Answered step by step

Verified Expert Solution

Question

1 Approved Answer

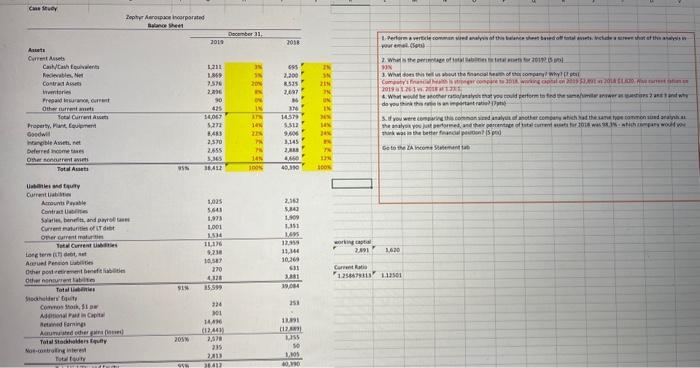

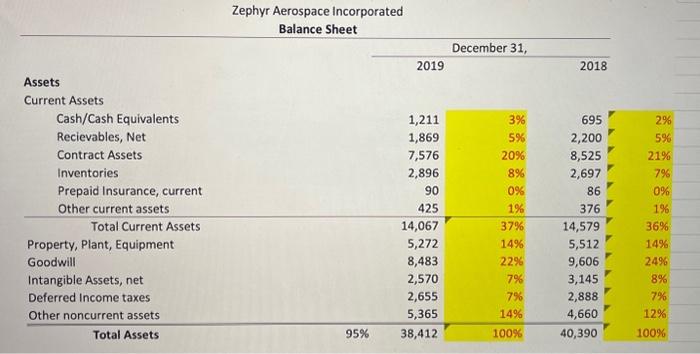

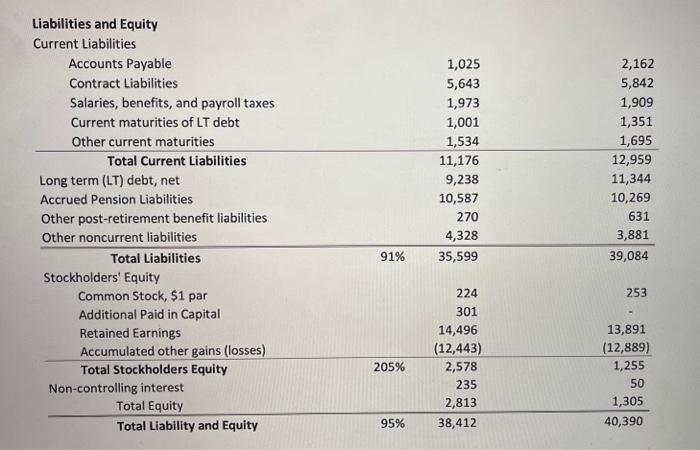

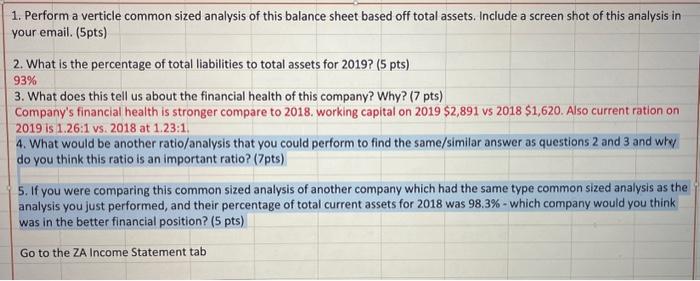

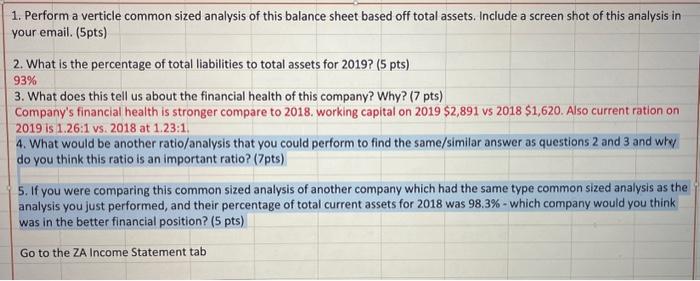

**see image for relevant data** #4 What would be another ratio/analysis that you could perform to find the same/similar answer as question 2 (liability to

**see image for relevant data**#4 What would be another ratio/analysis that you could perform to find the same/similar answer as question 2 (liability to asset percentage?) and question 3 (what does this tell about financial health?)? why do you think this ratio is important? #5 If you are comparing this common-size analysis of another company, which had the same type common-size analysis, and their total current asset for 2018 is 98.3% - Which company is better financial option?  #4 #5

#4 #5

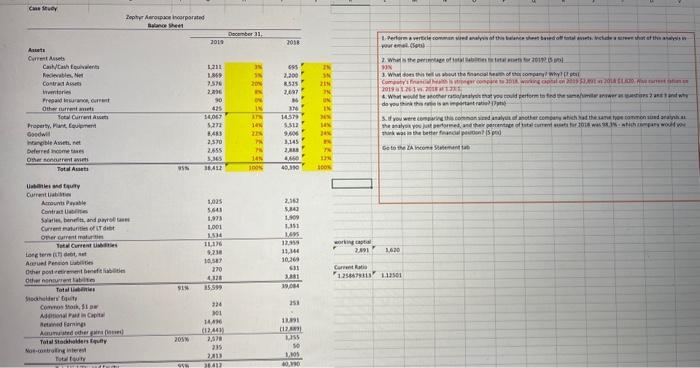

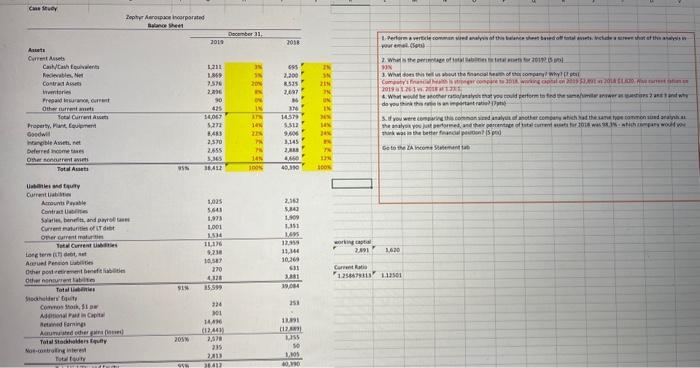

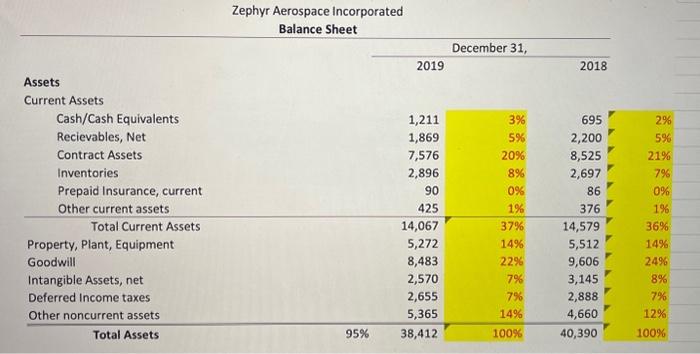

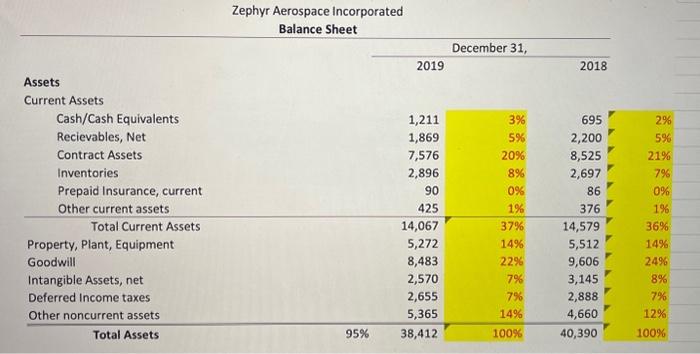

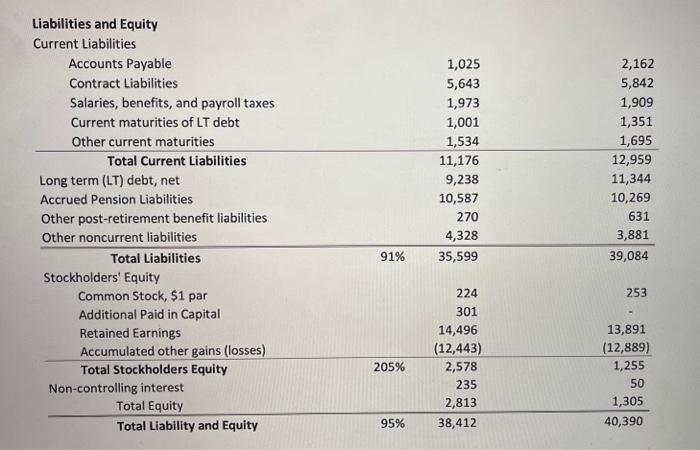

wartintitists) B) Zephyr Aerospace Incorporated Balance Sheet Liabilities and Equity Current Liabilities 1. Perform a verticle common sized analysis of this balance sheet based off total assets. Include a screen shot of this analysis in your email. (5pts) 2. What is the percentage of total liabilities to total assets for 2019? (5 pts) 93% 3. What does this tell us about the financial health of this company? Why? (7 pts) Company's financial health is stronger compare to 2018. working capital on 2019$2,891 vs 2018$1,620. Also current ration on 2019 is 1.26:1 vs. 2018 at 1.23:1 4. What would be another ratio/analysis that you could perform to find the same/similar answer as questions 2 and 3 and why do you think this ratio is an important ratio? (7pts) 5. If you were comparing this common sized analysis of another company which had the same type common sized analysis as the analysis you just performed, and their percentage of total current assets for 2018 was 98.3% - which company would you think was in the better financial position? (5 pts) Go to the ZA Income Statement tab wartintitists) B) Zephyr Aerospace Incorporated Balance Sheet Liabilities and Equity Current Liabilities 1. Perform a verticle common sized analysis of this balance sheet based off total assets. Include a screen shot of this analysis in your email. (5pts) 2. What is the percentage of total liabilities to total assets for 2019? (5 pts) 93% 3. What does this tell us about the financial health of this company? Why? (7 pts) Company's financial health is stronger compare to 2018. working capital on 2019$2,891 vs 2018$1,620. Also current ration on 2019 is 1.26:1 vs. 2018 at 1.23:1 4. What would be another ratio/analysis that you could perform to find the same/similar answer as questions 2 and 3 and why do you think this ratio is an important ratio? (7pts) 5. If you were comparing this common sized analysis of another company which had the same type common sized analysis as the analysis you just performed, and their percentage of total current assets for 2018 was 98.3% - which company would you think was in the better financial position? (5 pts) Go to the ZA Income Statement tab

wartintitists) B) Zephyr Aerospace Incorporated Balance Sheet Liabilities and Equity Current Liabilities 1. Perform a verticle common sized analysis of this balance sheet based off total assets. Include a screen shot of this analysis in your email. (5pts) 2. What is the percentage of total liabilities to total assets for 2019? (5 pts) 93% 3. What does this tell us about the financial health of this company? Why? (7 pts) Company's financial health is stronger compare to 2018. working capital on 2019$2,891 vs 2018$1,620. Also current ration on 2019 is 1.26:1 vs. 2018 at 1.23:1 4. What would be another ratio/analysis that you could perform to find the same/similar answer as questions 2 and 3 and why do you think this ratio is an important ratio? (7pts) 5. If you were comparing this common sized analysis of another company which had the same type common sized analysis as the analysis you just performed, and their percentage of total current assets for 2018 was 98.3% - which company would you think was in the better financial position? (5 pts) Go to the ZA Income Statement tab wartintitists) B) Zephyr Aerospace Incorporated Balance Sheet Liabilities and Equity Current Liabilities 1. Perform a verticle common sized analysis of this balance sheet based off total assets. Include a screen shot of this analysis in your email. (5pts) 2. What is the percentage of total liabilities to total assets for 2019? (5 pts) 93% 3. What does this tell us about the financial health of this company? Why? (7 pts) Company's financial health is stronger compare to 2018. working capital on 2019$2,891 vs 2018$1,620. Also current ration on 2019 is 1.26:1 vs. 2018 at 1.23:1 4. What would be another ratio/analysis that you could perform to find the same/similar answer as questions 2 and 3 and why do you think this ratio is an important ratio? (7pts) 5. If you were comparing this common sized analysis of another company which had the same type common sized analysis as the analysis you just performed, and their percentage of total current assets for 2018 was 98.3% - which company would you think was in the better financial position? (5 pts) Go to the ZA Income Statement tab

**see image for relevant data**

#4 What would be another ratio/analysis that you could perform to find the same/similar answer as question 2 (liability to asset percentage?) and question 3 (what does this tell about financial health?)? why do you think this ratio is important?#5 If you are comparing this common-size analysis of another company, which had the same type common-size analysis, and their total current asset for 2018 is 98.3% - Which company is better financial option?

#4 #5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started