Answered step by step

Verified Expert Solution

Question

1 Approved Answer

see below thanks :) Hammond Manufacturing Inc. was legally incorporated on January 2, 2020. Its articles of incorporation granted it the right to issue an

see below thanks :)

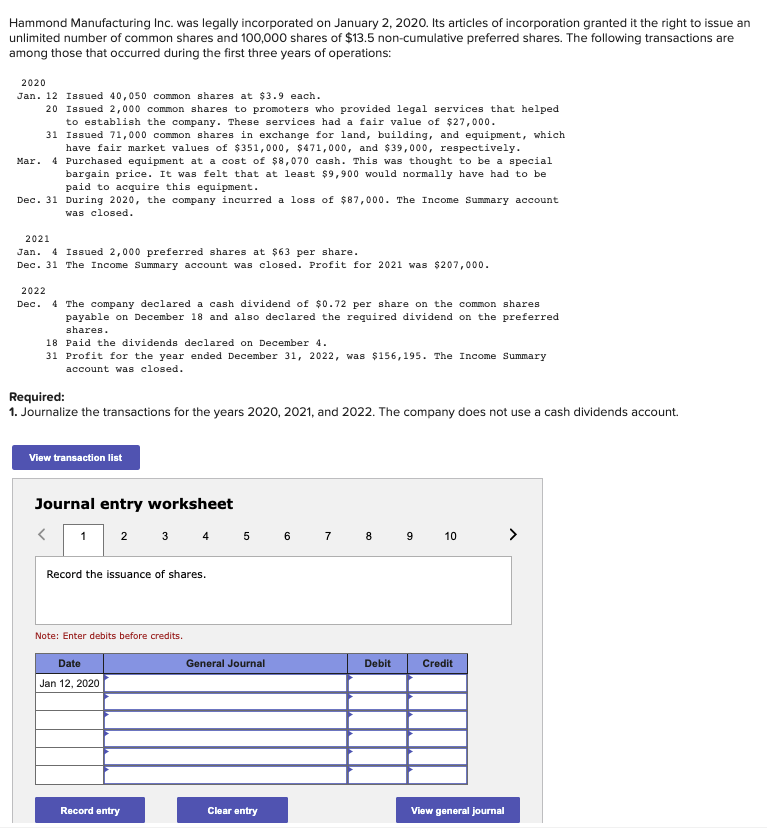

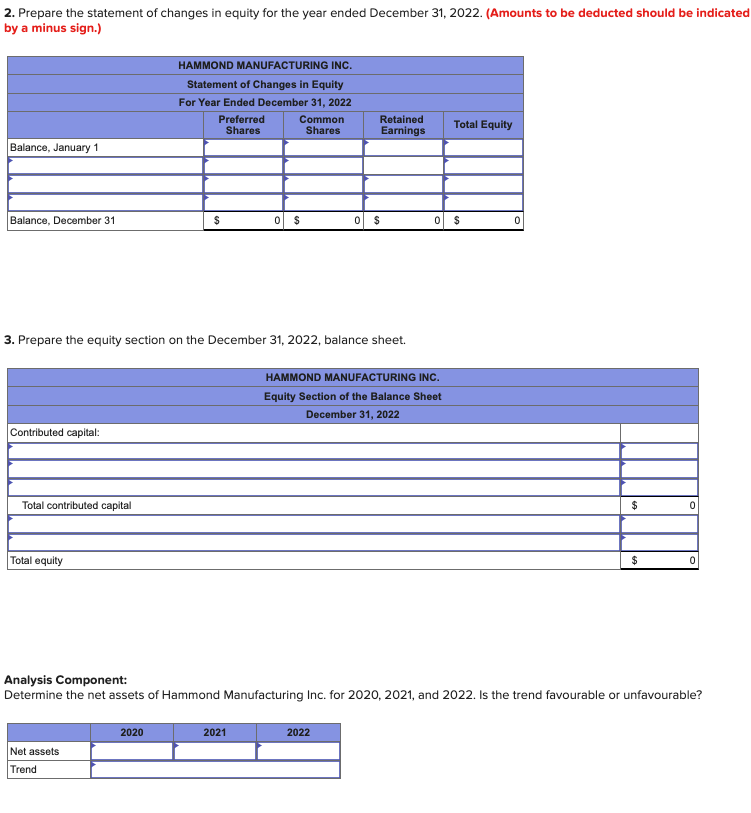

Hammond Manufacturing Inc. was legally incorporated on January 2, 2020. Its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $13.5 non-cumulative preferred shares. The following transactions are among those that occurred during the first three years of operations: 2020 Jan. 12 Issued 40,050 common shares at $3.9 each. 20 Issued 2,000 common shares to promoters who provided legal services that helped to establish the company. These services had a fair value of $27,000. 31 Issued 71,000 common shares in exchange for land, building, and equipment, which have fair market values of $351,000,$471,000, and $39,000, respectively. Mar. 4 purchased equipment at a cost of $8,070 cash. This was thought to be a special bargain price. It was felt that at least $9,900 would normally have had to be paid to acquire this equipment. Dec. 31 During 2020, the company incurred a loss of $87,000. The Income summary account was closed. 2021 Jan. 4 Issued 2,000 preferred shares at $63 per share. Dec. 31 The Income Summary account was closed. Profit for 2021 was $207,000. 2022 Dec. 4 The company declared a cash dividend of $0.72 per share on the common shares payable on December 18 and also declared the required dividend on the preferred shares. 18 Paid the dividends declared on December 4 . 31 profit for the year ended December 31,2022 , was $156,195. The Income Summary account was closed. Required: 1. Journalize the transactions for the years 2020, 2021, and 2022. The company does not use a cash dividends account. Journal entry worksheet Ivole: ciller uedils veivre creuls. 2. Prepare the statement of changes in equity for the year ended December 31,2022 . (Amounts to be deducted should be indicated by a minus sign.) 3. Prepare the equity section on the December 31,2022 , balance sheet. Analysis Component: Determine the net assets of Hammond Manufacturing Inc. for 2020,2021 , and 2022. Is the trend favourable or unfavourable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started