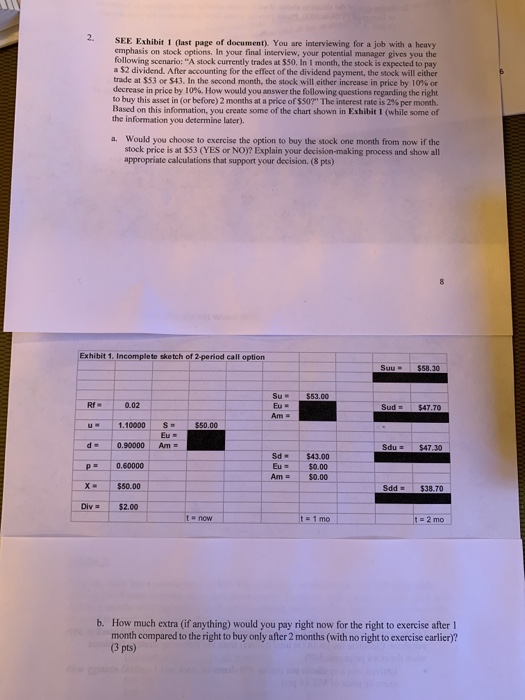

SEE Exhibit 1 (last page of document). You are interviewing for a job with a heavy emphasis on stock options. In your final interview, your potential manager gives you the following scenarios Astock currently trades $50. In 1 month, the stock is expected to pay a $2 dividend. After accounting for the effect of the dividend payment, the stock will either trade at $53 or $43. In the second month, the stock will either increase in price by 10% or decrease in price by 10%. How would you answer the following questions regarding the right to buy this asustin (or before) 2 months at a price of $SOT The interest rate is 296 per month Based on this information, you create some of the chart shown in Exhibit 1 (while some of the information you determine later). a. Would you choose to exercise the option to buy the stock one month from now if the stock price is at $53 (YES or NO)? Explain your decision-making process and show all appropriate calculations that support your decision. (8 pts) Exhibit 1. Incomplete sketch of 2-period call option 0.02 Sud 47.70 1.10000 SE 0.90000 Sdu - $47.30 Sd 0.60000 $43.00 $0.00 $0.00 Am = $50.00 SCH BA L Div $2.00 b. How much extra (if anything) would you pay right now for the right to exercise after month compared to the right to buy only after 2 months (with no right to exercise carlier)? (3 pts) SEE Exhibit 1 (last page of document). You are interviewing for a job with a heavy emphasis on stock options. In your final interview, your potential manager gives you the following scenarios Astock currently trades $50. In 1 month, the stock is expected to pay a $2 dividend. After accounting for the effect of the dividend payment, the stock will either trade at $53 or $43. In the second month, the stock will either increase in price by 10% or decrease in price by 10%. How would you answer the following questions regarding the right to buy this asustin (or before) 2 months at a price of $SOT The interest rate is 296 per month Based on this information, you create some of the chart shown in Exhibit 1 (while some of the information you determine later). a. Would you choose to exercise the option to buy the stock one month from now if the stock price is at $53 (YES or NO)? Explain your decision-making process and show all appropriate calculations that support your decision. (8 pts) Exhibit 1. Incomplete sketch of 2-period call option 0.02 Sud 47.70 1.10000 SE 0.90000 Sdu - $47.30 Sd 0.60000 $43.00 $0.00 $0.00 Am = $50.00 SCH BA L Div $2.00 b. How much extra (if anything) would you pay right now for the right to exercise after month compared to the right to buy only after 2 months (with no right to exercise carlier)? (3 pts)