Answered step by step

Verified Expert Solution

Question

1 Approved Answer

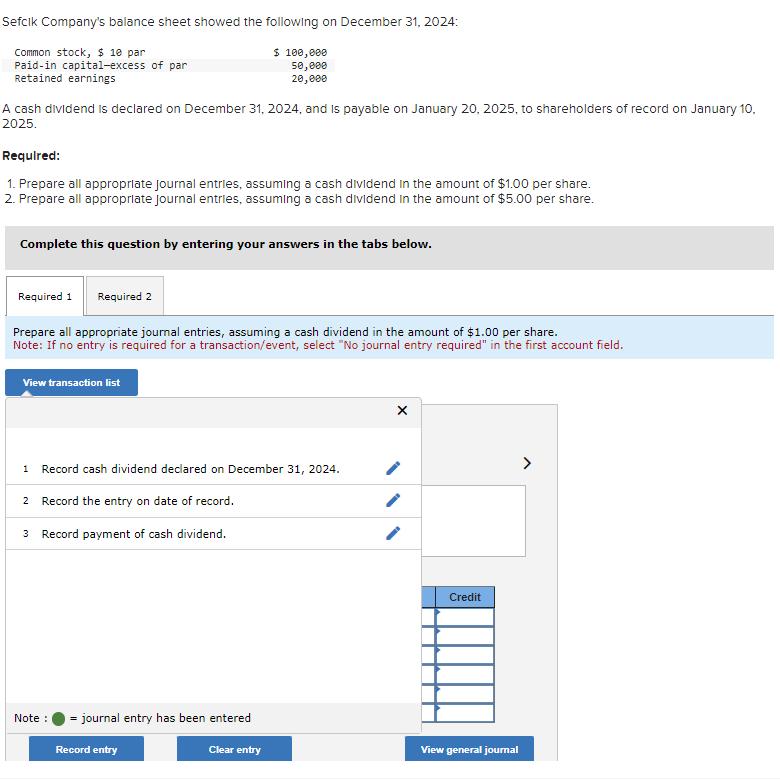

Sefcik Company's balance sheet showed the following on December 31, 2024: Common stock, $ 10 par Paid-in capital-excess of par Retained earnings A cash

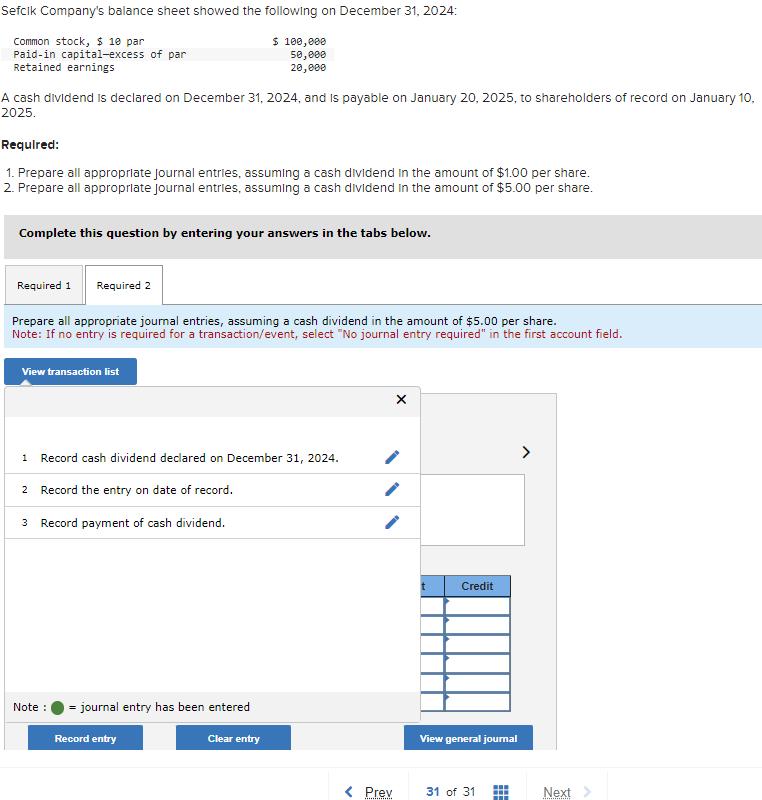

Sefcik Company's balance sheet showed the following on December 31, 2024: Common stock, $ 10 par Paid-in capital-excess of par Retained earnings A cash dividend is declared on December 31, 2024, and is payable on January 20, 2025, to shareholders of record on January 10, 2025. Required: 1. Prepare all appropriate Journal entries, assuming a cash dividend in the amount of $1.00 per share. 2. Prepare all appropriate journal entries, assuming a cash dividend in the amount of $5.00 per share. Complete this question by entering your answers in the tabs below. $ 100,000 50,000 20,000 Required 1 Required 2 Prepare all appropriate journal entries, assuming a cash dividend in the amount of $1.00 per share. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list 1 Record cash dividend declared on December 31, 2024. 2 Record the entry on date of record. 3 Record payment of cash dividend. Note : = journal entry has been entered Clear entry Record entry X Credit View general journal Sefcik Company's balance sheet showed the following on December 31, 2024: Common stock, $ 10 par Paid-in capital-excess of par Retained earnings A cash dividend is declared on December 31, 2024, and is payable on January 20, 2025, to shareholders of record on January 10, 2025. Required: 1. Prepare all appropriate journal entries, assuming a cash dividend in the amount of $1.00 per share. 2. Prepare all appropriate journal entries, assuming a cash dividend in the amount of $5.00 per share. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare all appropriate journal entries, assuming a cash dividend in the amount of $5.00 per share. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list $ 100,000 50,000 20,000 1 Record cash dividend declared on December 31, 2024. 2 Record the entry on date of record. 3 Record payment of cash dividend. Note : = journal entry has been entered Record entry Clear entry < Prev X t Credit View general journal 31 of 31 www Next

Step by Step Solution

★★★★★

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

1 Scenario 1 Cash Dividend of 100 per share The number of shares is 10000010 10000 shares Journal en...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started