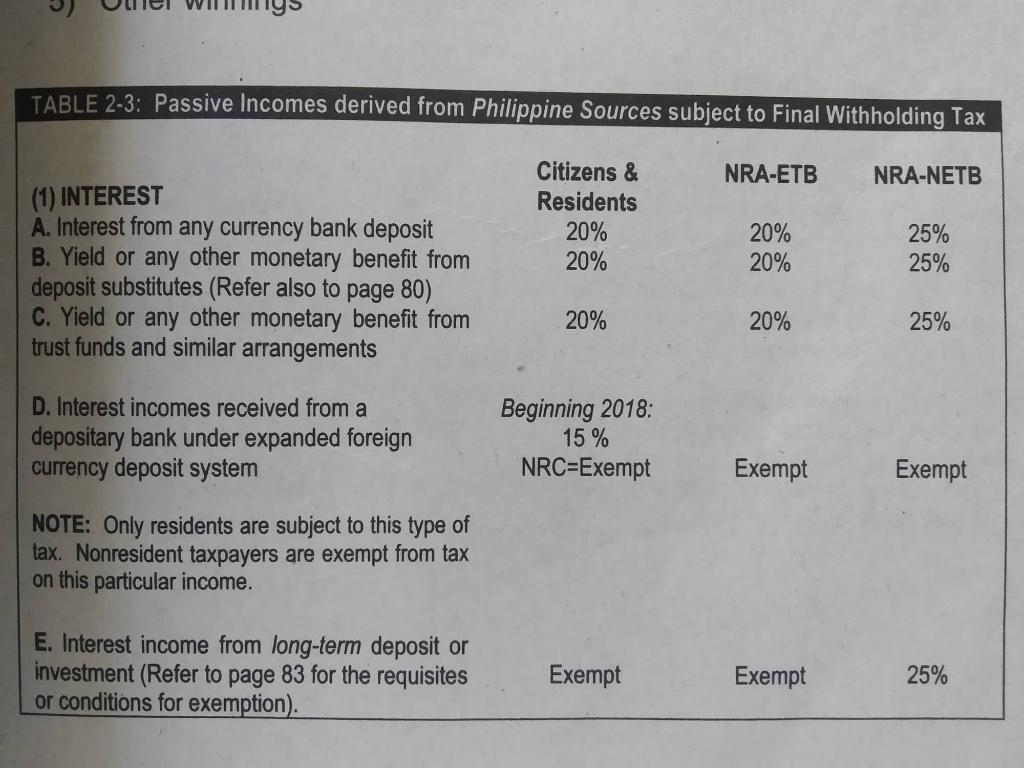

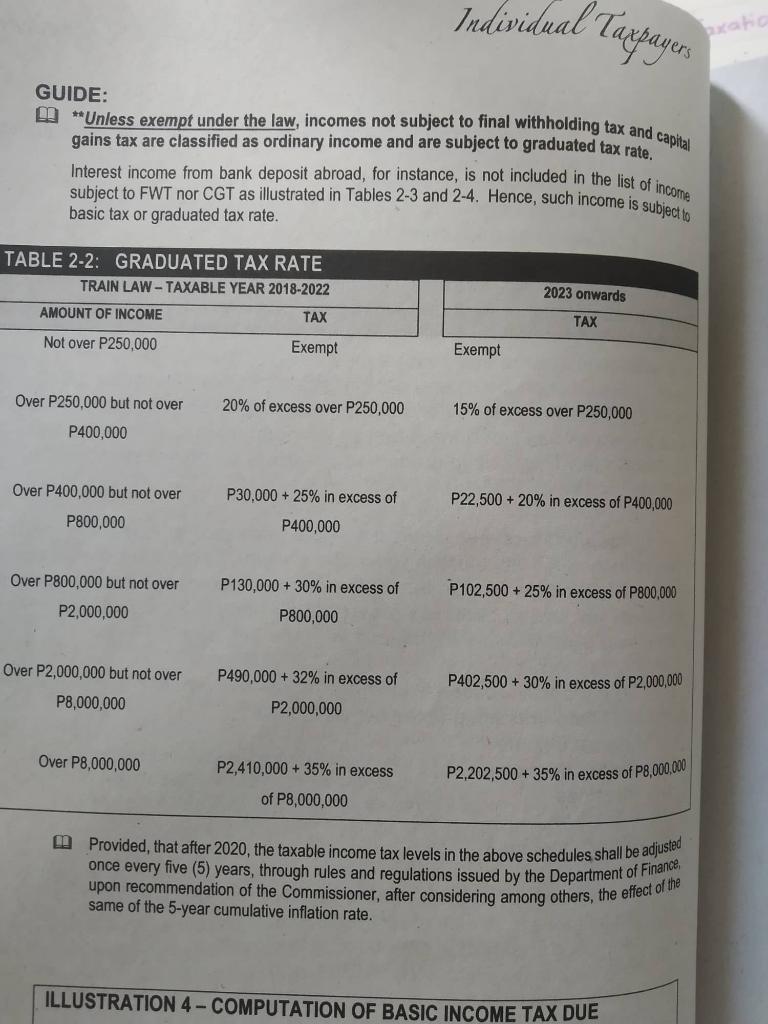

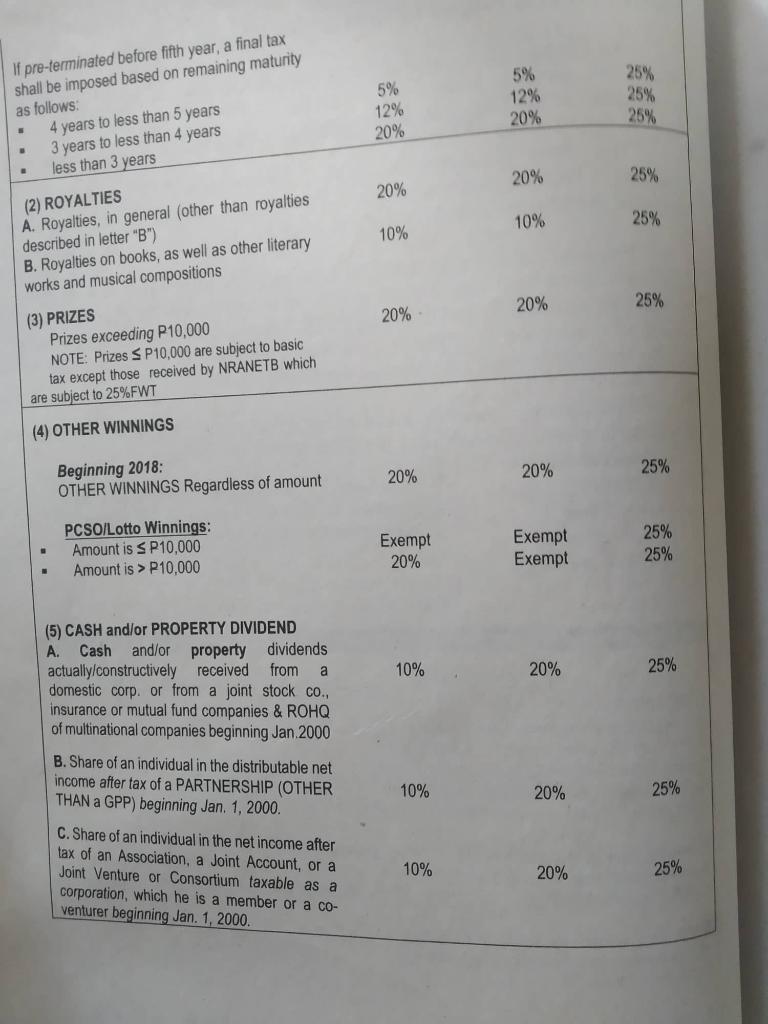

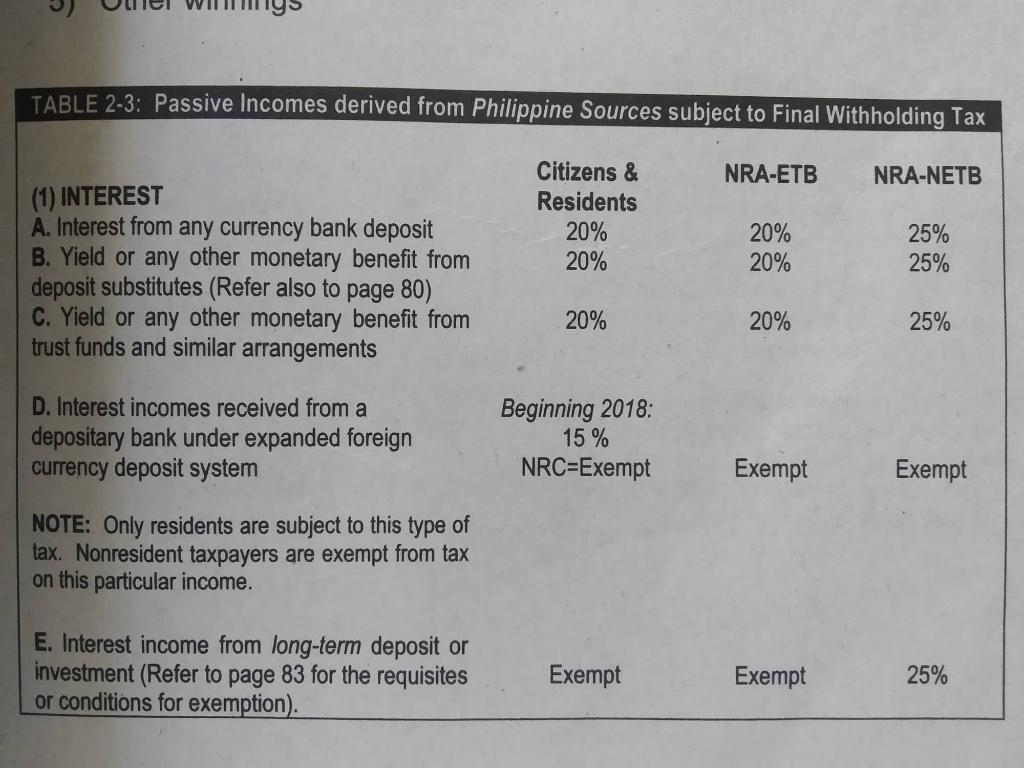

once every five (5) years, through rules and regulations issued by the Department of Finance Individual Taxpayers **Unless exempt under the law, incomes not subject to final withholding tax and capital Interest income from bank deposit abroad, for instance, is not included in the list of income subject to FWT nor CGT as illustrated in Tables 2-3 and 2-4. Hence, such income is subject to GUIDE: gains tax are classified as ordinary income and are subject to graduated tax rate. basic tax or graduated tax rate. TABLE 2-2: GRADUATED TAX RATE TRAIN LAW - TAXABLE YEAR 2018-2022 AMOUNT OF INCOME TAX 2023 onwards TAX Not over P250,000 Exempt Exempt Over P250,000 but not over 20% of excess over P250,000 15% of excess over P250,000 P400,000 Over P400,000 but not over P30,000 + 25% in excess of P22,500 + 20% in excess of P400,000 P800,000 P400,000 Over P800,000 but not over P2,000,000 P102,500 + 25% in excess of P800,000 P130,000 + 30% in excess of P800,000 Over P2,000,000 but not over P8,000,000 P402,500 + 30% in excess of P2,000,000 P490,000 + 32% in excess of P2,000,000 Over P8,000,000 P2,410,000 + 35% in excess P2,202,500 + 35% in excess of P8,000,000 of P8,000,000 Provided that after 2020, the taxable income tax levels in the above schedules shall be adjusted same of the 5-year cumulative inflation rate. ILLUSTRATION 4 - COMPUTATION OF BASIC INCOME TAX DUE If pre-terminated before fifth year, a final tax shall be imposed based on remaining maturity as follows: 4 years to less than 5 years 3 years to less than 4 years less than 3 years 5% 12% 20% 5% 12% 20% 25% 25% 25% . 20% 25% 20% 10% 25% 10% (2) ROYALTIES A. Royalties, in general other than royalties described in letter "B") B. Royalties on books, as well as other literary works and musical compositions (3) PRIZES Prizes exceeding P10,000 NOTE: Prizes 3 P10,000 are subject to basic tax except those received by NRANETB which are subject to 25%FWT 20% 25% 20% (4) OTHER WINNINGS 20% 25% Beginning 2018: OTHER WINNINGS Regardless of amount 20% PCSO/Lotto Winnings: Amount is s P10,000 Amount is > P10,000 Exempt 20% Exempt Exempt 25% 25% . 10% 20% 25% (5) CASH and/or PROPERTY DIVIDEND A. Cash and/or property dividends actually constructively received from a domestic corp. or from a joint stock co. insurance or mutual fund companies & ROHQ of multinational companies beginning Jan 2000 10% 20% 25% B. Share of an individual in the distributable net income after tax of a PARTNERSHIP (OTHER THAN a GPP) beginning Jan 1, 2000. C. Share of an individual in the net income after tax of an Association, a Joint Account, or a Joint Venture or Consortium taxable as a corporation, which he is a member or a co- venturer beginning Jan. 1, 2000. 10% 20% 25% TABLE 2-3: Passive Incomes derived from Philippine Sources subject to Final Withholding Tax NRA-ETB NRA-NETB Citizens & Residents 20% 20% 20% 20% 25% 25% (1) INTEREST A. Interest from any currency bank deposit B. Yield or any other monetary benefit from deposit substitutes (Refer also to page 80) C. Yield or any other monetary benefit from trust funds and similar arrangements 20% 20% 25% D. Interest incomes received from a depositary bank under expanded foreign currency deposit system Beginning 2018: 15 % NRC=Exempt Exempt Exempt NOTE: Only residents are subject to this type of tax. Nonresident taxpayers are exempt from tax on this particular income. E. Interest income from long-term deposit or investment (Refer to page 83 for the requisites or conditions for exemption). Exempt Exempt 25% once every five (5) years, through rules and regulations issued by the Department of Finance Individual Taxpayers **Unless exempt under the law, incomes not subject to final withholding tax and capital Interest income from bank deposit abroad, for instance, is not included in the list of income subject to FWT nor CGT as illustrated in Tables 2-3 and 2-4. Hence, such income is subject to GUIDE: gains tax are classified as ordinary income and are subject to graduated tax rate. basic tax or graduated tax rate. TABLE 2-2: GRADUATED TAX RATE TRAIN LAW - TAXABLE YEAR 2018-2022 AMOUNT OF INCOME TAX 2023 onwards TAX Not over P250,000 Exempt Exempt Over P250,000 but not over 20% of excess over P250,000 15% of excess over P250,000 P400,000 Over P400,000 but not over P30,000 + 25% in excess of P22,500 + 20% in excess of P400,000 P800,000 P400,000 Over P800,000 but not over P2,000,000 P102,500 + 25% in excess of P800,000 P130,000 + 30% in excess of P800,000 Over P2,000,000 but not over P8,000,000 P402,500 + 30% in excess of P2,000,000 P490,000 + 32% in excess of P2,000,000 Over P8,000,000 P2,410,000 + 35% in excess P2,202,500 + 35% in excess of P8,000,000 of P8,000,000 Provided that after 2020, the taxable income tax levels in the above schedules shall be adjusted same of the 5-year cumulative inflation rate. ILLUSTRATION 4 - COMPUTATION OF BASIC INCOME TAX DUE If pre-terminated before fifth year, a final tax shall be imposed based on remaining maturity as follows: 4 years to less than 5 years 3 years to less than 4 years less than 3 years 5% 12% 20% 5% 12% 20% 25% 25% 25% . 20% 25% 20% 10% 25% 10% (2) ROYALTIES A. Royalties, in general other than royalties described in letter "B") B. Royalties on books, as well as other literary works and musical compositions (3) PRIZES Prizes exceeding P10,000 NOTE: Prizes 3 P10,000 are subject to basic tax except those received by NRANETB which are subject to 25%FWT 20% 25% 20% (4) OTHER WINNINGS 20% 25% Beginning 2018: OTHER WINNINGS Regardless of amount 20% PCSO/Lotto Winnings: Amount is s P10,000 Amount is > P10,000 Exempt 20% Exempt Exempt 25% 25% . 10% 20% 25% (5) CASH and/or PROPERTY DIVIDEND A. Cash and/or property dividends actually constructively received from a domestic corp. or from a joint stock co. insurance or mutual fund companies & ROHQ of multinational companies beginning Jan 2000 10% 20% 25% B. Share of an individual in the distributable net income after tax of a PARTNERSHIP (OTHER THAN a GPP) beginning Jan 1, 2000. C. Share of an individual in the net income after tax of an Association, a Joint Account, or a Joint Venture or Consortium taxable as a corporation, which he is a member or a co- venturer beginning Jan. 1, 2000. 10% 20% 25% TABLE 2-3: Passive Incomes derived from Philippine Sources subject to Final Withholding Tax NRA-ETB NRA-NETB Citizens & Residents 20% 20% 20% 20% 25% 25% (1) INTEREST A. Interest from any currency bank deposit B. Yield or any other monetary benefit from deposit substitutes (Refer also to page 80) C. Yield or any other monetary benefit from trust funds and similar arrangements 20% 20% 25% D. Interest incomes received from a depositary bank under expanded foreign currency deposit system Beginning 2018: 15 % NRC=Exempt Exempt Exempt NOTE: Only residents are subject to this type of tax. Nonresident taxpayers are exempt from tax on this particular income. E. Interest income from long-term deposit or investment (Refer to page 83 for the requisites or conditions for exemption). Exempt Exempt 25%