See attached images please

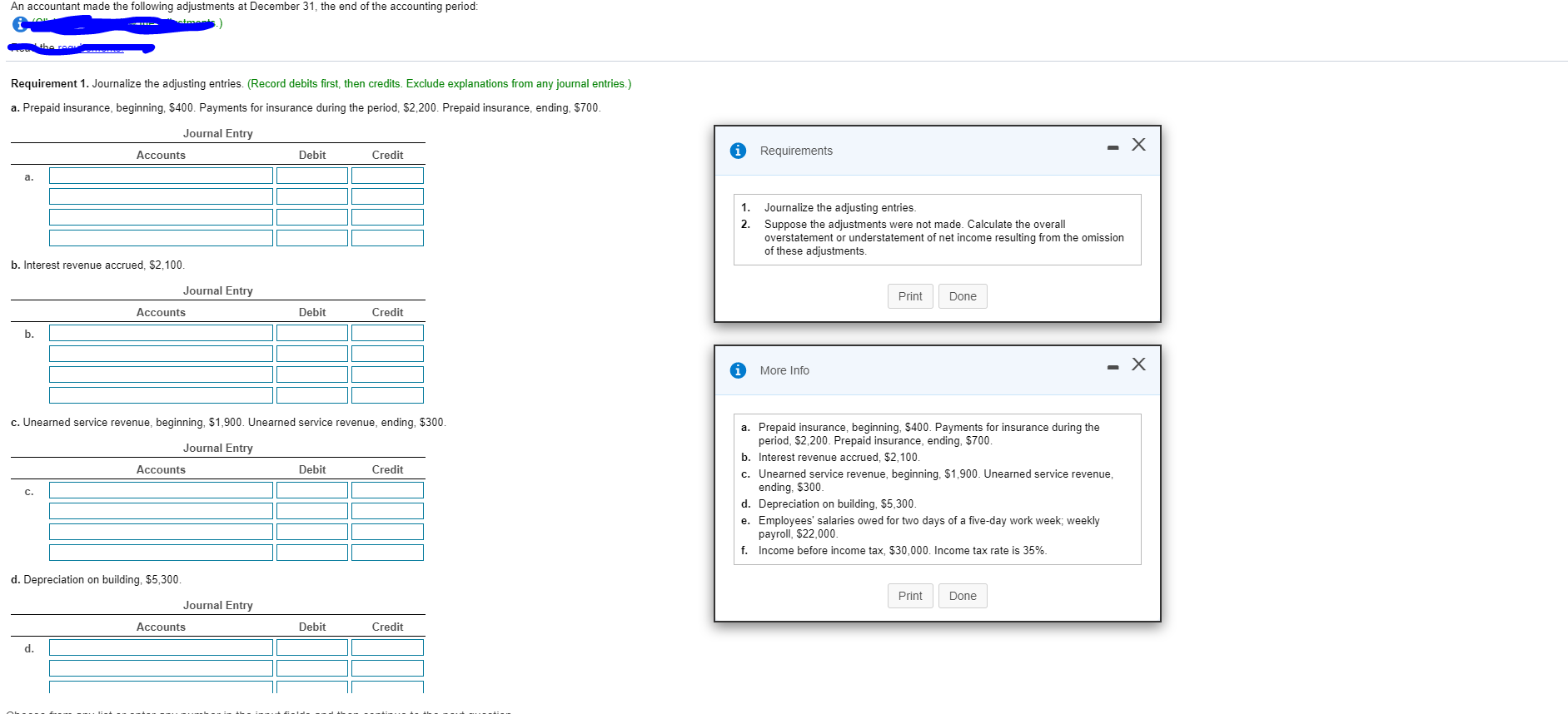

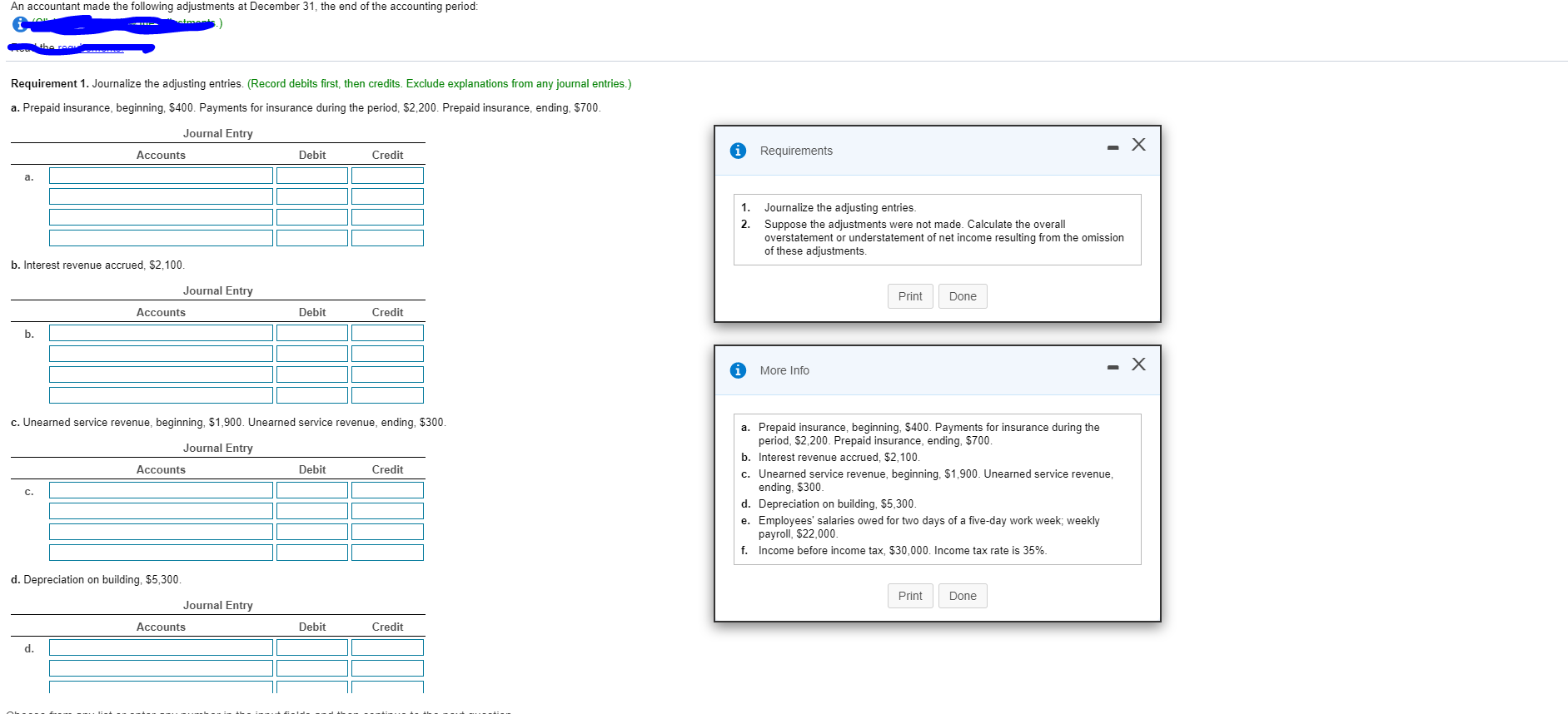

An accountant made the following adjustments at December 31, the end of the accounting period:

| 1. | Journalize the adjusting entries. |

| 2. | Suppose the adjustments were not made. Calculate the overall overstatement or understatement of net income resulting from the omission of these adjustments. |

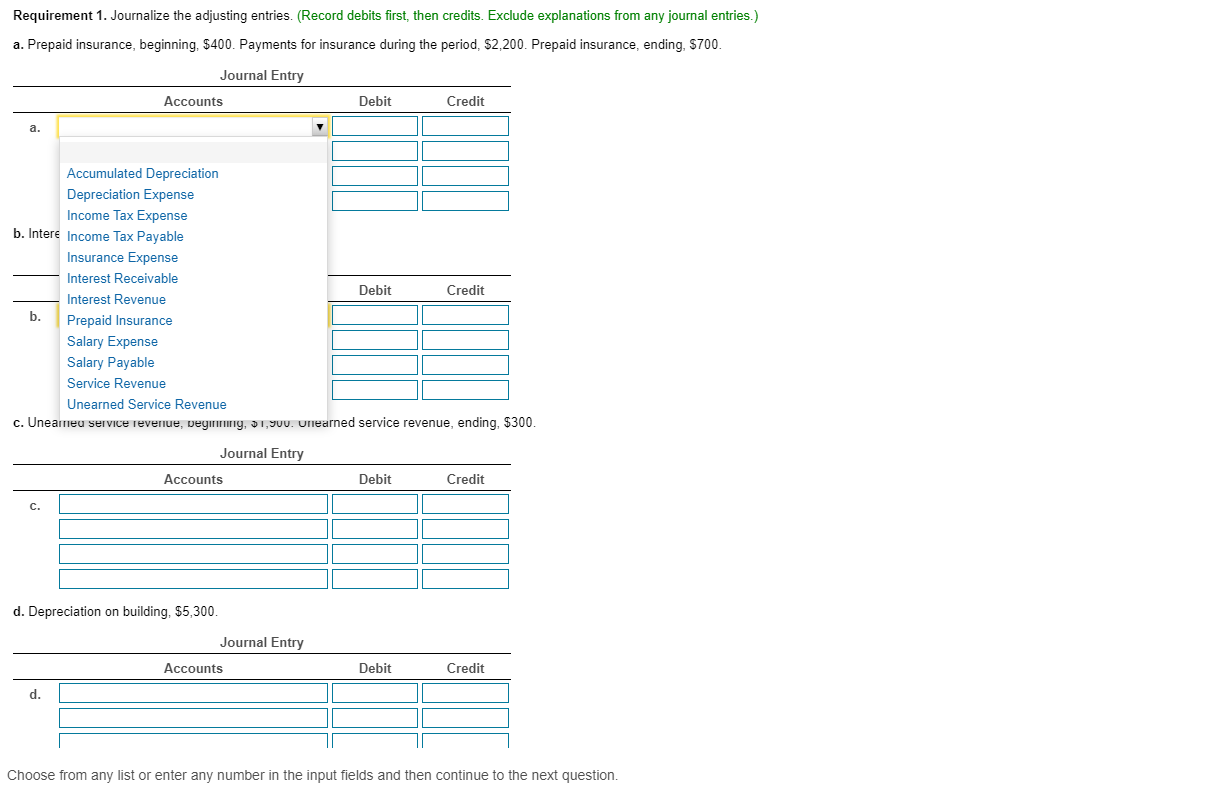

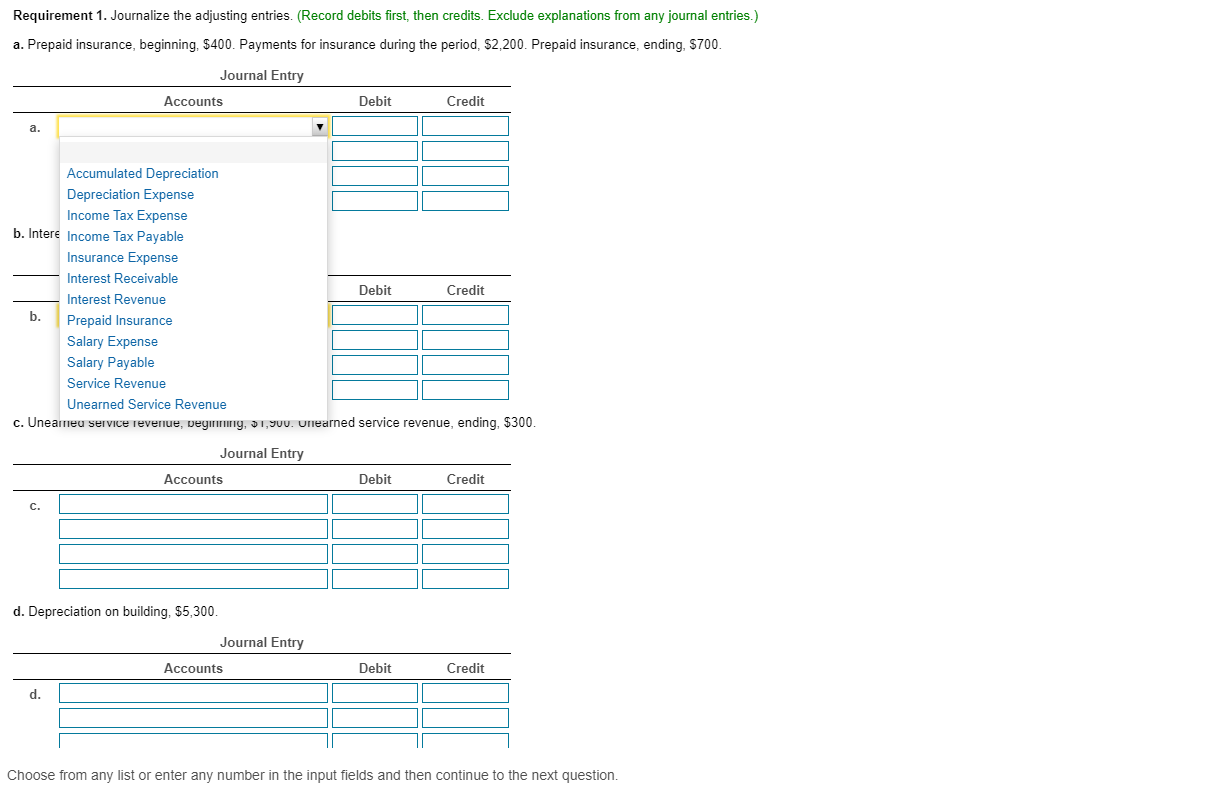

| a. | Prepaid insurance, beginning, $ 400$400. Payments for insurance during the period, $ 2 comma 200$2,200. Prepaid insurance, ending, $ 700$700. |

| b. | Interest revenue accrued, $ 2 comma 100$2,100. |

| c. | Unearned service revenue, beginning, $ 1 comma 900$1,900. Unearned service revenue, ending, $ 300$300. |

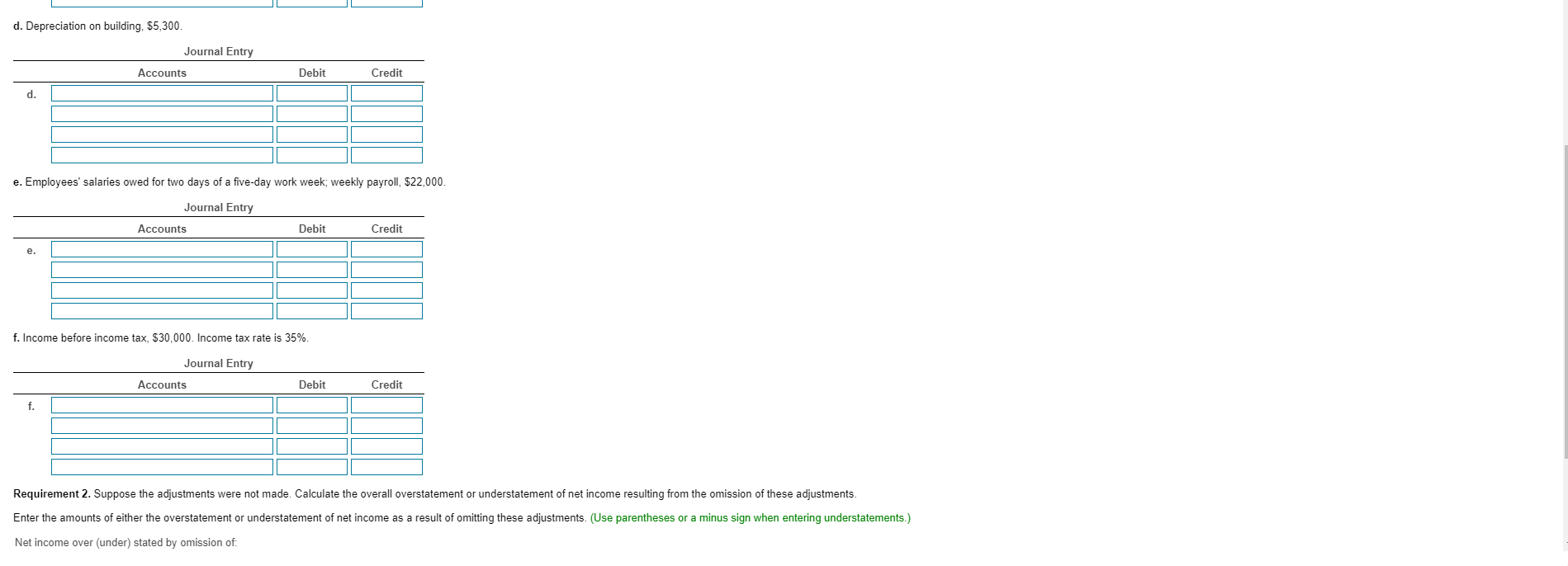

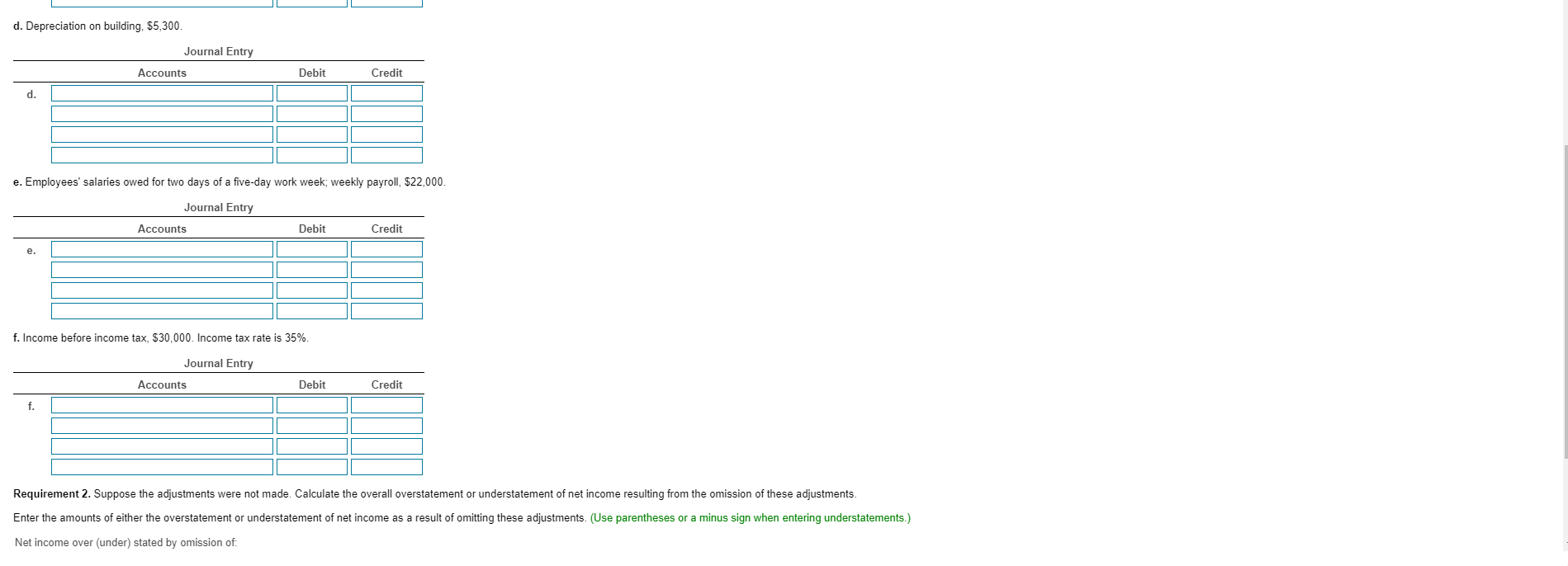

| d. | Depreciation on building, $ 5 comma 300$5,300. |

| e. | Employees' salaries owed for twotwo days of a five-day work week; weekly payroll, $ 22 comma 000$22,000. |

| f. | Income before income tax, $ 30 comma 000$30,000. Income tax rate is 3535%.    |

An accountant made the following adjustments at December 31, the end of the accounting period: strent Requirement 1. Journalize the adjusting entries. (Record debits first, then credits. Exclude explanations from any journal entries.) a. Prepaid insurance, beginning, $400. Payments for insurance during the period, S2,200. Prepaid insurance, ending, S700. Journal Entry X Requirements Credit Accounts Debit Journalize the adjusting entries. 1 Suppose the adjustments were not made. Calculate the overall overstatement or understatement of net income resulting from the omission of these adjustments. 2 b. Interest revenue accrued, $2,100. Journal Entry Print Done Accounts Debit Credit b. X More Info c. Unearned service revenue, beginning, $1,900. Unearned service revenue, ending, $300. a. Prepaid insurance, beginning, $400. Payments for insurance during the period, $2,200. Prepaid insurance, ending, $700. b. Interest revenue accrued, $2,100 c. Unearned service revenue, beginning, $1,900. Unearned service revenue, ending, $300 d. Depreciation on building, $5,300. Journal Entry Credit Accounts Debit e. Employees' salaries owed for two days of a five-day work week; weekly payroll, $22,000 f. Income before income tax, $30,000. Income tax rate is 35%. d. Depreciation on building, $5,300. Print Done Journal Entry Credit Accounts Debit d. Requirement 1. Journalize the adjusting entries. (Record debits first, then credits. Exclude explanations from any journal entries.) a. Prepaid insurance, beginning, $400. Payments for insurance during the period, S2,200. Prepaid insurance, ending, $700. Journal Entry Credit Accounts Debit . Accumulated Depreciation Depreciation Expense Income Tax Expense b. Intere Income Tax Payable Insurance Expense Interest Receivable Credit Debit Interest Revenue b. Prepaid Insurance Salary Expense Salary Payable Service Revenue Unearned Service Revenue ending, $300 c. Uneareu service reveriue, Deyi ng, 1,00. Urnearned service revenue, Journal Entry Credit Accounts Debit d. Depreciation on building, $5,300 Journal Entry Debit Credit Accounts Choose from any list or enter any number in the input fields and then continue to the next question. d. Depreciation on building, $5,300. Journal Entry Credit Accounts Debit e. Employees' salaries owed for two days of a five-day work week; weekly payroll, $22,000. Journal Entry Accounts Debit Credit e. f. Income before income tax, $30,000. Income tax rate is 35%. Journal Entry Accounts Debit Credit f. Requirement 2. Suppose the adjustments were not made. Calculate the overall overstatement or understatement of net income resulting from the omission of these adjustments. Enter the amounts of either the overstatement or understatement of net income as a result of omitting these adjustments. (Use parentheses or a minus sign when entering understatements.) Net income over (under) stated by omission of. e. Employees' salaries owed for two days of a five-day work week, weekly payroll, $22,000. Journal Entry Credit Accounts Debit f. Income before income tax, $30,000. Income tax rate is 35%. Journal Entry Debit Accounts Credit f. Requirement 2. Suppose the adjustments were not made. Calculate the overall overstatement or understatement of net income resulting from the omission of these adjustments. Enter the amounts of either the overstatement or understatement of net income as a result of omitting these adjustments. (Use parentheses or a minus sign when entering understatements.) Net income over (under) stated by omission of Insurance Expense Interest Revenue Service Revenue Depreciation Expense Salary Expense Income Tax Expense Total over (under) statement of net income Choose from any list or enter any number in the input fields and then continue to the next