See the attached financial statements of Amazon 2020. Use the information from the financial statements to complete the following tasks.

Selected Pages from consolidated Financial Statements-Amazon 2020.pdf

Instructions From the balance sheet, income statement, statement of cash flows, and notes to the financial statements, answer the following (Each question a, b, c, d, and e): a. What are the largest assets included in the companys balance sheet? Why would a company of this type (size and industry) have a large investment in this particular type of asset? b. In a review of the companys statement of cash flows: 1. What are the primary sources and uses of cash from investing activities? 2. Did investing activities cause the companys cash to increase or decrease? 3. What are the primary sources and uses of cash from financing activities? 4. Did financing activities cause the companys cash to increase or decrease? c. In a review of the companys income statement, did the company have a net income or a net loss for the most recent year? What percentage of total revenues was that net income or net loss? d. Select three items in the notes accompanying the financial statements and explain briefly the importance of these items to people making decisions about investing in, or extending credit to, this company. e. Assume that you are a lender and this company has asked to borrow an amount of cash equal to 10 percent of its total assets, to be repaid in 90 days. Would you consider this company to be a good credit risk? Explain.

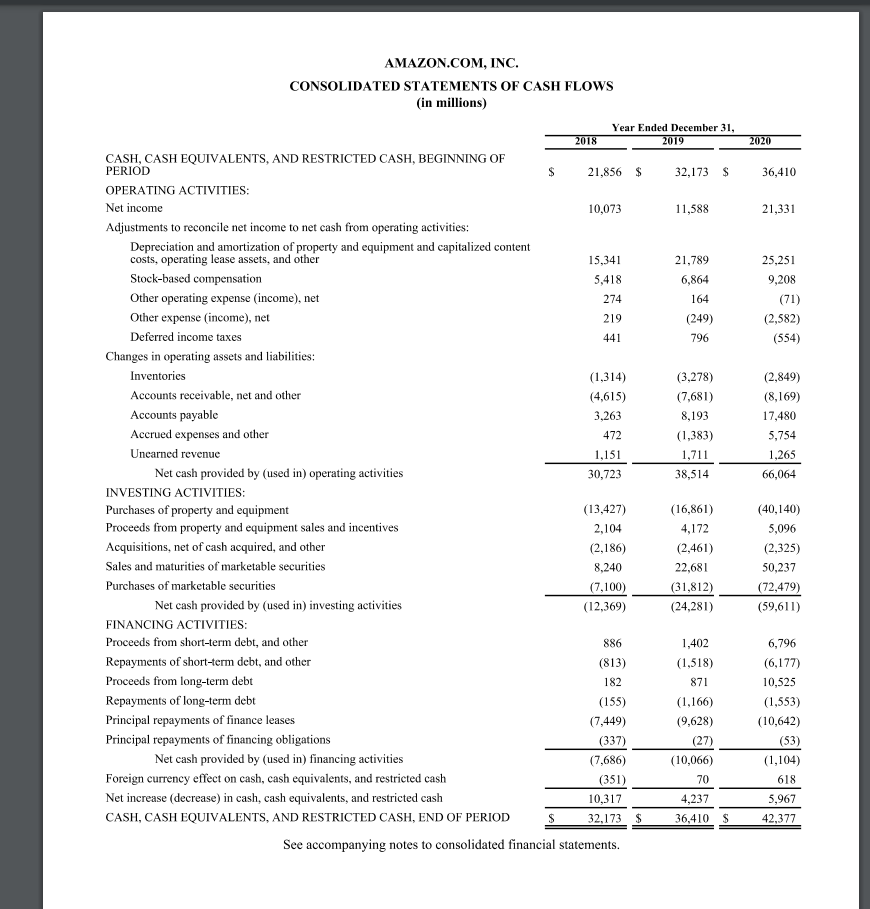

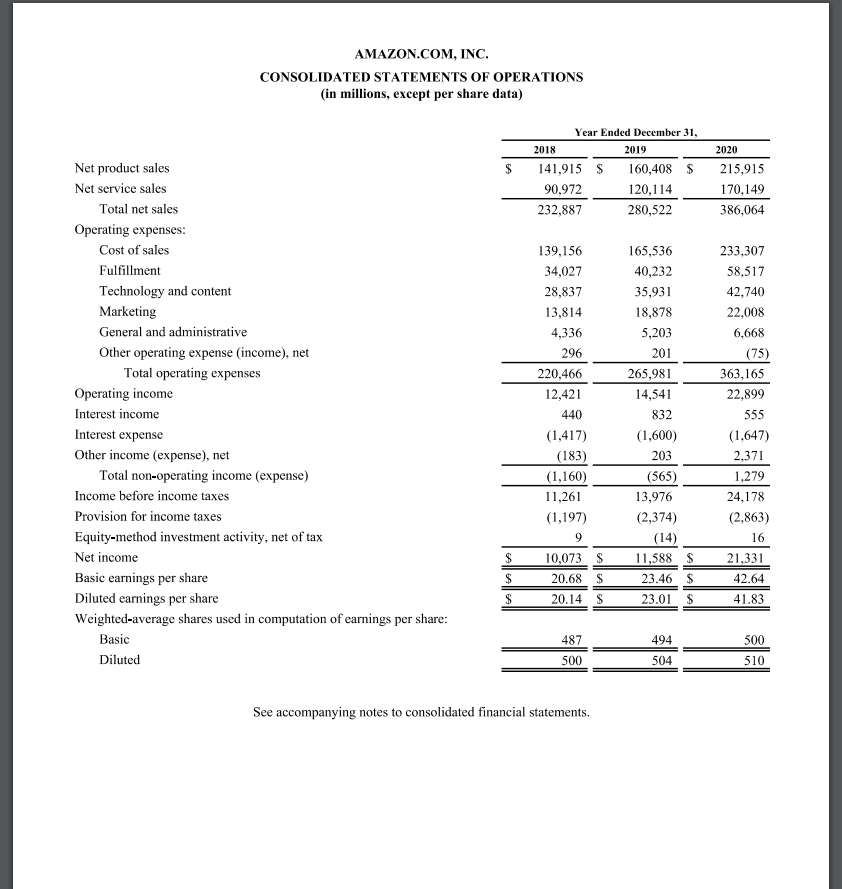

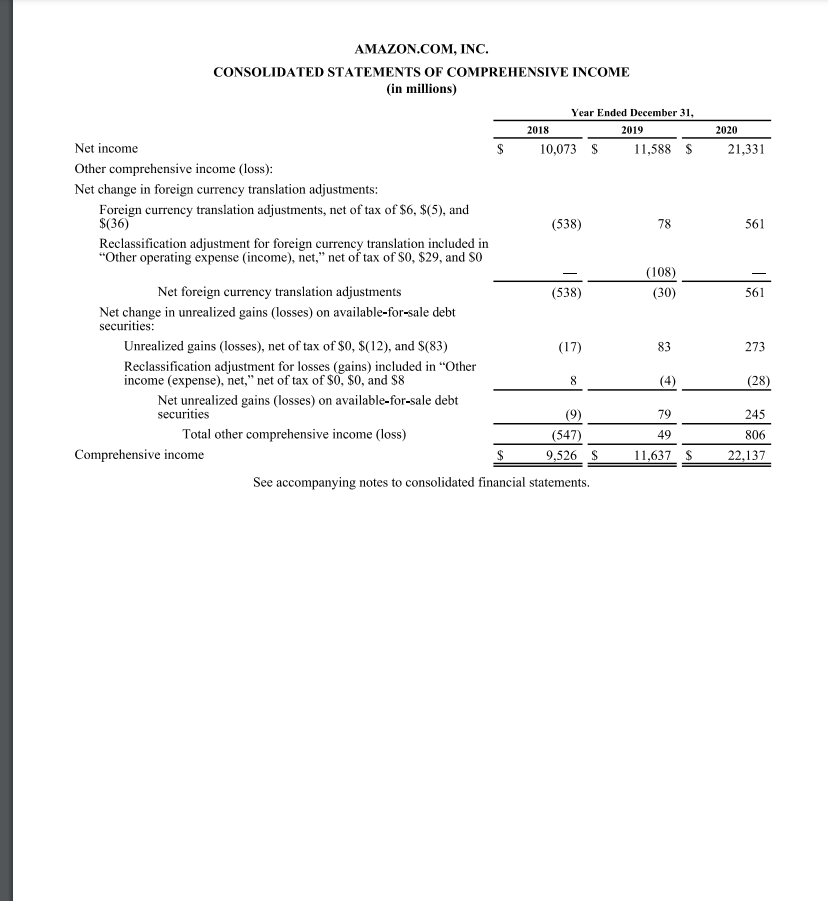

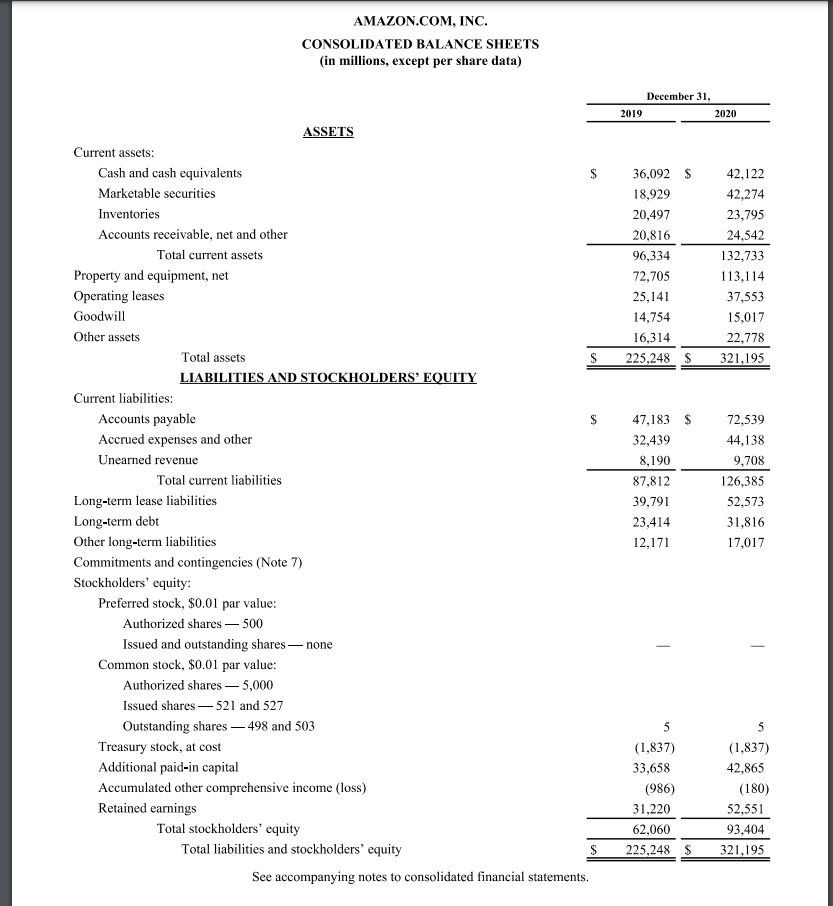

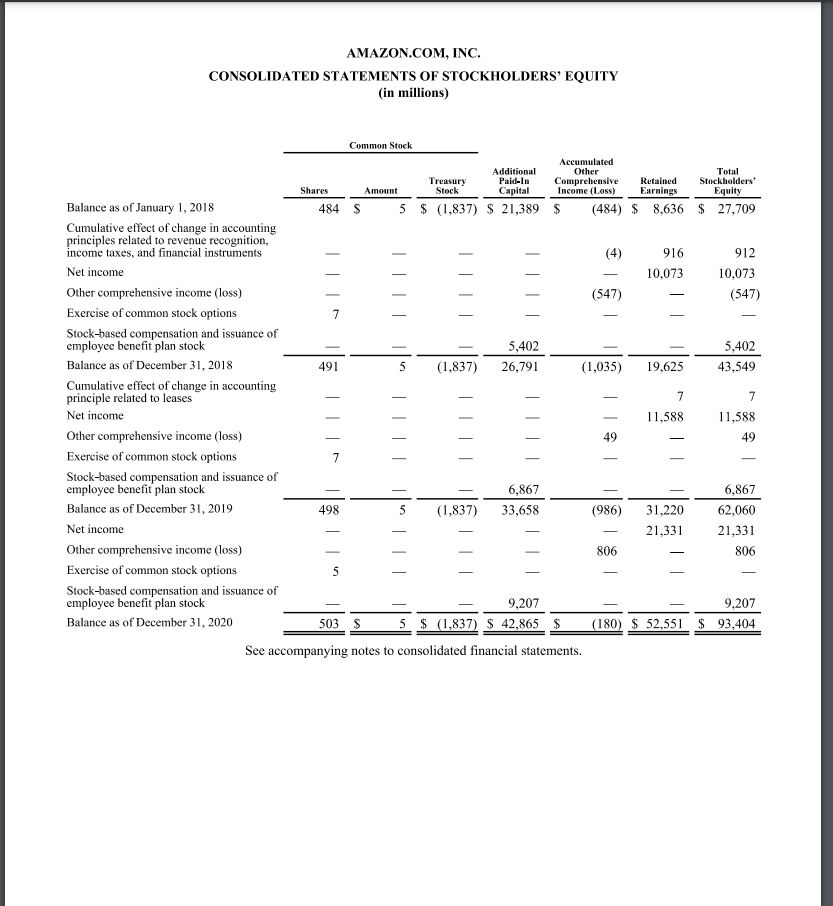

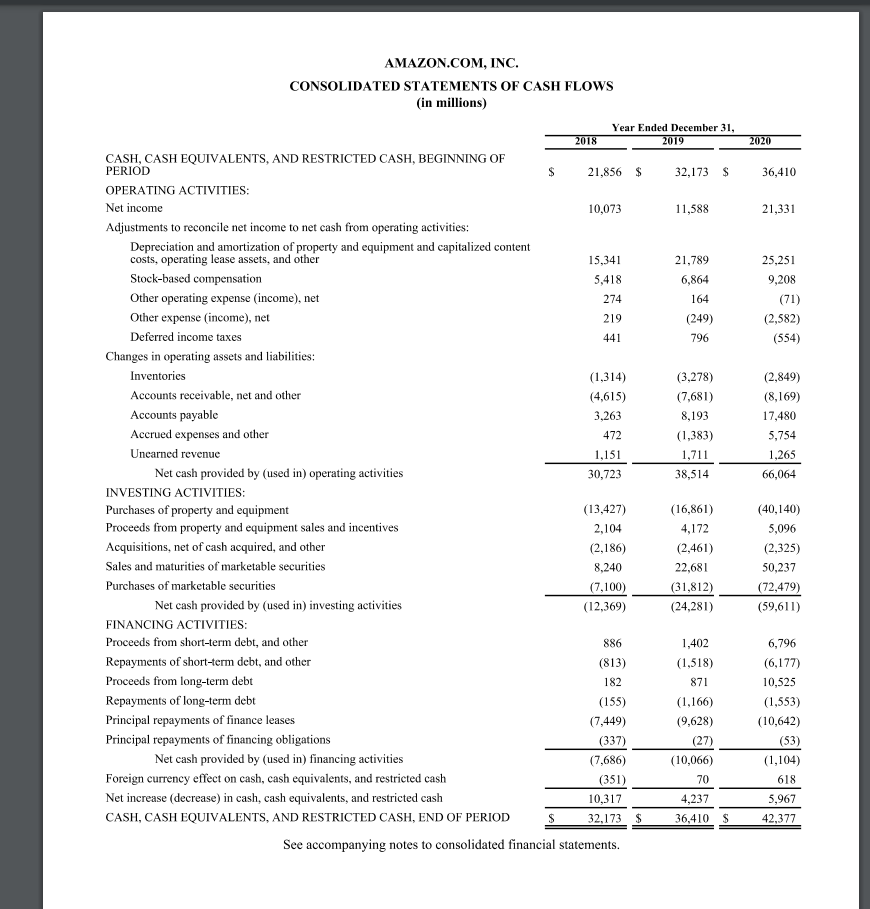

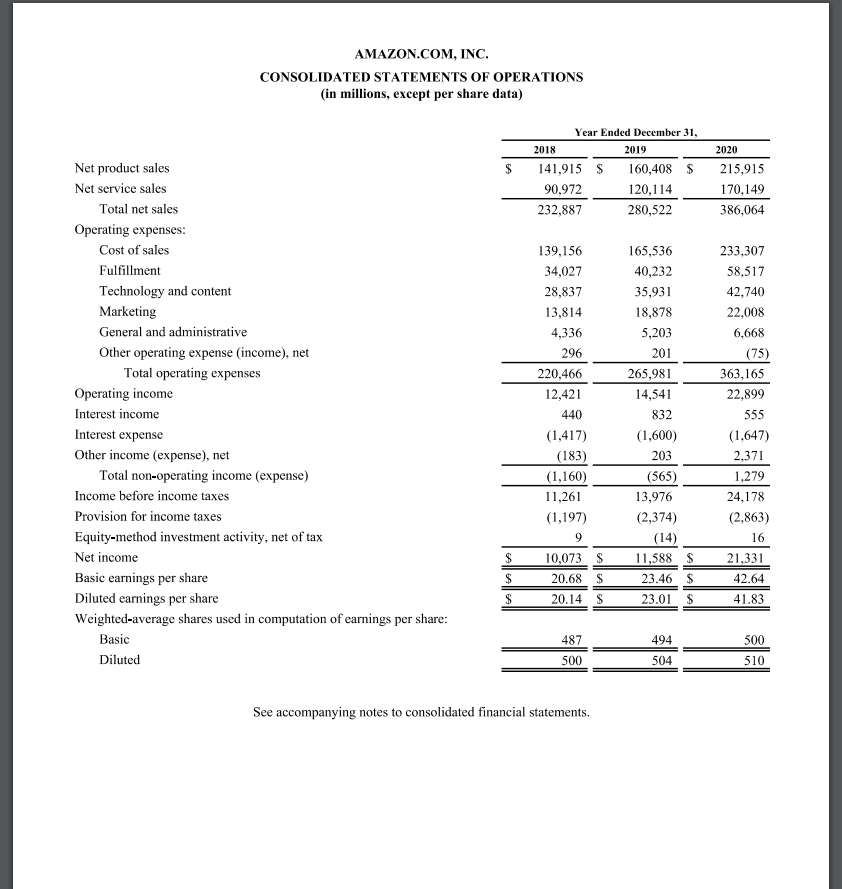

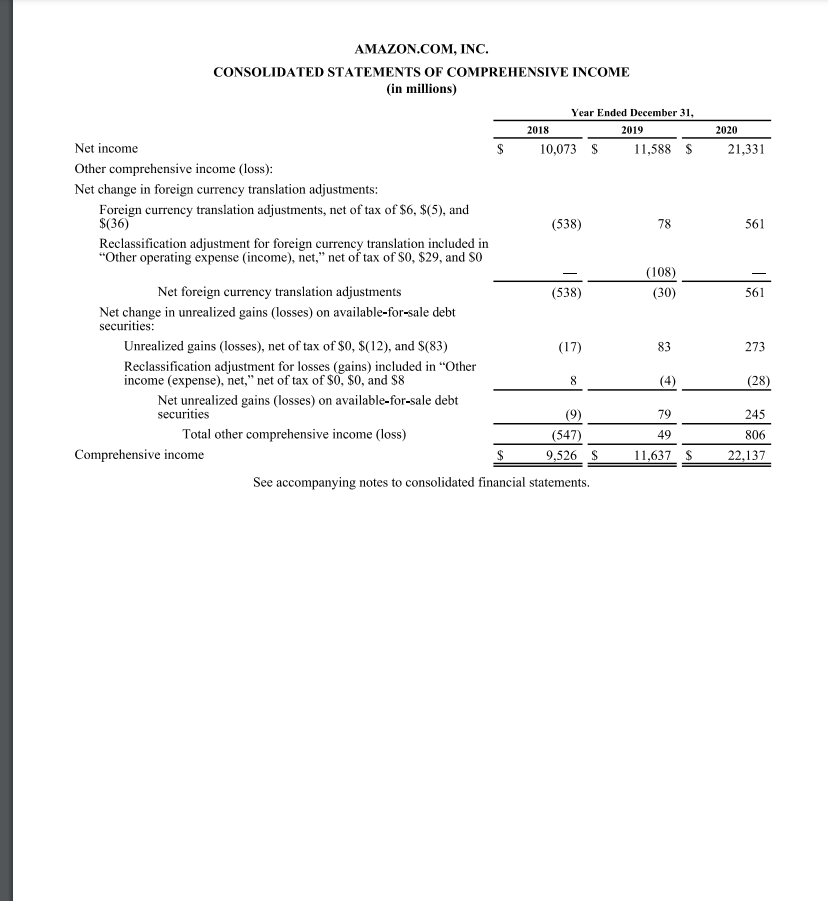

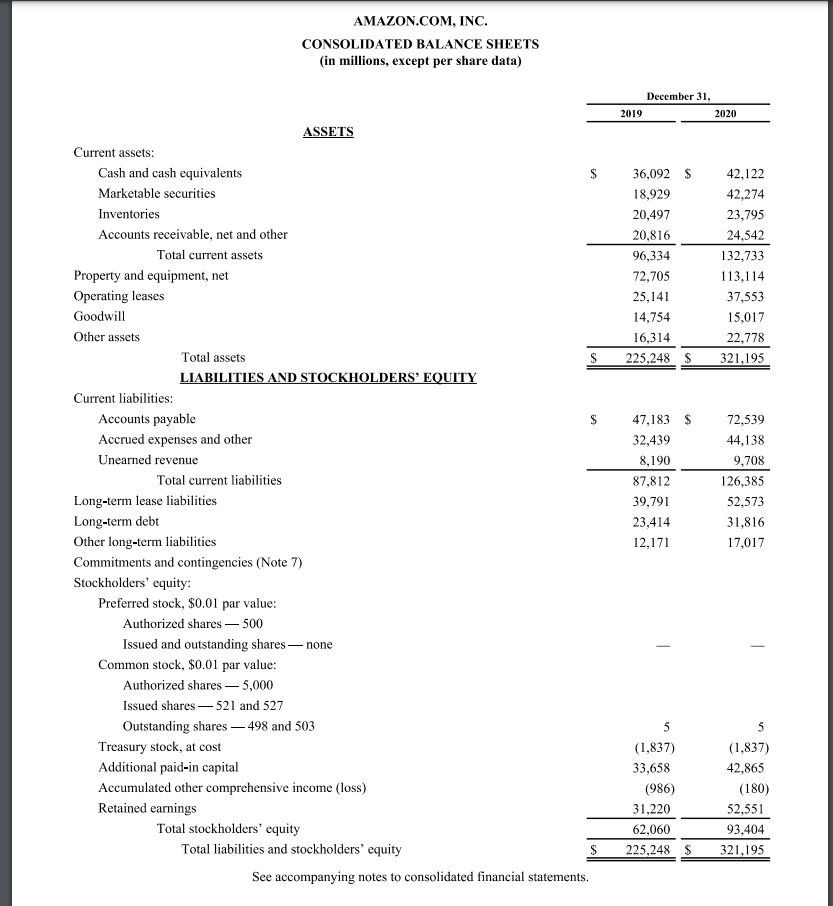

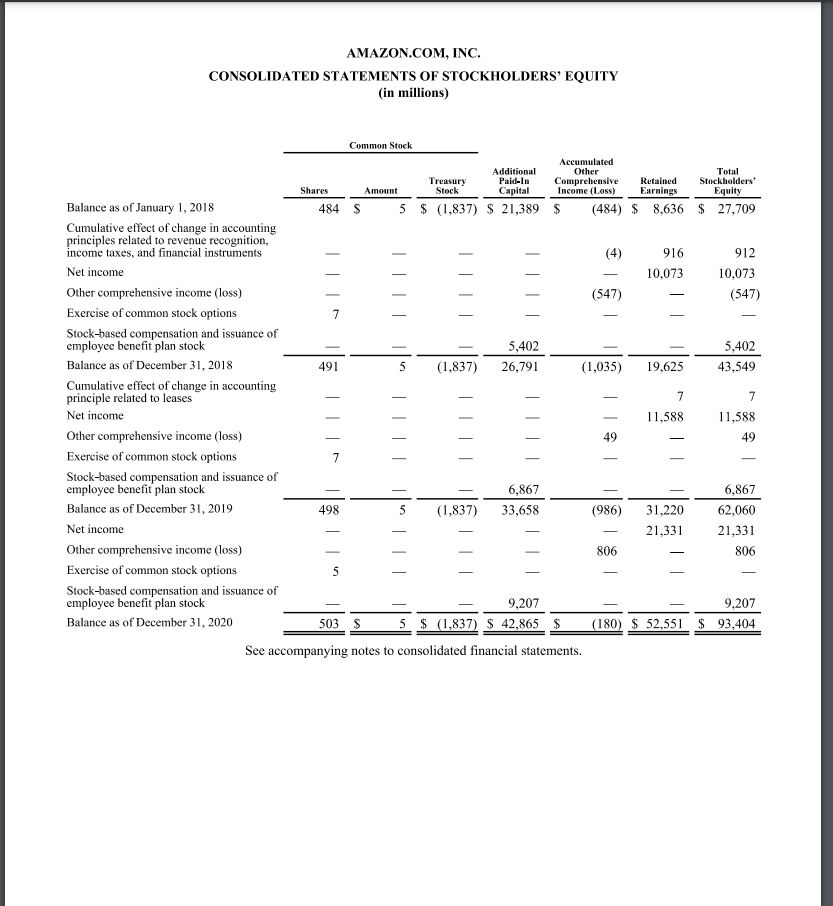

2020 36,410 21,331 25,251 9,208 (71) (2,582) (554) 796 (2,849) (8,169) 17,480 AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) Year Ended December 31, 2018 2019 CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, BEGINNING OF PERIOD 21,856 $ 32,173 $ OPERATING ACTIVITIES: Net income 10,073 11,588 Adjustments to reconcile net income to net cash from operating activities: Depreciation and amortization of property and equipment and capitalized content costs, operating lease assets, and other 15,341 21,789 Stock-based compensation 5,418 6,864 Other operating expense (income), net 274 164 Other expense (income), net 219 (249) Deferred income taxes 441 Changes in operating assets and liabilities: Inventories (1,314) (3,278) Accounts receivable, net and other (4,615) (7,681) Accounts payable 3,263 8,193 Accrued expenses and other 472 (1,383) Uncarned revenue 1,151 1,711 Net cash provided by (used in) operating activities 30,723 38,514 INVESTING ACTIVITIES: Purchases of property and equipment (13,427) (16,861) Proceeds from property and equipment sales and incentives 2,104 4,172 Acquisitions, net of cash acquired, and other (2,186) (2,461) Sales and maturities of marketable securities 8,240 22,681 Purchases of marketable securities (7,100) (31,812) Net cash provided by (used in) investing activities (12,369) (24,281) FINANCING ACTIVITIES: Proceeds from short-term debt, and other 1,402 Repayments of short-term debt, and other (813) (1,518) Proceeds from long-term debt 182 871 Repayments of long-term debt (155) (1,166) Principal repayments of finance leases (7,449) (9,628) Principal repayments of financing obligations (337) (27) Net cash provided by (used in) financing activities (7,686) (10,066) Foreign currency effect on cash, cash equivalents, and restricted cash (351) 70 Net increase (decrease) in cash, cash equivalents, and restricted cash 10,317 4,237 CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, END OF PERIOD S 32,173 $ 36,410 $ See accompanying notes to consolidated financial statements. 5,754 1,265 66,064 (40,140) 5,096 (2,325) 50,237 (72,479) (59,611) 886 6,796 (6,177) 10,525 (1,553) (10,642) (53) (1,104) 618 5,967 42,377 AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in millions, except per share data) $ Year Ended December 31, 2018 2019 141,915 $ 160,408 $ 90,972 120,114 232,887 280,522 2020 215,915 170,149 386,064 Net product sales Net service sales Total net sales Operating expenses: Cost of sales Fulfillment Technology and content Marketing General and administrative Other operating expense (income), net Total operating expenses Operating income Interest income Interest expense Other income (expense), net Total non-operating income (expense) Income before income taxes Provision for income taxes Equity-method investment activity, net of tax Net income Basic earnings per share Diluted earnings per share Weighted-average shares used in computation of earnings per share: Basic Diluted 139,156 34,027 28,837 13,814 4,336 296 220,466 12,421 440 (1,417) (183) (1,160) 11,261 (1,197) 9 10,073 $ 165,536 40,232 35,931 18,878 5,203 201 265,981 14,541 832 (1,600) 203 (565) 13,976 (2,374) (14) 11,588 $ 23.46 $ 23.01 $ 233,307 58,517 42,740 22,008 6,668 (75) 363,165 22,899 555 (1,647) 2,371 1,279 24,178 (2,863) 16 21,331 42.64 41.83 $ $ 20.68 $ $ 20.14 S 487 494 500 500 504 510 See accompanying notes to consolidated financial statements. 2019 2020 21,331 78 561 AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in millions) Year Ended December 31, 2018 Net income $ 10,073 $ 11,588 $ Other comprehensive income (loss): Net change in foreign currency translation adjustments: Foreign currency translation adjustments, net of tax of $6, $(5), and $(36) (538) Reclassification adjustment for foreign currency translation included in *Other operating expense (income), net," net of tax of $0, $29, and SO (108) Net foreign currency translation adjustments (538) (30) Net change in unrealized gains (losses) on available-for-sale debt securities: Unrealized gains (losses), net of tax of $0, $(12), and S(83) (17) Reclassification adjustment for losses (gains) included in "Other income (expense), net," net of tax of $0, $0, and $8 Net unrealized gains (losses) on available-for-sale debt securities (9) 79 Total other comprehensive income (loss) (547) 49 Comprehensive income $ 9,526 S 11,637 $ See accompanying notes to consolidated financial statements. 561 83 273 8 (28) 245 806 22,137 AMAZON.COM, INC. CONSOLIDATED BALANCE SHEETS (in millions, except per share data) December 31, 2019 2020 S 36,092 $ 18,929 20,497 20,816 96,334 72,705 25,141 14,754 16,314 225,248 $ 42,122 42,274 23,795 24,542 132,733 113,114 37,553 15,017 22,778 321,195 S S ASSETS Current assets: Cash and cash equivalents Marketable securities Inventories Accounts receivable, net and other Total current assets Property and equipment, net Operating leases Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued expenses and other Unearned revenue Total current liabilities Long-term lease liabilities Long-term debt Other long-term liabilities Commitments and contingencies (Note 7) Stockholders' equity: Preferred stock, $0.01 par value: Authorized shares 500 Issued and outstanding shares none Common stock, $0.01 par value: Authorized shares 5,000 Issued shares 521 and 527 Outstanding shares 498 and 503 Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive income (loss) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity See accompanying notes to consolidated financial statements. 47,183 $ 32,439 8,190 87,812 39,791 23,414 12,171 72,539 44,138 9,708 126,385 52,573 31,816 17,017 5 (1,837) 33,658 (986) 31,220 62,060 225,248 $ 5 (1,837) 42,865 (180) 52,551 93,404 321,195 S AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (in millions) . Common Stock Accumulated Additional Other Total Treasury Paldin Comprehensive Retained Stockholders Shares Amount Stock Capital Income (Loss) Earnings Equity Balance as of January 1, 2018 484 $ 5 $ (1,837) $ 21,389 $ (484) $ 8,636 $ 27,709 Cumulative effect of change in accounting principles related to revenue recognition, income taxes, and financial instruments 916 912 Net income 10,073 10,073 Other comprehensive income (loss) (547) (547) Exercise of common stock options 7 Stock-based compensation and issuance of employee benefit plan stock 5,402 5,402 Balance as of December 31, 2018 491 5 (1,837) 26,791 (1,035) 19,625 43,549 Cumulative effect of change in accounting principle related to leases 7 7 Net income 11,588 11,588 Other comprehensive income (loss) 49 Exercise of common stock options 7 Stock-based compensation and issuance of employee benefit plan stock 6,867 6,867 Balance as of December 31, 2019 498 (1,837) 33,658 (986) 31.220 62,060 Net income 21,331 21,331 Other comprehensive income (loss) 806 806 Exercise of common stock options 5 Stock-based compensation and issuance of employee benefit plan stock 9,207 9,207 Balance as of December 31, 2020 503 $ 5 $ (1,837) $ 42,865 $ (180) $ 52,551 $ 93,404 See accompanying notes to consolidated financial statements. IT 49 2020 36,410 21,331 25,251 9,208 (71) (2,582) (554) 796 (2,849) (8,169) 17,480 AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) Year Ended December 31, 2018 2019 CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, BEGINNING OF PERIOD 21,856 $ 32,173 $ OPERATING ACTIVITIES: Net income 10,073 11,588 Adjustments to reconcile net income to net cash from operating activities: Depreciation and amortization of property and equipment and capitalized content costs, operating lease assets, and other 15,341 21,789 Stock-based compensation 5,418 6,864 Other operating expense (income), net 274 164 Other expense (income), net 219 (249) Deferred income taxes 441 Changes in operating assets and liabilities: Inventories (1,314) (3,278) Accounts receivable, net and other (4,615) (7,681) Accounts payable 3,263 8,193 Accrued expenses and other 472 (1,383) Uncarned revenue 1,151 1,711 Net cash provided by (used in) operating activities 30,723 38,514 INVESTING ACTIVITIES: Purchases of property and equipment (13,427) (16,861) Proceeds from property and equipment sales and incentives 2,104 4,172 Acquisitions, net of cash acquired, and other (2,186) (2,461) Sales and maturities of marketable securities 8,240 22,681 Purchases of marketable securities (7,100) (31,812) Net cash provided by (used in) investing activities (12,369) (24,281) FINANCING ACTIVITIES: Proceeds from short-term debt, and other 1,402 Repayments of short-term debt, and other (813) (1,518) Proceeds from long-term debt 182 871 Repayments of long-term debt (155) (1,166) Principal repayments of finance leases (7,449) (9,628) Principal repayments of financing obligations (337) (27) Net cash provided by (used in) financing activities (7,686) (10,066) Foreign currency effect on cash, cash equivalents, and restricted cash (351) 70 Net increase (decrease) in cash, cash equivalents, and restricted cash 10,317 4,237 CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, END OF PERIOD S 32,173 $ 36,410 $ See accompanying notes to consolidated financial statements. 5,754 1,265 66,064 (40,140) 5,096 (2,325) 50,237 (72,479) (59,611) 886 6,796 (6,177) 10,525 (1,553) (10,642) (53) (1,104) 618 5,967 42,377 AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in millions, except per share data) $ Year Ended December 31, 2018 2019 141,915 $ 160,408 $ 90,972 120,114 232,887 280,522 2020 215,915 170,149 386,064 Net product sales Net service sales Total net sales Operating expenses: Cost of sales Fulfillment Technology and content Marketing General and administrative Other operating expense (income), net Total operating expenses Operating income Interest income Interest expense Other income (expense), net Total non-operating income (expense) Income before income taxes Provision for income taxes Equity-method investment activity, net of tax Net income Basic earnings per share Diluted earnings per share Weighted-average shares used in computation of earnings per share: Basic Diluted 139,156 34,027 28,837 13,814 4,336 296 220,466 12,421 440 (1,417) (183) (1,160) 11,261 (1,197) 9 10,073 $ 165,536 40,232 35,931 18,878 5,203 201 265,981 14,541 832 (1,600) 203 (565) 13,976 (2,374) (14) 11,588 $ 23.46 $ 23.01 $ 233,307 58,517 42,740 22,008 6,668 (75) 363,165 22,899 555 (1,647) 2,371 1,279 24,178 (2,863) 16 21,331 42.64 41.83 $ $ 20.68 $ $ 20.14 S 487 494 500 500 504 510 See accompanying notes to consolidated financial statements. 2019 2020 21,331 78 561 AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in millions) Year Ended December 31, 2018 Net income $ 10,073 $ 11,588 $ Other comprehensive income (loss): Net change in foreign currency translation adjustments: Foreign currency translation adjustments, net of tax of $6, $(5), and $(36) (538) Reclassification adjustment for foreign currency translation included in *Other operating expense (income), net," net of tax of $0, $29, and SO (108) Net foreign currency translation adjustments (538) (30) Net change in unrealized gains (losses) on available-for-sale debt securities: Unrealized gains (losses), net of tax of $0, $(12), and S(83) (17) Reclassification adjustment for losses (gains) included in "Other income (expense), net," net of tax of $0, $0, and $8 Net unrealized gains (losses) on available-for-sale debt securities (9) 79 Total other comprehensive income (loss) (547) 49 Comprehensive income $ 9,526 S 11,637 $ See accompanying notes to consolidated financial statements. 561 83 273 8 (28) 245 806 22,137 AMAZON.COM, INC. CONSOLIDATED BALANCE SHEETS (in millions, except per share data) December 31, 2019 2020 S 36,092 $ 18,929 20,497 20,816 96,334 72,705 25,141 14,754 16,314 225,248 $ 42,122 42,274 23,795 24,542 132,733 113,114 37,553 15,017 22,778 321,195 S S ASSETS Current assets: Cash and cash equivalents Marketable securities Inventories Accounts receivable, net and other Total current assets Property and equipment, net Operating leases Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued expenses and other Unearned revenue Total current liabilities Long-term lease liabilities Long-term debt Other long-term liabilities Commitments and contingencies (Note 7) Stockholders' equity: Preferred stock, $0.01 par value: Authorized shares 500 Issued and outstanding shares none Common stock, $0.01 par value: Authorized shares 5,000 Issued shares 521 and 527 Outstanding shares 498 and 503 Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive income (loss) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity See accompanying notes to consolidated financial statements. 47,183 $ 32,439 8,190 87,812 39,791 23,414 12,171 72,539 44,138 9,708 126,385 52,573 31,816 17,017 5 (1,837) 33,658 (986) 31,220 62,060 225,248 $ 5 (1,837) 42,865 (180) 52,551 93,404 321,195 S AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (in millions) . Common Stock Accumulated Additional Other Total Treasury Paldin Comprehensive Retained Stockholders Shares Amount Stock Capital Income (Loss) Earnings Equity Balance as of January 1, 2018 484 $ 5 $ (1,837) $ 21,389 $ (484) $ 8,636 $ 27,709 Cumulative effect of change in accounting principles related to revenue recognition, income taxes, and financial instruments 916 912 Net income 10,073 10,073 Other comprehensive income (loss) (547) (547) Exercise of common stock options 7 Stock-based compensation and issuance of employee benefit plan stock 5,402 5,402 Balance as of December 31, 2018 491 5 (1,837) 26,791 (1,035) 19,625 43,549 Cumulative effect of change in accounting principle related to leases 7 7 Net income 11,588 11,588 Other comprehensive income (loss) 49 Exercise of common stock options 7 Stock-based compensation and issuance of employee benefit plan stock 6,867 6,867 Balance as of December 31, 2019 498 (1,837) 33,658 (986) 31.220 62,060 Net income 21,331 21,331 Other comprehensive income (loss) 806 806 Exercise of common stock options 5 Stock-based compensation and issuance of employee benefit plan stock 9,207 9,207 Balance as of December 31, 2020 503 $ 5 $ (1,837) $ 42,865 $ (180) $ 52,551 $ 93,404 See accompanying notes to consolidated financial statements. IT 49