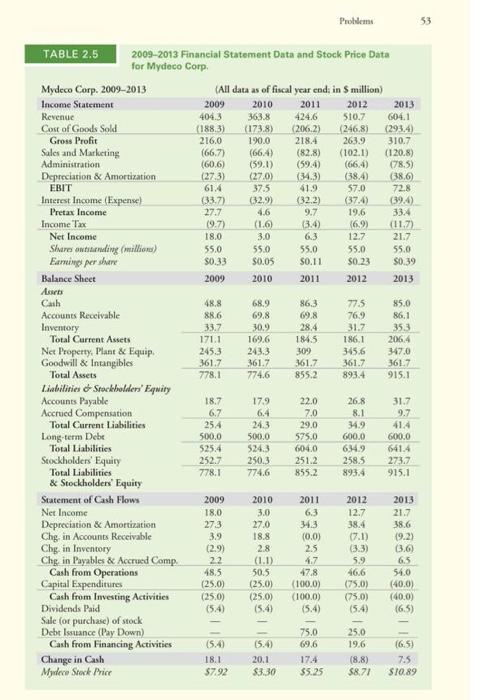

See Table 2.5 showing financial statement data and stock price data for Mydeco Corp. 1) What is Mydeco's market capitalization at the end of each year? 2) What is Mydeco's market-to-book ratio at the end of each year? 3) What is Mydeco's enterprise value at the end of each year? 4) By what percentage did Mydeco's revenues grow cach year from 2010 to 2013? 5) By what percentage did not income grow each year? Probleme 53 4043 190,0 19.7) TABLE 2.5 2009-2013 Financial Statement Data and Stock Price Data for Mydeco Corp Mydeco Corp. 2009-2013 (All data as of fiscal year end; in 5 million) Income Statement 2009 2010 2011 2012 2013 Revenue 363.8 424.6 510.7 604.1 Cost of Goods Sold (188.3) (173.8) (2062) (246.8) (293,4 Gross Profit 216.0 218.4 2639 310.7 Sales and Marketing (66.7) (664) (82.8) (102.1) (120.8) Administration (60.6) (59.1) (59.4) (664) (78.5) Depreciation & Amortization (273) (27.0) (34.3) (38.4) (38.6 EBIT 61.4 37.5 41.9 57.0 72.8 Interest Income (Expense) (33.7) (32.9) (32.2) (37.4) (39.) Pretax Income 27.7 4.6 9.7 19,6 33.4 Income Tax (1. (3.4) (6.9) (117) Net Income 18.0 3.0 12.7 217 Shares outistiending (millione) 55.0 55.0 55.0 55.0 55.0 Earnings per share $0.33 $0.05 0.11 $0.23 50.39 Balance Sheet 2009 2010 2011 2012 2013 Asarts Cash 48.8 68.9 86.3 775 85.0 Accounts Receivable 886 69.8 69.8 76.9 86.1 Inventory 33.7 30.2 28.4 31.7 353 Total Current Assets 171.1 169.6 184.5 186.1 2064 Net Property Plant & Equip 245.3 243.3 909 35.6 347.0 Goodwill & Intangibles 361.7 361.7 361.7 361.7 3617 Total Assets 778.1 774,6 855.2 893.4 915.1 Liabilities - Stockholders' Equity Accounts Payable 18.7 17.9 22.0 26.8 31.7 Accrued Compensation 6.7 6.4 7.0 8.1 9.7 Total Current Liabilities 25 A 24.3 29.0 34.9 41.4 Long term Debe 500.0 500.0 575.0 600.0 600.0 Total Liabilities 525.4 604.0 64.9 641.4 Stockholders' Equity 2527 250.3 251.2 2585 273.7 Total Liabilities 778.1 774.6 855.2 893.4 915.1 & Stockholders' Equity Statement of Cash Flows 2009 2010 2011 2012 2013 Net Income 18.0 3.0 6,3 12.7 21.7 Depreciation & Amortization 27.3 27.0 34.3 38.4 38.6 Chg in Accounts Receivable 18.8 (7.1) 19.2) Chg in Inventory (2.9) 2.8 (3.3) (3.6) Chg in Payables & Accrued Comp. (1.1) 4.7 5.9 Cash from Operations 48.5 50.5 47.8 16.6 54.0 Capital Expenditures (25.0) (25.0) (1000) (75.0) (40.0) Cash from Investing Activities (25.0) (25.0) (100.0) (750) (400) Dividends Paid (54) (5.4) (5.4) (6.5) Sale (or purchase) of stock Debt Issuance (Pay Down) 75.0 25.0 Cash from Financing Activities (5.4) (5.4) 69.6 19.6 (6.5) Change in Cash 18.1 20.1 17.4 (8.8) 7.5 Mydee Stock Price $7.92 $330 $5.25 $877 $10.89 5243 3.9 (0,0) 2.5 22 65 (5.4)