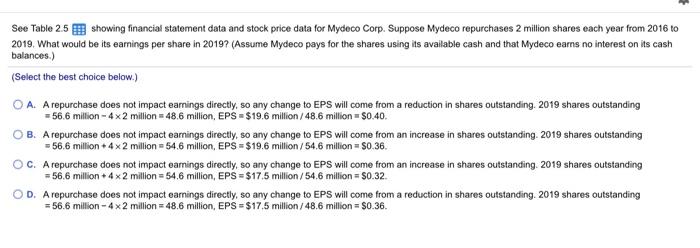

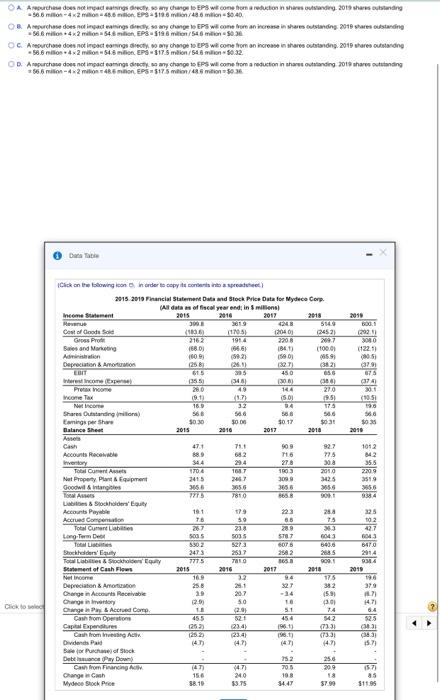

See Table 2.5 showing financial statement data and stock price data for Mydeco Corp. Suppose Mydeco repurchases 2 million shares each year from 2016 to 2019. What would be its earnings per share in 2019? (Assume Mydeco pays for the shares using its available cash and that Mydeco earns no interest on its cash balances.) (Select the best choice below.) O A. A repurchase does not impact earnings directly, so any change to EPS will come from a reduction in shares outstanding. 2019 shares outstanding =56.6 million - 4x2 million = 48.6 million, EPS = $19.6 million / 48.6 million = $0.40. OB. A repurchase does not impact earnings directly, so any change to EPS will come from an increase in shares outstanding 2019 shares outstanding = 56.6 million + 4 x 2 million = 54.6 million, EPS = $19.6 million / 54.6 million = $0.36. OC. A repurchase does not impact earnings directly, so any change to EPS will come from an increase in shares outstanding 2019 shares outstanding = 56.6 million+ 4 x 2 million=54.6 million, EPS = $17.5 million/54.6 million = $0.32 OD. A repurchase does not impact earnings directly, so any change to EPS will come from a reduction in shares outstanding. 2019 shares outstanding = 56.6 million - 4x2 million = 48.6 million, EPS = $17.5 million / 48.6 million = $0.36. CA Arputhese does not impadan directly any change to EPS will come from a reduction in shares outstanding 2015 shares outstanding -566-42 million 48. EP3 - 519.6 milion/48.6 million $0.40 OB Apurchase does not in aning directly any changes EPS Wicone from an increase in shares outstanding 2019 shares outstanding -5684 2 milion 54. min, EPS-5198 min 54 milion 50.36 OC A repurchase does not impact oning directo my change to LPs we come from an increase in share outstanding 2010 share outstanding 5864x2 min 548 min.EPS-317.5 milion/ 54.6 million $0:32. OD Apurchase does not impact eaming directo my change to EPS will come from a reduction in share outstanding 2018 share outstanding 566 million-42 min 45 min.EPS5175 millones 6 milion5036 Der 2010 DOG.1 2931 (22.11 05 3291 75 374 ce 2005 30 31 566 $035 2010 Click on the towing connorder to copy cooperate 2015. 2010 Financial Statement and the Price Data for Mydeca Corp. (All data as of fiscal year end in millions Income Sweet 2015 2018 2017 2018 MU 5140 Cost of Goods Sold {1036 11105 1204 (2452) GoPro 2162 1914 22013 Sales and More 1666 110001 Ashion 100 (59.21 1590 059 Depreciation Art M 182 (312 615 305 450 SG Experie) 35 34 (308 Protax come 280 49 144 270 10.1 15.01 1951 33 175 Share Outstanding on 566 500 500 Konings per she 30 30 300 S017 Balance Sheet 2015 2018 2017 2018 Ae Cash 471 71.1 92.7 Account Recebe 889 682 T15 77.5 inventory 344 234 27.8 30 Total 1706 1017 1803 2010 Net Property Equipment 2415 309 . Goodwils 050 3556 3058 255.0 Totes 15 7810 865 Stockholders' Boty Accounts Payable 181 9 288 Accred Compense 18 30 08 15 Total Cunere Labin 303 Long.Com 5035 5707 6043 fo bor 6 Sockelders' Equity 22 2685 Tabs & Stockholm 7775 TA10 865 90. Statement of Cash Flows 2015 2016 2017 2018 None 169 32 94 175 Depreciation & A 258 327 382 Change in Accounts Receivable 29 207 (58 Clarge imary (25) 50 10 301 Change Pay & Acord Core 1 51 Carom persone 521 454 42 Capital perdre (252) 234) 1961) 723 Chromen Ac 25 23:41 . (7331 Dividendal (4) Se o Puch fick Daban Pay Down 25.6 Caw from Financing (4) 4471 705 2009 Change Cash 20 108 18 Myde Stock Price 58.10 33.75 34.47 37.90 1012 842 35.5 200 3519 305.6 Nair coment 207 427 0415 3473 2014 14 2010 198 379 6.4 52.5 15. 57 as $11.95