Answered step by step

Verified Expert Solution

Question

1 Approved Answer

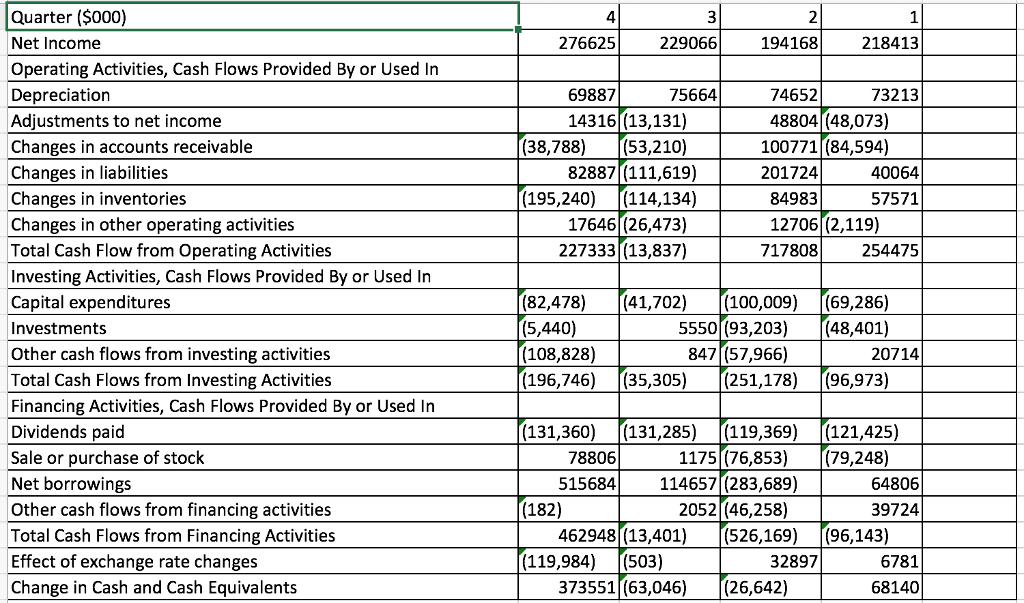

See the cash flow statement LOADING... : a. What were the company's cumulative earnings over these four quarters? What were its cumulative cash flows from

See the cash flow statement

See the cash flow statement

LOADING...

:

a. What were the company's cumulative earnings over these four quarters? What were its cumulative cash flows from operating activities?

b. What fraction of the cash from operating activities was used for investment over the four quarters?

c. What fraction of the cash from operating activities was used for financing activities over the four quarters?

Quarter ($000) Net Income Operating Activities, Cash Flows Provided By or Used In Depreciation Adjustments to net income Changes in accounts receivable Changes in liabilities Changes in inventories Changes in other operating activities Total Cash Flow from Operating Activities Investing Activities, Cash Flows Provided By or Used In Capital expenditures Investments Other cash flows from investing activities Total Cash Flows from Investing Activities Financing Activities, Cash Flows Provided By or Used In Dividends paid Sale or purchase of stock Net borrowings Other cash flows from financing activities Total Cash Flows from Financing Activities Effect of exchange rate changes Change in Cash and Cash Equivalents 4 1 276625 229066 194168 218413 73213 74652 48804 (48,073) 69887 75664 14316 (13,131) (53,210) 100771 (84,594) 201724 (38,788) 82887[(111,619) (114,134) 40064 57571 (195,240) 84983 12706 (2,119) 176461(26,473) 227333 (13,837) 717808 254475 (82,478) (5,440) (108,828) (196,746) (41,702) (100,009) (69,286) 5550 (93,203)(48,401) 847 (57,966) 20714 (35,305) 251,178) (119,369) 515684114657(283,689) 462945(13,401) (526,169) (96,973) (131,360) (131,285) (121,425) 78806 1175((76,853)(79,248) 64806 (182) 2052 (46,258) 39724 (96,143) 6781 68140 (119,984) (503) 32897 373551 (63,046)[(26,642)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started