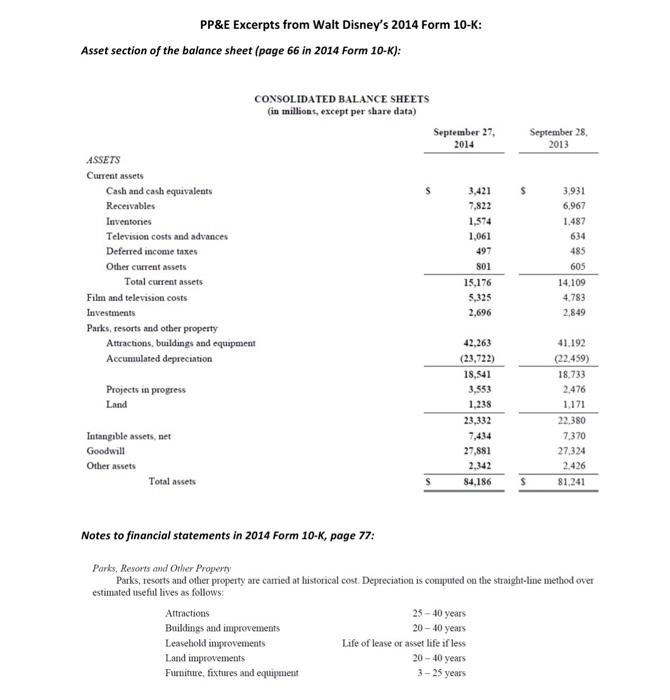

See two excerpts from Walt Disney's 2014 Form 10-K and discussion questions in the attachment. Discuss the questions in groups. Then find relevant parts from 10-K of your company for the Financial Statement Analysis Project. Answer similar questions and leave your answers below. If you work in groups for the FSA project, you may complement each other by replying in the same thread. 1. What types of plant assets does your company have? 2. What depreciation method does your company use? 3. What is the net book value of all your company's PP\&E? 4. Give an example of each type of PP\&E listed in the Notes excerpt, if any. What does Walt Disney's Form 10K communicate about its PP\&E? In February 2015, The Walt Disney Company (DIS) unveiled its new interactive queue for one of its oldest attractions at its Magic Kingdom Park (Walt Disney World) in Orlando, Peter Pan's Flight (see video here.) As guests wait in line, they enter into the Darling's foyer. From the foyer, guests head into the children's nursery. Tinker Bell is seemingly in the room and guests can interact with Tinker Bell and other items in the room. There is a shadow interaction feature created by Disney developers ("Imagineering employees") that allows guests to "play" with shadows. Walt Disney invests a lot of money into its parks, including upgrades as described above. See two excerpts from Walt Disney's 2014 Form 10-K: a partial balance sheet (page 66) and a section from the notes to financial statements (page 77). Questions 1. What types of plant assets does Walt Disney have? 2. What depreciation method does Walt Disney use? 3. What is the net book value of all of Walt Disney's PP\&E? 4. Give an example of each type of PP\&E listed in the Notes excerpt. 5. The category of "Furniture, fixtures, and equipment" has a range of estimated life in years from 325 years. Give an example of a specific asset that might be in this category. What might be its estimated life and why? PP\&E Excerpts from Walt Disney's 2014 Form 10-K: Asset section of the balance sheet (page 66 in 2014 Form 10-K): CONSOLIDATED BALANCE SHEETS fin millions. excent ner share datal Notes to financial statements in 2014 Form 10-K, page 77: Parks, Resorts and Other Propern Parks, resorts and other property are camied at historical cost. Depreciation is computed on the straight-line method over estimated Isefiul lives as follows: See two excerpts from Walt Disney's 2014 Form 10-K and discussion questions in the attachment. Discuss the questions in groups. Then find relevant parts from 10-K of your company for the Financial Statement Analysis Project. Answer similar questions and leave your answers below. If you work in groups for the FSA project, you may complement each other by replying in the same thread. 1. What types of plant assets does your company have? 2. What depreciation method does your company use? 3. What is the net book value of all your company's PP\&E? 4. Give an example of each type of PP\&E listed in the Notes excerpt, if any. What does Walt Disney's Form 10K communicate about its PP\&E? In February 2015, The Walt Disney Company (DIS) unveiled its new interactive queue for one of its oldest attractions at its Magic Kingdom Park (Walt Disney World) in Orlando, Peter Pan's Flight (see video here.) As guests wait in line, they enter into the Darling's foyer. From the foyer, guests head into the children's nursery. Tinker Bell is seemingly in the room and guests can interact with Tinker Bell and other items in the room. There is a shadow interaction feature created by Disney developers ("Imagineering employees") that allows guests to "play" with shadows. Walt Disney invests a lot of money into its parks, including upgrades as described above. See two excerpts from Walt Disney's 2014 Form 10-K: a partial balance sheet (page 66) and a section from the notes to financial statements (page 77). Questions 1. What types of plant assets does Walt Disney have? 2. What depreciation method does Walt Disney use? 3. What is the net book value of all of Walt Disney's PP\&E? 4. Give an example of each type of PP\&E listed in the Notes excerpt. 5. The category of "Furniture, fixtures, and equipment" has a range of estimated life in years from 325 years. Give an example of a specific asset that might be in this category. What might be its estimated life and why? PP\&E Excerpts from Walt Disney's 2014 Form 10-K: Asset section of the balance sheet (page 66 in 2014 Form 10-K): CONSOLIDATED BALANCE SHEETS fin millions. excent ner share datal Notes to financial statements in 2014 Form 10-K, page 77: Parks, Resorts and Other Propern Parks, resorts and other property are camied at historical cost. Depreciation is computed on the straight-line method over estimated Isefiul lives as follows