Answered step by step

Verified Expert Solution

Question

1 Approved Answer

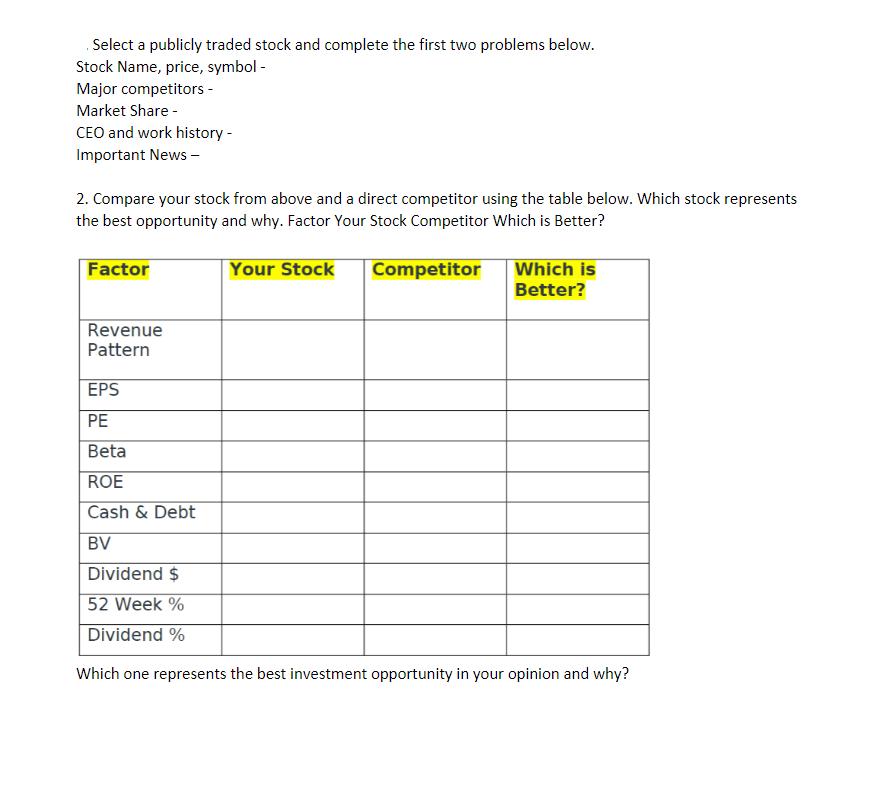

Select a publicly traded stock and complete the first two problems below. Stock Name, price, symbol - Major competitors - Market Share - CEO

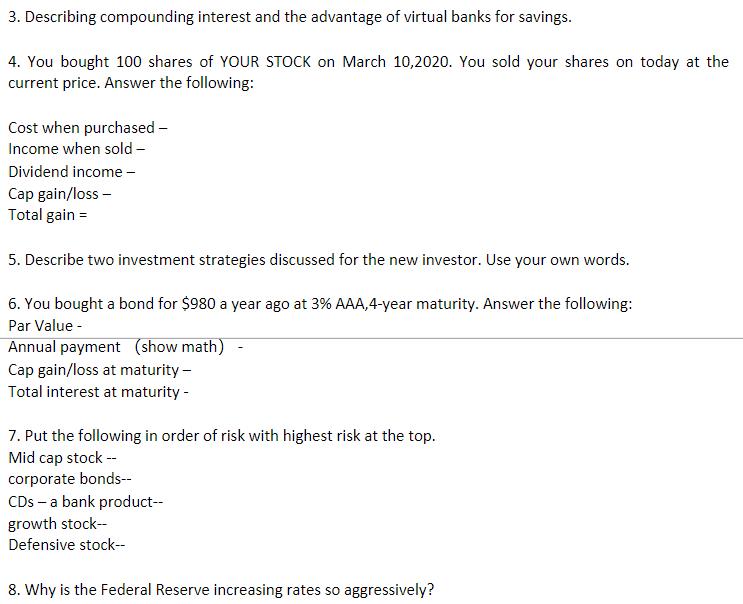

Select a publicly traded stock and complete the first two problems below. Stock Name, price, symbol - Major competitors - Market Share - CEO and work history - Important News - 2. Compare your stock from above and a direct competitor using the table below. Which stock represents the best opportunity and why. Factor Your Stock Competitor Which is Better? Your Stock Competitor Factor Revenue Pattern EPS PE Beta ROE Cash & Debt BV Which is Better? Dividend $ 52 Week % Dividend % Which one represents the best investment opportunity in your opinion and why? 3. Describing compounding interest and the advantage of virtual banks for savings. 4. You bought 100 shares of YOUR STOCK on March 10,2020. You sold your shares on today at the current price. Answer the following: Cost when purchased - Income when sold- Dividend income - Cap gain/loss - Total gain = 5. Describe two investment strategies discussed for the new investor. Use your own words. 6. You bought a bond for $980 a year ago at 3% AAA,4-year maturity. Answer the following: Par Value - Annual payment (show math) Cap gain/loss at maturity - Total interest at maturity - 7. Put the following in order of risk with highest risk at the top. Mid cap stock -- corporate bonds-- CDs - a bank product-- growth stock-- Defensive stock-- 8. Why is the Federal Reserve increasing rates so aggressively? 8. Why is the Federal Reserve increasing rates so aggressively? 9. What is the current rate on a bond with a coupon rate of 5% selling at $1100? Why is the current rate lower than the coupon rate? Show math.

Step by Step Solution

★★★★★

3.31 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Ill provide information and answers to your questions as best as I can based on the data available up to my last training data in September 2021 Please note that some details may have changed so its a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started