See Exhibit A below showing analysis for Hershey Company MD&A portion of the Form 10-K.

| Horizontal Analysis | 12/31/18 | 12/31/17 | Dollar Change | Percentage Change |

| Sales | | | | |

| Gross Profit | | | | |

- Complete this chart using values from the exhibit provided.

- Which of the following is not addressed in the 2018 vs 2017 comparative analysis of sales provided in this report?

- Overall, net sales increased year-over-year in 2018 vs 2017.

- The recent acquisition of Amplify and Pirate Brands increased sales volumes in 2018 as compared to 2017.

- Decrease in promotional expenses resulted in favorable net price realization in 2018 as compared to 2017.

- An unfavorable impact from foreign currency exchange rates of 0.2%.

- Read the 2018 vs 2017 comparative analysis for Cost of Sales and Gross Margin in Exhibit A. If you needed further clarification, which of the following questions could you ask your accountant?

- Why did favorable supply chain productivity help offset higher costs in 2018 vs 2017?

- To confirm, higher transportation costs (freight and logistics) caused a decrease in gross margin in 2018 as compared to 2017?

- Why did additional plant costs due to new production lines and an unfavorable product mix contribute to a lower gross margin in 2018 as compared to 2017?

- All of the above questions could add clarification to your understanding.

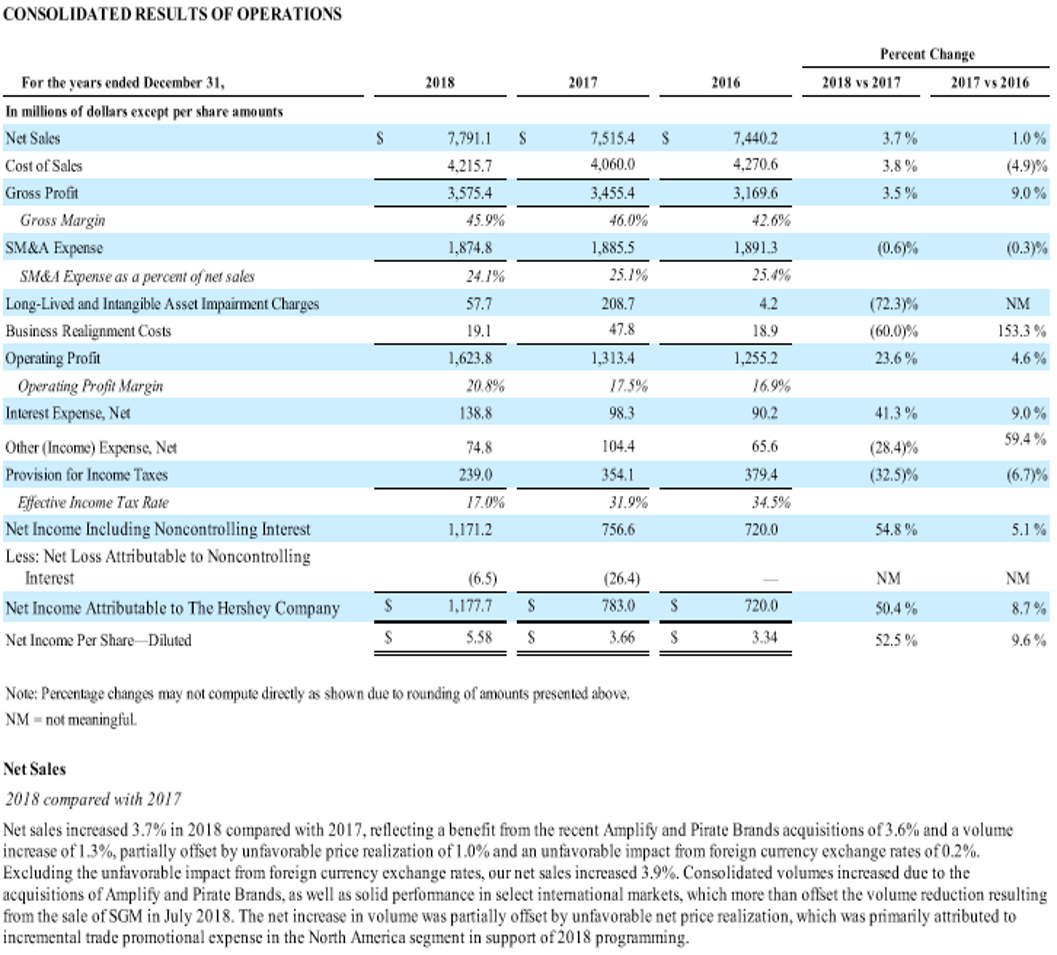

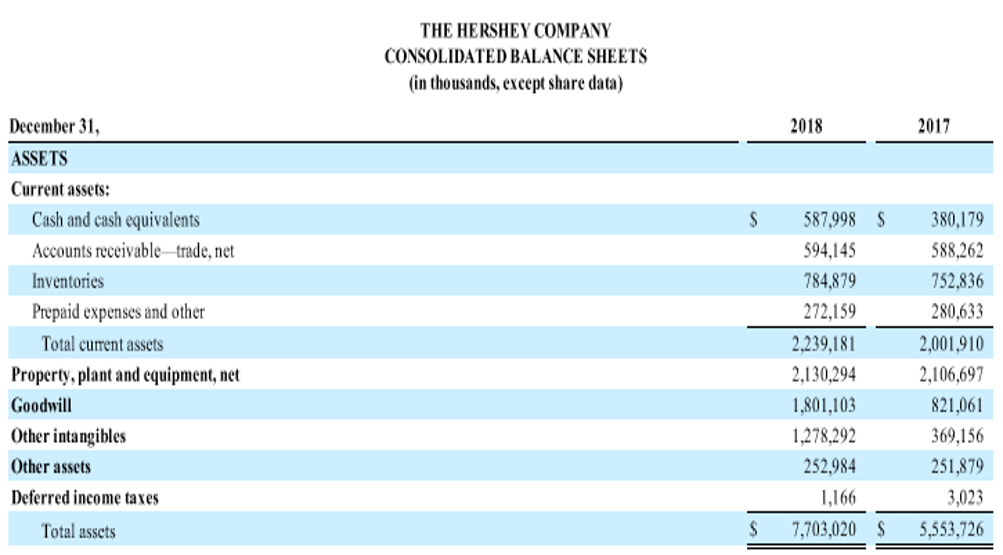

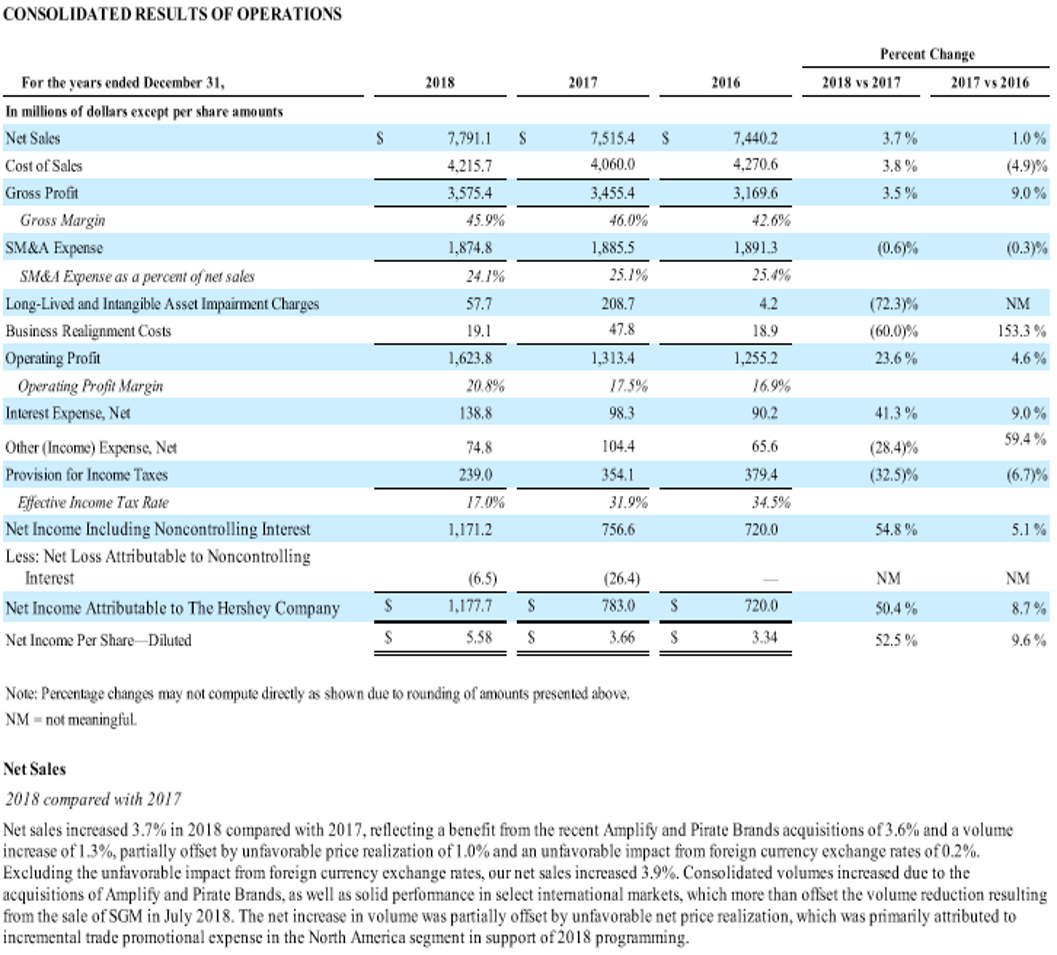

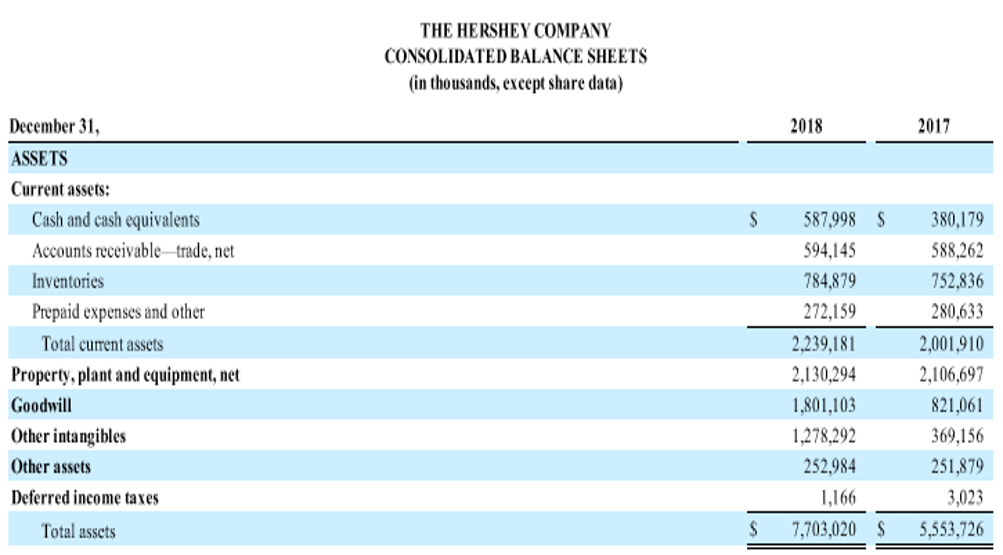

CONSOLIDATED RESULTS OF OPERATIONS Percent Change 2018 vs 2017 2017 vs 2016 2018 2017 2016 S S S 3.7% 3.8 % 3.5% 1.0% (4.9)% 9.0% For the years ended December 31, In millions of dollars except per share amounts Net Sales Cost of Sales Gross Profit Gross Margin SM&A Expense SM&A Expense as a percent of net sales Long-Lived and Intangible Asset Impairment Charges Business Realignment Costs Operating Profit Operating Profit Margir Interest Expense, Net 7.791.1 4,215.7 3.575.4 45.9% 1,874.8 24.1% 57.7 (0.69% (0.39% 7,515.4 4,060.0 3,455.4 46.0% 1,885.5 25.1% 208.7 47.8 1,313.4 17.5% 98.3 7,440.2 4,270.6 3,169.6 42.6% 1,891.3 25.4% 4.2 18.9 1,255.2 16.9% 90.2 19.1 (72.39% (60.09% 23.6% NM 153.3% 4.6% 1,623.8 20.8% 138.8 41.3% 9.0% 59.4% 65.6 104.4 354.1 (28.49% (32.59% (6.79% 74.8 239.0 17.0% 1,171.2 31.9% 756.6 379.4 34.5% 720.0 54.8% 5.1% Other (Income) Expense, Net Provision for Income Taxes Ellective Income Tax Rate Net Income Including Noncontrolling Interest Less: Net Loss Attributable to Noncontrolling Interest Net Income Attributable to The Hershey Company Net Income Per Share Diluted (6.5) 1,177.7 5,58 S $ NM 50.4% (264) 783.0 3.66 S s S s 720.0 3.34 NM 8.7% 9.6% 52.5% Note: Percentage changes may not compute directly as shown due to rounding of amounts presented above, NM not meaningful Net Sales 2018 compared with 2017 Net sales increased 3.7% in 2018 compared with 2017, reflecting a benefit from the recent Amplify and Pirate Brands acquisitions of 3.6% and a volume increase of 1.3%, partially offset by unfavorable price realization of 1.0% and an unfavorable impact from foreign currency exchange rates of 0.2% Excluding the unfavorable impact from forcign currency exchange rates, our net sales increased 3.9%. Consolidated volumes increased due to the acquisitions of Amplify and Pirate Brands, as well as solid performance in select interational markets, which inore than offset the volume reduction resulting from the sale of SGM in July 2018. The net increase in volume was partially offset by unfavorable net price realization, which was primarily attributed to incremental trade promotional expense in the North America segment in support of 2018 programning. THE HERSHEY COMPANY CONSOLIDATED BALANCE SHEETS (in thousands, except share data) 2018 2017 S $ December 31, ASSETS Current assets: Cash and cash equivalents Accounts receivable-trade, net Inventories Prepaid expenses and other Total current assets Property, plant and equipment, net Goodwill Other intangibles Other assets 587,998 594,145 784,879 272,159 2.239,181 2,130,294 1,801,103 1,278,292 252,984 1,166 7,703,020 380,179 588,262 752.836 280,633 2.001.910 2,106,697 821,061 369,156 251,879 3,023 5,553,726 Deferred income taxes Total assets $ $ CONSOLIDATED RESULTS OF OPERATIONS Percent Change 2018 vs 2017 2017 vs 2016 2018 2017 2016 S S S 3.7% 3.8 % 3.5% 1.0% (4.9)% 9.0% For the years ended December 31, In millions of dollars except per share amounts Net Sales Cost of Sales Gross Profit Gross Margin SM&A Expense SM&A Expense as a percent of net sales Long-Lived and Intangible Asset Impairment Charges Business Realignment Costs Operating Profit Operating Profit Margir Interest Expense, Net 7.791.1 4,215.7 3.575.4 45.9% 1,874.8 24.1% 57.7 (0.69% (0.39% 7,515.4 4,060.0 3,455.4 46.0% 1,885.5 25.1% 208.7 47.8 1,313.4 17.5% 98.3 7,440.2 4,270.6 3,169.6 42.6% 1,891.3 25.4% 4.2 18.9 1,255.2 16.9% 90.2 19.1 (72.39% (60.09% 23.6% NM 153.3% 4.6% 1,623.8 20.8% 138.8 41.3% 9.0% 59.4% 65.6 104.4 354.1 (28.49% (32.59% (6.79% 74.8 239.0 17.0% 1,171.2 31.9% 756.6 379.4 34.5% 720.0 54.8% 5.1% Other (Income) Expense, Net Provision for Income Taxes Ellective Income Tax Rate Net Income Including Noncontrolling Interest Less: Net Loss Attributable to Noncontrolling Interest Net Income Attributable to The Hershey Company Net Income Per Share Diluted (6.5) 1,177.7 5,58 S $ NM 50.4% (264) 783.0 3.66 S s S s 720.0 3.34 NM 8.7% 9.6% 52.5% Note: Percentage changes may not compute directly as shown due to rounding of amounts presented above, NM not meaningful Net Sales 2018 compared with 2017 Net sales increased 3.7% in 2018 compared with 2017, reflecting a benefit from the recent Amplify and Pirate Brands acquisitions of 3.6% and a volume increase of 1.3%, partially offset by unfavorable price realization of 1.0% and an unfavorable impact from foreign currency exchange rates of 0.2% Excluding the unfavorable impact from forcign currency exchange rates, our net sales increased 3.9%. Consolidated volumes increased due to the acquisitions of Amplify and Pirate Brands, as well as solid performance in select interational markets, which inore than offset the volume reduction resulting from the sale of SGM in July 2018. The net increase in volume was partially offset by unfavorable net price realization, which was primarily attributed to incremental trade promotional expense in the North America segment in support of 2018 programning. THE HERSHEY COMPANY CONSOLIDATED BALANCE SHEETS (in thousands, except share data) 2018 2017 S $ December 31, ASSETS Current assets: Cash and cash equivalents Accounts receivable-trade, net Inventories Prepaid expenses and other Total current assets Property, plant and equipment, net Goodwill Other intangibles Other assets 587,998 594,145 784,879 272,159 2.239,181 2,130,294 1,801,103 1,278,292 252,984 1,166 7,703,020 380,179 588,262 752.836 280,633 2.001.910 2,106,697 821,061 369,156 251,879 3,023 5,553,726 Deferred income taxes Total assets $ $