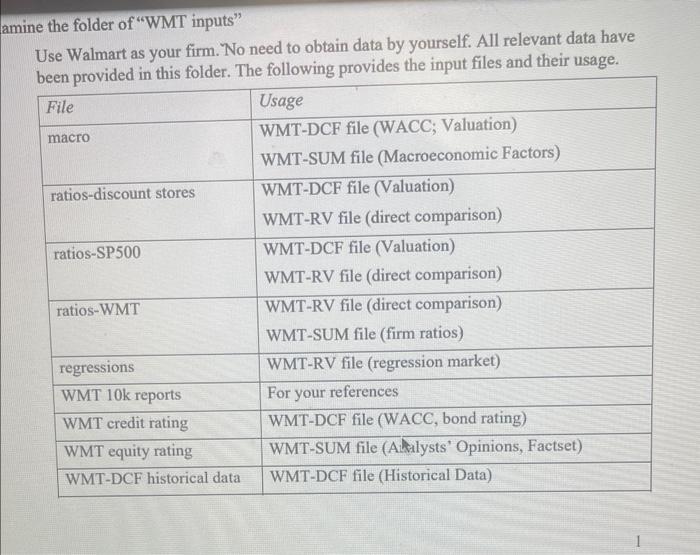

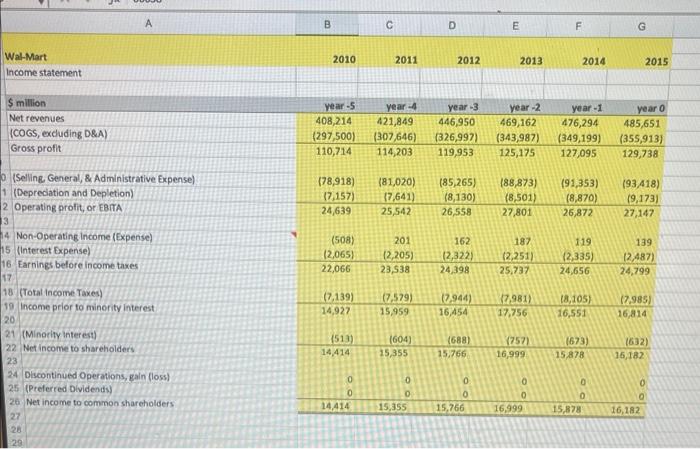

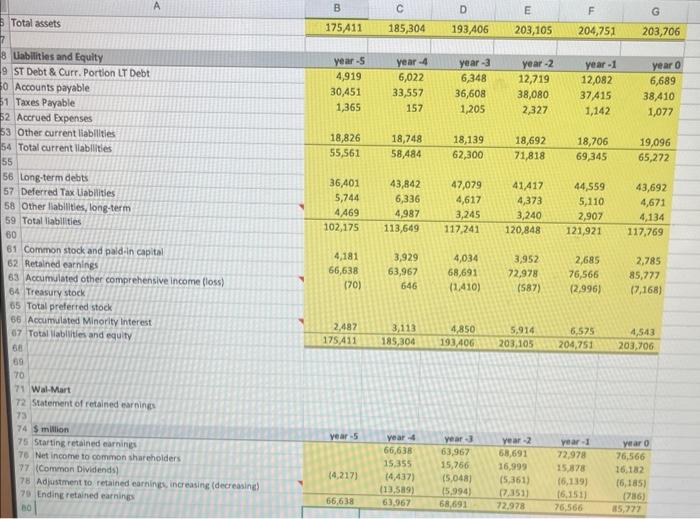

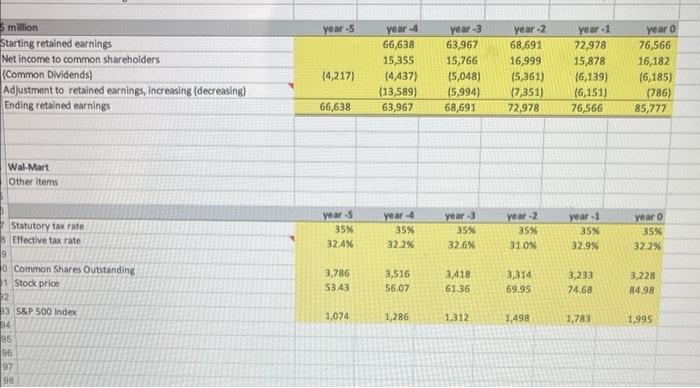

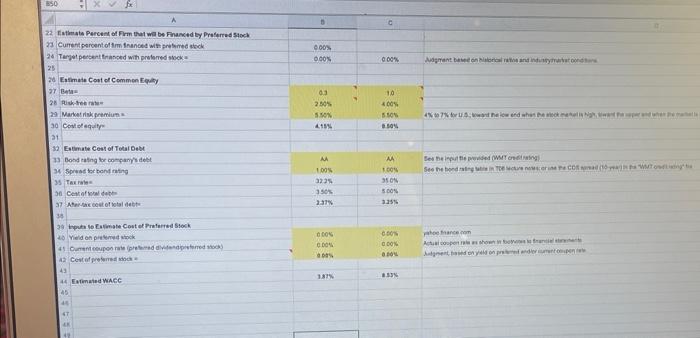

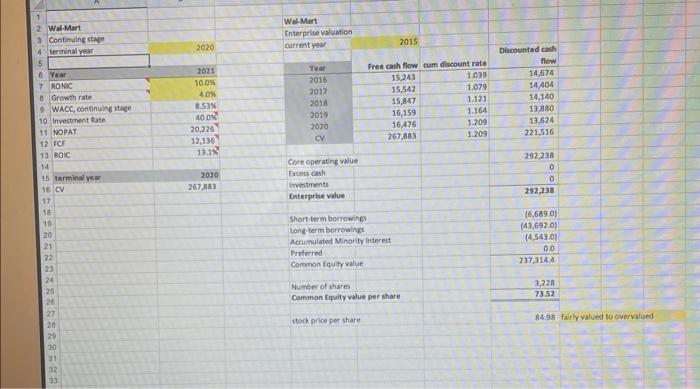

Select a publicly traded firm (Walmart). Estimate its firm value and equity value per share in the most recent year. Examine the folder of "WMT sample files" WMT-DCF.xls: Enterprise DCF Valuation. The file contains 5 worksheets. The model is for large, mature, and non-financial firms. It has 2 stages (5-year explicit forecast stage and stable stage), and no plugs. WMT-RV.xis: Relative Valuation. The file contains 2 worksheets. WMT-SUM.ppt: analysis and summary. Examine the folder of "WMT inputs" Use Walmart as your firm. No need to obtain data by yourself. All relevant data have been provided in this folder. The following provides the input files and their usage. ine the folder of "WMT inputs" Use Walmart as your firm. No need to obtain data by yourself. All relevant data have Conduct the DCF valuation (DCF.xls) Use the most recent years' data to update yellow cells in the following worksheets: Historical Data, WACC, and Valuation. In the worksheet of Historical Data, check the balance between total assets and total liabilities \& equities. In the worksheet of Reorganizing and Forecasting, check the 3 reconciliations. In the worksheet of Examining Ratios, examine forecast ratios and key ratios, and make necessary changes of the forecast ratios. Conduct the relative valuation (RV.xls) Use the most recent years' data to update yellow cells in the following worksheets: Direct Comparison, and Regression Market. Work on the summary file (SUM.ppt) Use the results from DCF and RV as well as other inputs of the most recent year to update/revise blue color areas. Decide whether the firm's stock price is by and large fairly valued (for a hold), deeply undervalued (for a strong buy), or highly overvalued (for a strong sell). Work on the summary file (SUM.ppt) Use the results from DCF and RV as well as other inputs of the most recent year to update/revise blue color areas. Decide whether the firm's stock price is by and large fairly valued (for a hold), deepl: undervalued (for a strong buy), or highly overvalued (for a strong sell). Submit three files (DCF, RV, and SUM) On or before the due day, submit three files to Canvas (Assignments). References Other DCF models t06-WMT-10yr.xls (10-year explicit forecast period) t06-WMT-detailed 10yr.xls (2-stage FCF, with plugs in forecast) t06-WMT-KGW model.xls (3-stage FCF \& EP, with plugs in forecast) Other types of firms' DCF models t08-AMZN t11-AEG Wal-Mart Other items Select a publicly traded firm (Walmart). Estimate its firm value and equity value per share in the most recent year. Examine the folder of "WMT sample files" WMT-DCF.xls: Enterprise DCF Valuation. The file contains 5 worksheets. The model is for large, mature, and non-financial firms. It has 2 stages (5-year explicit forecast stage and stable stage), and no plugs. WMT-RV.xis: Relative Valuation. The file contains 2 worksheets. WMT-SUM.ppt: analysis and summary. Examine the folder of "WMT inputs" Use Walmart as your firm. No need to obtain data by yourself. All relevant data have been provided in this folder. The following provides the input files and their usage. ine the folder of "WMT inputs" Use Walmart as your firm. No need to obtain data by yourself. All relevant data have Conduct the DCF valuation (DCF.xls) Use the most recent years' data to update yellow cells in the following worksheets: Historical Data, WACC, and Valuation. In the worksheet of Historical Data, check the balance between total assets and total liabilities \& equities. In the worksheet of Reorganizing and Forecasting, check the 3 reconciliations. In the worksheet of Examining Ratios, examine forecast ratios and key ratios, and make necessary changes of the forecast ratios. Conduct the relative valuation (RV.xls) Use the most recent years' data to update yellow cells in the following worksheets: Direct Comparison, and Regression Market. Work on the summary file (SUM.ppt) Use the results from DCF and RV as well as other inputs of the most recent year to update/revise blue color areas. Decide whether the firm's stock price is by and large fairly valued (for a hold), deeply undervalued (for a strong buy), or highly overvalued (for a strong sell). Work on the summary file (SUM.ppt) Use the results from DCF and RV as well as other inputs of the most recent year to update/revise blue color areas. Decide whether the firm's stock price is by and large fairly valued (for a hold), deepl: undervalued (for a strong buy), or highly overvalued (for a strong sell). Submit three files (DCF, RV, and SUM) On or before the due day, submit three files to Canvas (Assignments). References Other DCF models t06-WMT-10yr.xls (10-year explicit forecast period) t06-WMT-detailed 10yr.xls (2-stage FCF, with plugs in forecast) t06-WMT-KGW model.xls (3-stage FCF \& EP, with plugs in forecast) Other types of firms' DCF models t08-AMZN t11-AEG Wal-Mart Other items