Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Selangor Power Berhad is a leading power and electric utility company serving over eight million customers. Its core activities are in the generation, transmission and

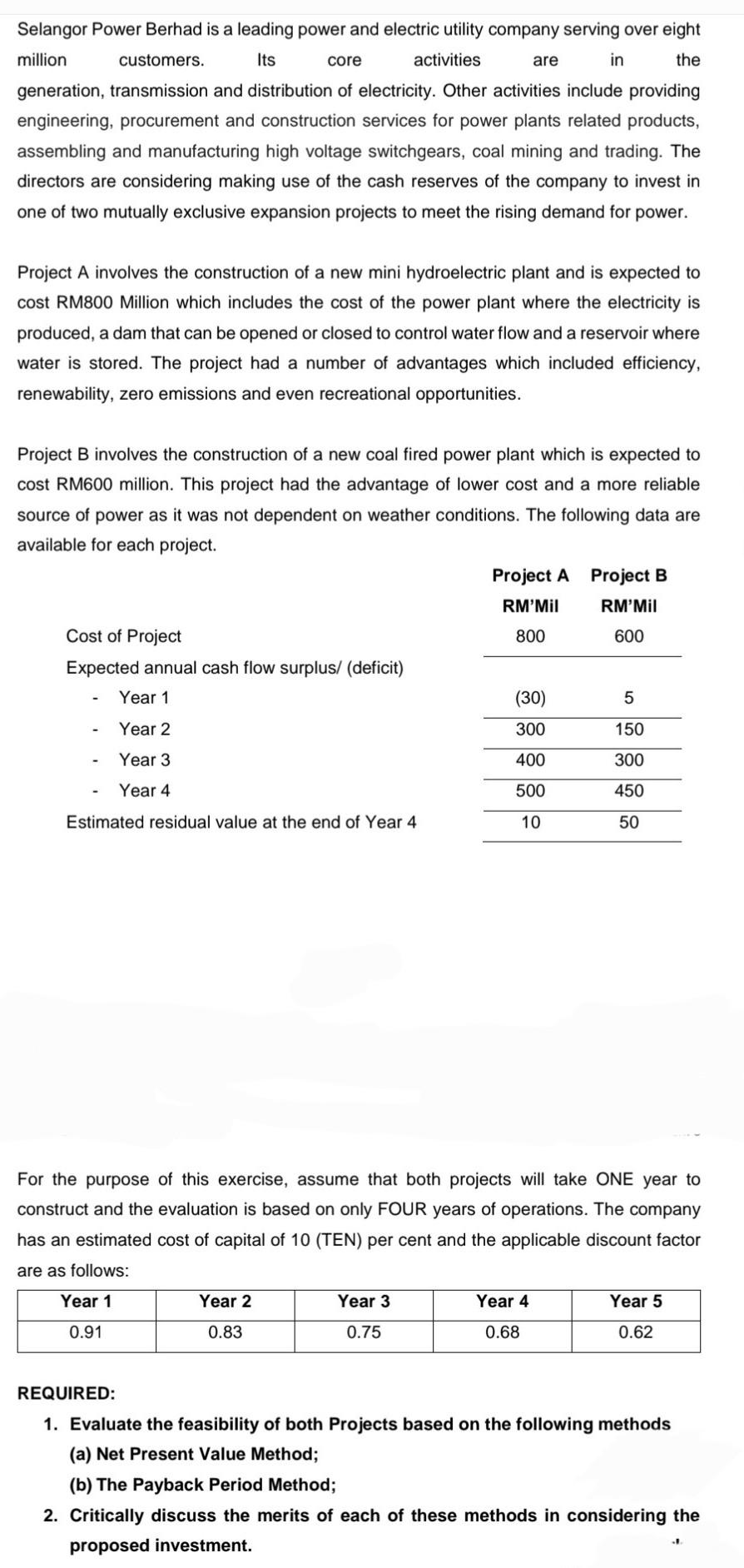

Selangor Power Berhad is a leading power and electric utility company serving over eight million customers. Its core activities are in the generation, transmission and distribution of electricity. Other activities include providing engineering, procurement and construction services for power plants related products, assembling and manufacturing high voltage switchgears, coal mining and trading. The directors are considering making use of the cash reserves of the company to invest in one of two mutually exclusive expansion projects to meet the rising demand for power. Project A involves the construction of a new mini hydroelectric plant and is expected to cost RM800 Million which includes the cost of the power plant where the electricity is produced, a dam that can be opened or closed to control water flow and a reservoir where water is stored. The project had a number of advantages which included efficiency, renewability, zero emissions and even recreational opportunities. Project B involves the construction of a new coal fired power plant which is expected to cost RM600 million. This project had the advantage of lower cost and a more reliable source of power as it was not dependent on weather conditions. The following data are available for each project. Cost of Project Expected annual cash flow surplus/ (deficit) - Year 1 - Year 2 - Year 3 - Year 4 Estimated residual value at the end of Year 4 For the purpose of this exercise, assume that both projects will take ONE year to construct and the evaluation is based on only FOUR years of operations. The company has an estimated cost of capital of 10 (TEN) per cent and the applicable discount factor are as follows: REQUIRED: 1. Evaluate the feasibility of both Projects based on the following methods (a) Net Present Value Method; (b) The Payback Period Method; 2. Critically discuss the merits of each of these methods in considering the proposed investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started