Question

See photo below: it;'s a bit blurry so I copied the text. Please check my labels, what I've filled in so far (that it's right)

See photo below: it;'s a bit blurry so I copied the text.

Please check my labels, what I've filled in so far (that it's right) and fill in the rest. show working

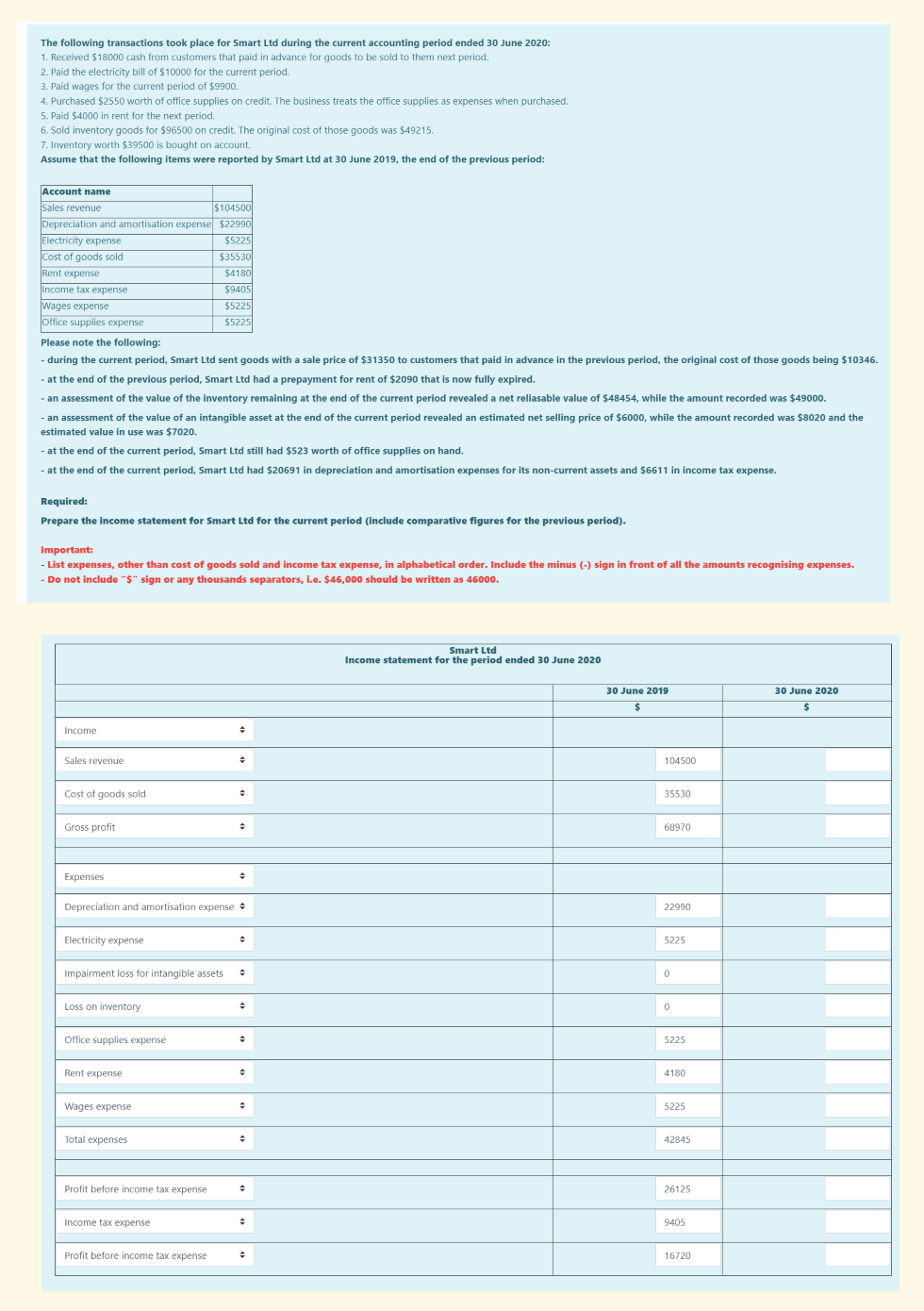

The following transactions took place for Smart Ltd during the current accounting period ended 30 June 2020:

1. Received $18000 cash from customers that paid in advance for goods to be sold to them next period.

2. Paid the electricity bill of $10000 for the current period.

3. Paid wages for the current period of $9900.

4. Purchased $2550 worth of office supplies on credit. The business treats the office supplies as expenses when purchased.

5. Paid $4000 in rent for the next period.

6. Sold inventory goods for $96500 on credit. The original cost of those goods was $49215.

7. Inventory worth $39500 is bought on account.

Assume that the following items were reported by Smart Ltd at 30 June 2019, the end of the previous period:

| Account name |

|

|---|---|

| Sales revenue | $104500 |

| Depreciation and amortisation expense | $22990 |

| Electricity expense | $5225 |

| Cost of goods sold | $35530 |

| Rent expense | $4180 |

| Income tax expense | $9405 |

| Wages expense | $5225 |

| Office supplies expense | $5225 |

Please note the following:

- during the current period, Smart Ltd sent goods with a sale price of $31350 to customers that paid in advance in the previous period, the original cost of those goods being $10346.

- at the end of the previous period, Smart Ltd had a prepayment for rent of $2090 that is now fully expired.

- an assessment of the value of the inventory remaining at the end of the current period revealed a net reliasable value of $48454, while the amount recorded was $49000.

- an assessment of the value of an intangible asset at the end of the current period revealed an estimated net selling price of $6000, while the amount recorded was $8020 and the estimated value in use was $7020.

- at the end of the current period, Smart Ltd still had $523 worth of office supplies on hand.

- at the end of the current period, Smart Ltd had $20691 in depreciation and amortisation expenses for its non-current assets and $6611 in income tax expense.

Required: Prepare the income statement for Smart Ltd for the current period (include comparative figures for the previous period).

Important:

- List expenses, other than cost of goods sold and income tax expense, in alphabetical order. Include the minus (-) sign in front of all the amounts recognising expenses.

- Do not include "$" sign or any thousands separators, i.e. $46,000 should be written as 46000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started