Answered step by step

Verified Expert Solution

Question

1 Approved Answer

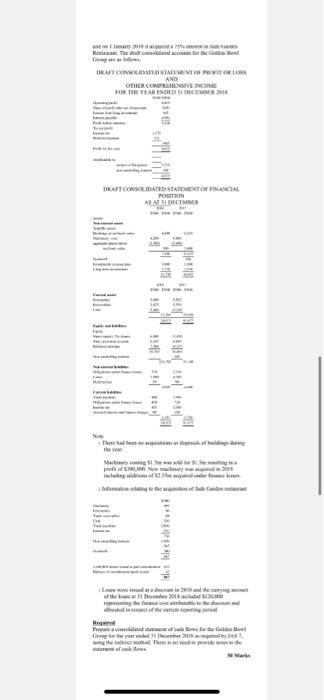

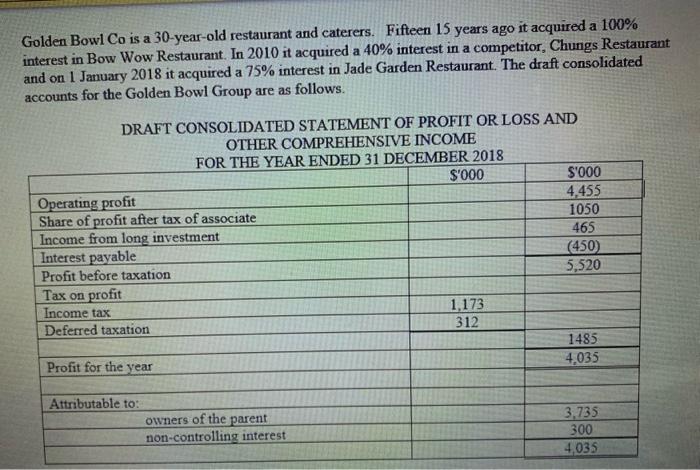

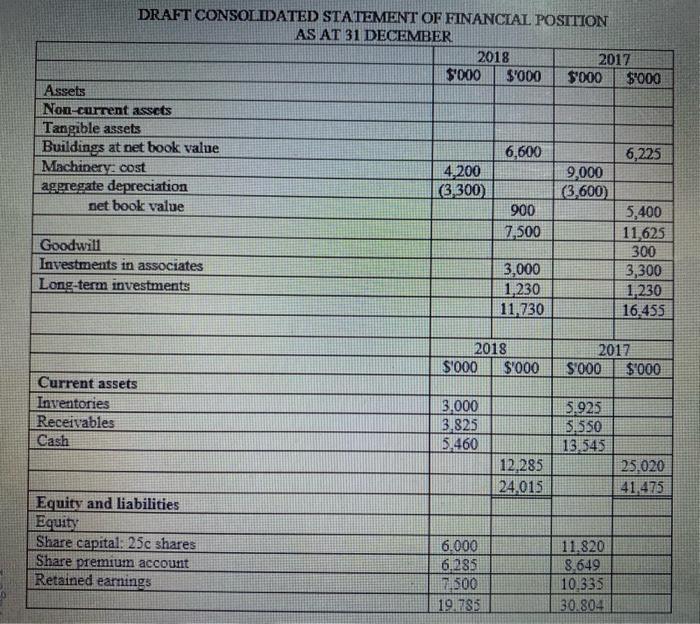

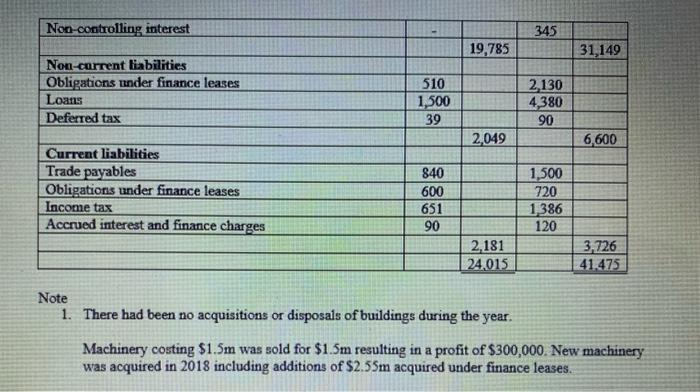

see photos below Fies the peut Golden Bowl Co is a 30-year-old restaurant and caterers. Fifteen 15 years ago it acquired a 100% interest in

see photos below

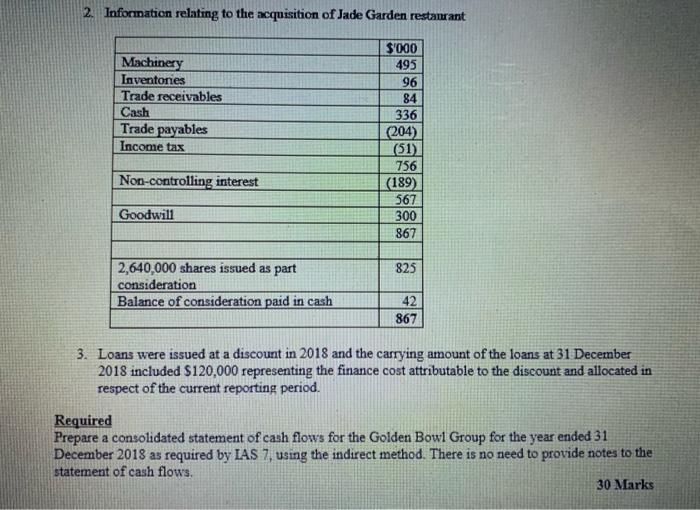

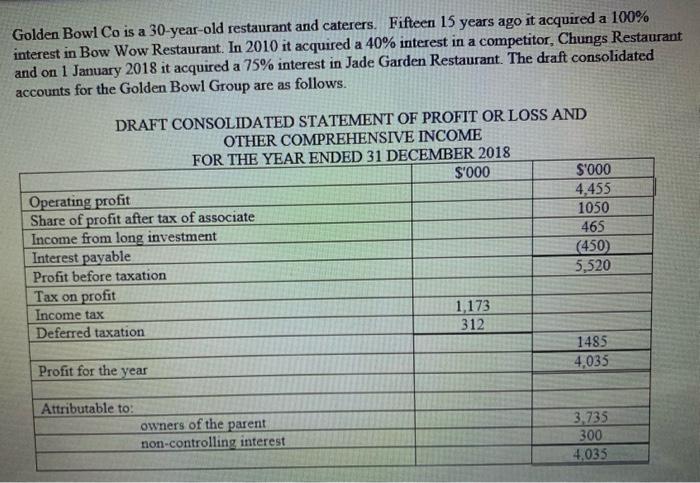

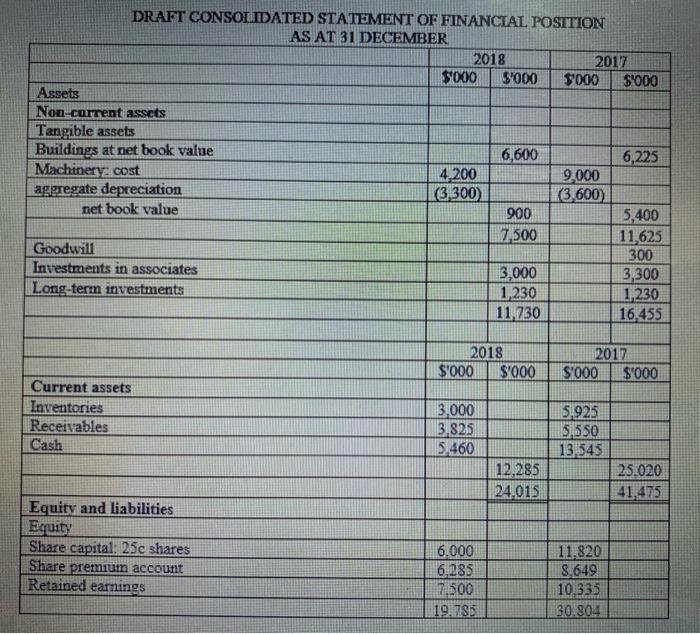

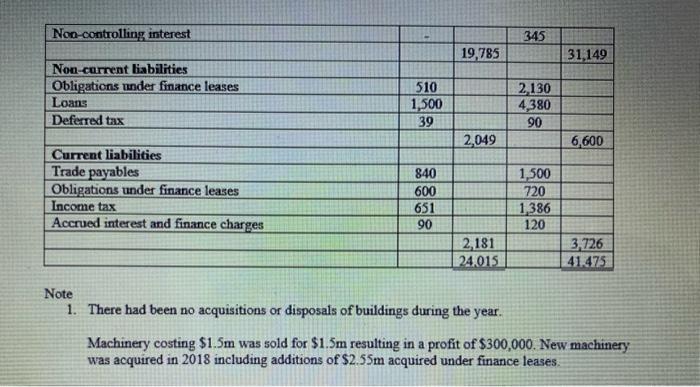

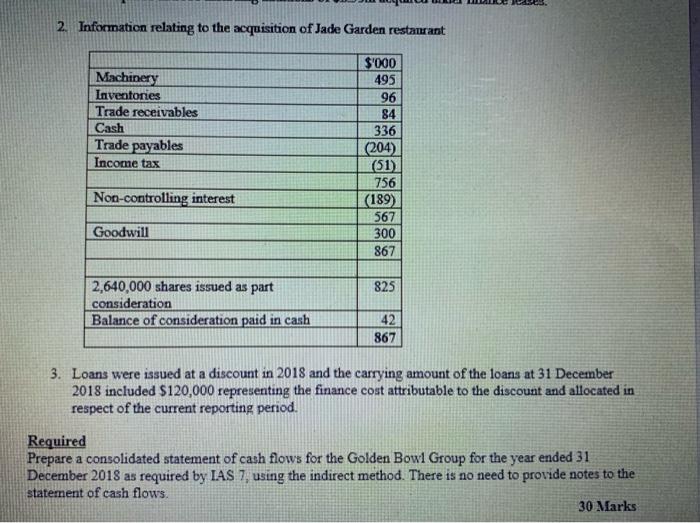

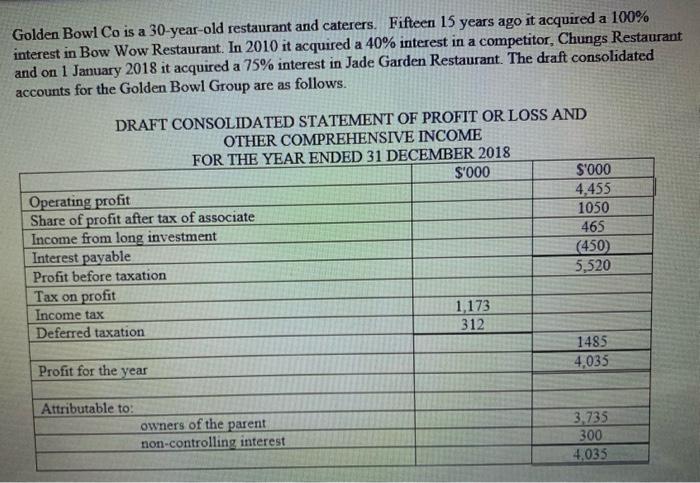

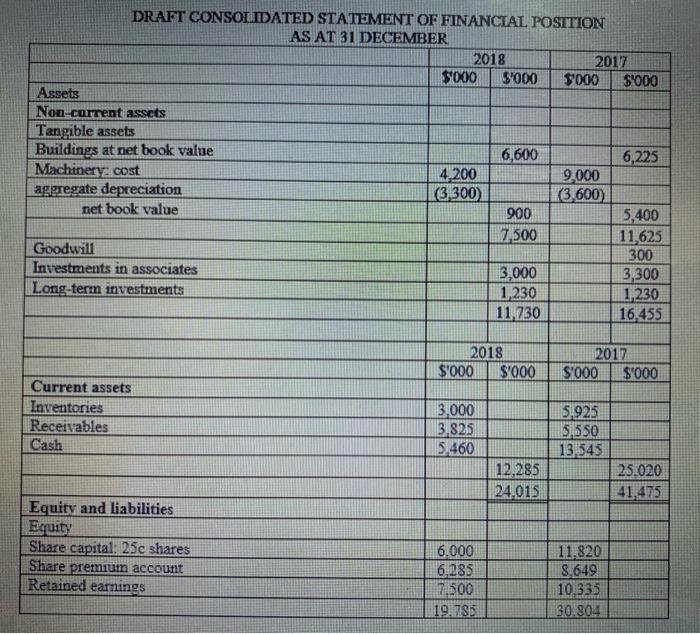

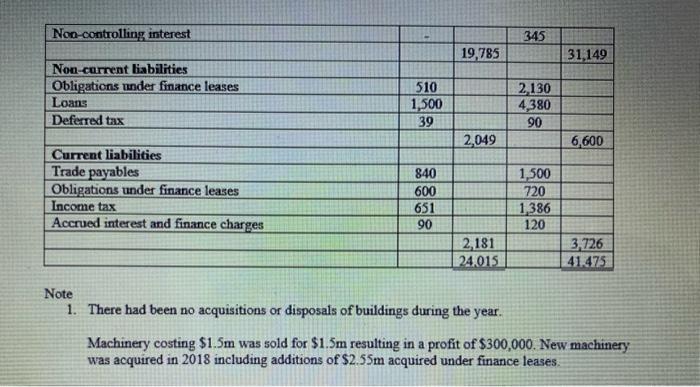

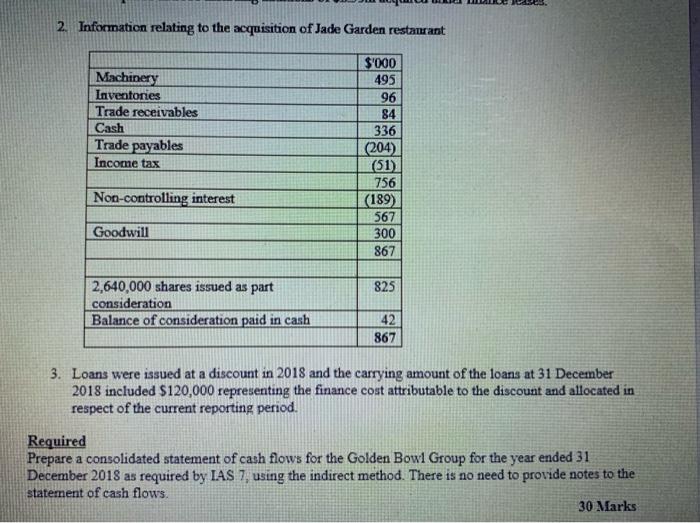

Fies the peut Golden Bowl Co is a 30-year-old restaurant and caterers. Fifteen 15 years ago it acquired a 100% interest in Bow Wow Restaurant. In 2010 it acquired a 40% interest in a competitor, Chungs Restaurant and on 1 January 2018 it acquired a 75% interest in Jade Garden Restaurant. The draft consolidated accounts for the Golden Bowl Group are as follows. DRAFT CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME EAD THE VEAR FNIDED 31 DECEMBER 2018 DRAFT CONSOT TDATKI 1. There had been no acquisitions or disposals of buildings during the year. Machinery costing $1.5m was sold for $1.5m resulting in a profit of $300,000. New machinery was acquired in 2018 including additions of $2.55m acquired under finance leases. 2. Information relating to the acquisition of Jade Garden restanrant 3. Loans were issued at a discount in 2018 and the carrying amount of the loans at 31 December 2018 included $120,000 representing the finance cost attributable to the discount and allocated in respect of the current reporting period. Required Prepare a consolidated statement of caih flows for the Golden Bowl Group for the year ended 31 December 2018 as required by LAS 7, using the indirect method. There is no need to provide notes to the statement of cash flows. 30 Marks Golden Bowl Co is a 30 -year-old restaurant and caterers. Fifteen 15 years ago it acquired a 100% interest in Bow Wow Restaurant. In 2010 it acquired a 40% interest in a competitor, Chungs Restaurant and on 1 January 2018 it acquired a 75% interest in Jade Garden Restaurant. The draft consolidated accounts for the Golden Bowl Group are as follows. DRAFT CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME EAD THE VF AR FNIDFD 31 DECEMBER 2018 DRAFT CONSOIIDATED STATEMENT OF FINANCTAL POSTTION AS AT 31 DECEMBER 1. There had been no acquisitions or disposals of buildings during the year. Machinery costing $1.5m was sold for $1.5m resulting in a profit of $300,000. New machinery was acquired in 2018 including additions of $2.55m acquired under finance leases. 2. Information relating to the acquisition of Jade Garden restaurant 3. Loans were issued at a discount in 2018 and the carrying amount of the loans at 31 December 2018 included $120,000 representing the finance cost attributable to the discount and allocated in respect of the current reporting period. Required Prepare a consolidated statement of cash flows for the Golden Bow1 Group for the year ended 31 December 2018 as required by IAS 7, using the indirect method. There is no need to provide notes to the statement of cash flows. Fies the peut Golden Bowl Co is a 30-year-old restaurant and caterers. Fifteen 15 years ago it acquired a 100% interest in Bow Wow Restaurant. In 2010 it acquired a 40% interest in a competitor, Chungs Restaurant and on 1 January 2018 it acquired a 75% interest in Jade Garden Restaurant. The draft consolidated accounts for the Golden Bowl Group are as follows. DRAFT CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME EAD THE VEAR FNIDED 31 DECEMBER 2018 DRAFT CONSOT TDATKI 1. There had been no acquisitions or disposals of buildings during the year. Machinery costing $1.5m was sold for $1.5m resulting in a profit of $300,000. New machinery was acquired in 2018 including additions of $2.55m acquired under finance leases. 2. Information relating to the acquisition of Jade Garden restanrant 3. Loans were issued at a discount in 2018 and the carrying amount of the loans at 31 December 2018 included $120,000 representing the finance cost attributable to the discount and allocated in respect of the current reporting period. Required Prepare a consolidated statement of caih flows for the Golden Bowl Group for the year ended 31 December 2018 as required by LAS 7, using the indirect method. There is no need to provide notes to the statement of cash flows. 30 Marks Golden Bowl Co is a 30 -year-old restaurant and caterers. Fifteen 15 years ago it acquired a 100% interest in Bow Wow Restaurant. In 2010 it acquired a 40% interest in a competitor, Chungs Restaurant and on 1 January 2018 it acquired a 75% interest in Jade Garden Restaurant. The draft consolidated accounts for the Golden Bowl Group are as follows. DRAFT CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME EAD THE VF AR FNIDFD 31 DECEMBER 2018 DRAFT CONSOIIDATED STATEMENT OF FINANCTAL POSTTION AS AT 31 DECEMBER 1. There had been no acquisitions or disposals of buildings during the year. Machinery costing $1.5m was sold for $1.5m resulting in a profit of $300,000. New machinery was acquired in 2018 including additions of $2.55m acquired under finance leases. 2. Information relating to the acquisition of Jade Garden restaurant 3. Loans were issued at a discount in 2018 and the carrying amount of the loans at 31 December 2018 included $120,000 representing the finance cost attributable to the discount and allocated in respect of the current reporting period. Required Prepare a consolidated statement of cash flows for the Golden Bow1 Group for the year ended 31 December 2018 as required by IAS 7, using the indirect method. There is no need to provide notes to the statement of cash flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started