Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Select all that are true. When calculating the cost of capital, the cost of retained earnings should be zero as the company already earned it

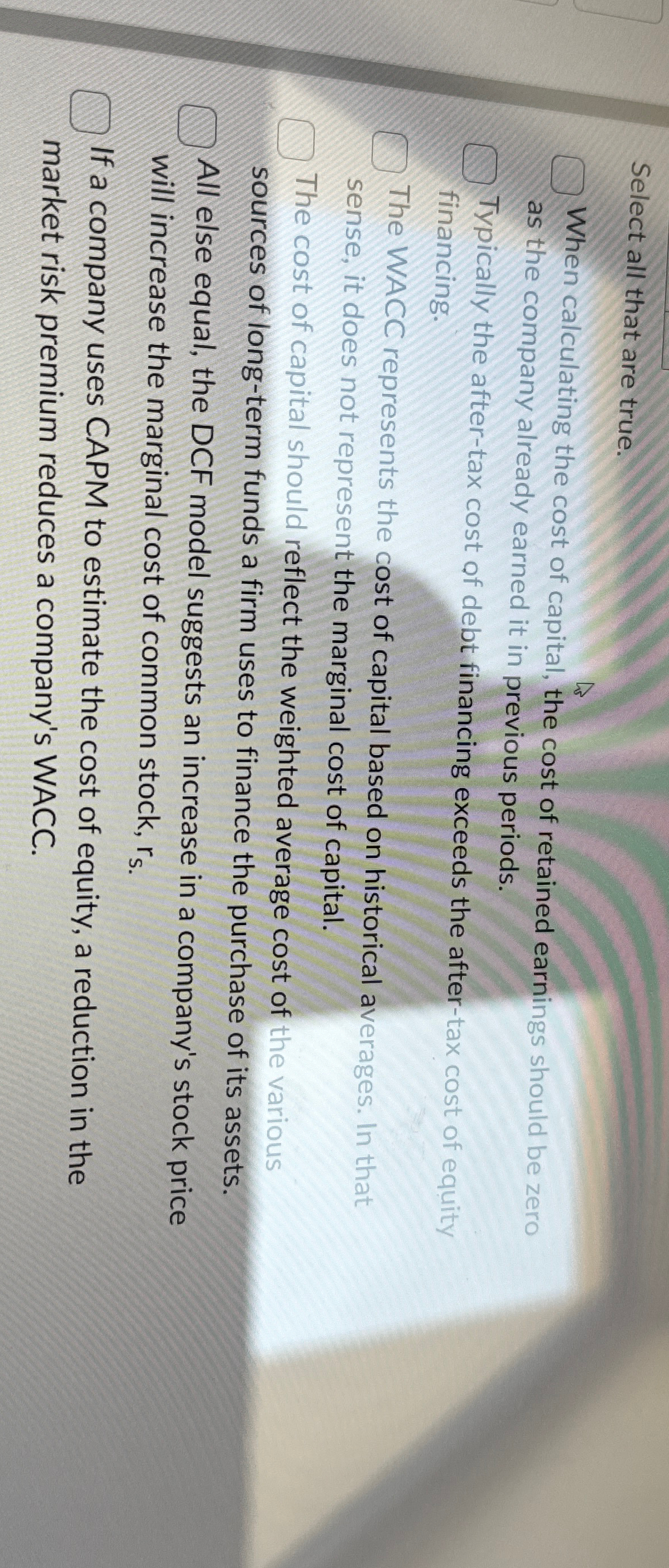

Select all that are true.

When calculating the cost of capital, the cost of retained earnings should be zero as the company already earned it in previous periods.

Typically the aftertax cost of debt financing exceeds the aftertax cost of equity financing.

The WACC represents the cost of capital based on historical averages. In that sense, it does not represent the marginal cost of capital.

The cost of capital should reflect the weighted average cost of the various sources of longterm funds a firm uses to finance the purchase of its assets.

All else equal, the DCF model suggests an increase in a company's stock price will increase the marginal cost of common stock,

If a company uses CAPM to estimate the cost of equity, a reduction in the market risk premium reduces a company's WACC.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started