Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Select all that apply Which of the following choices describe exclusions and deferrals for tax purposes? These provisions are narrowly defined. These provisions are the

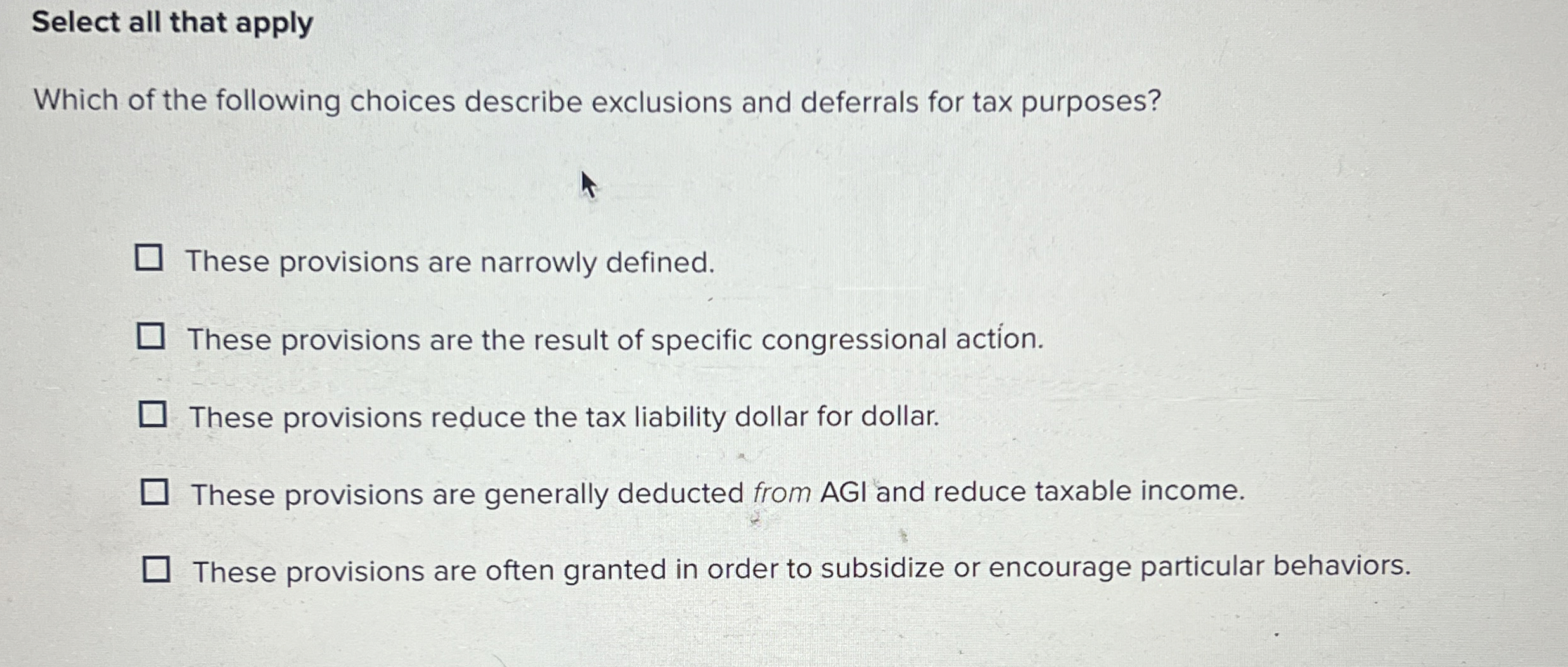

Select all that apply

Which of the following choices describe exclusions and deferrals for tax purposes?

These provisions are narrowly defined.

These provisions are the result of specific congressional action.

These provisions reduce the tax liability dollar for dollar.

These provisions are generally deducted from AGI and reduce taxable income.

These provisions are often granted in order to subsidize or encourage particular behaviors.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started