Answered step by step

Verified Expert Solution

Question

1 Approved Answer

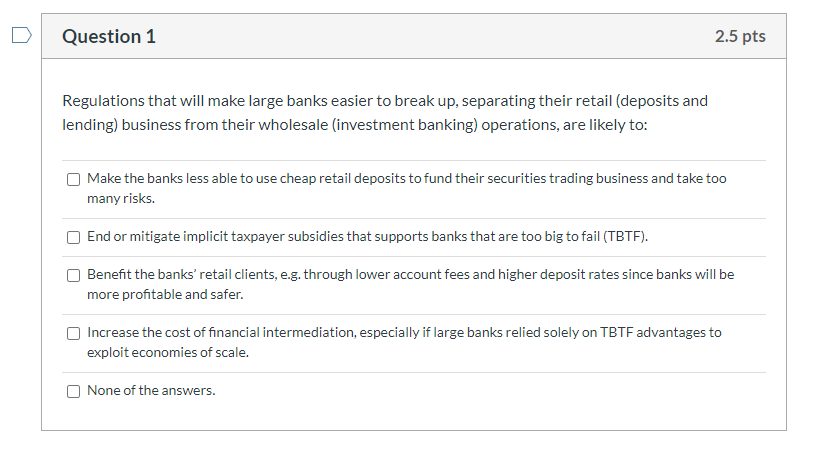

Select All Correct answers Question 1 2.5 pts Regulations that will make large banks easier to break up, separating their retail (deposits and lending) business

Select All Correct answers

Question 1 2.5 pts Regulations that will make large banks easier to break up, separating their retail (deposits and lending) business from their wholesale investment banking) operations, are likely to: Make the banks less able to use cheap retail deposits to fund their securities trading business and take too many risks. End or mitigate implicit taxpayer subsidies that supports banks that are too big to fail (TBTF). Benefit the banks' retail clients, e.g. through lower account fees and higher deposit rates since banks will be more profitable and safer. U Increase the cost of financial intermediation, especially if large banks relied solely on TBTF advantages to exploit economies of scale. None of the answersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started