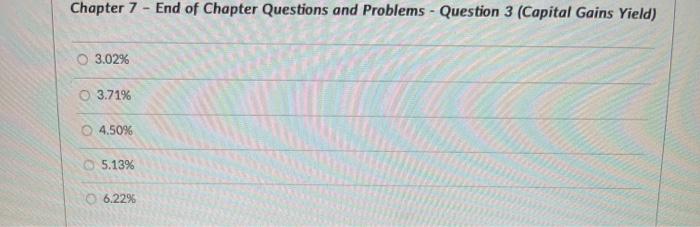

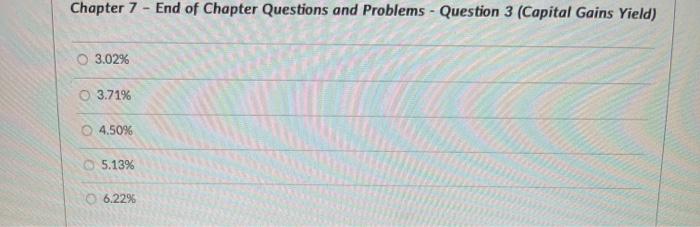

select an answer please

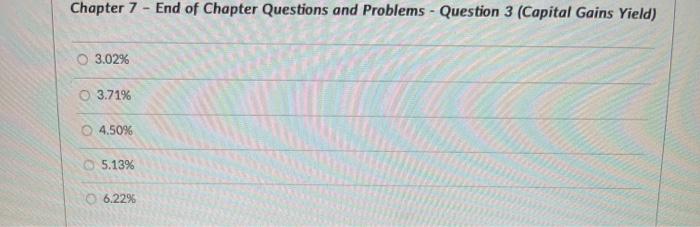

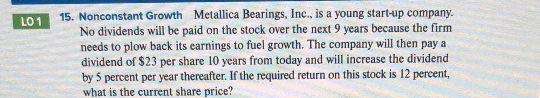

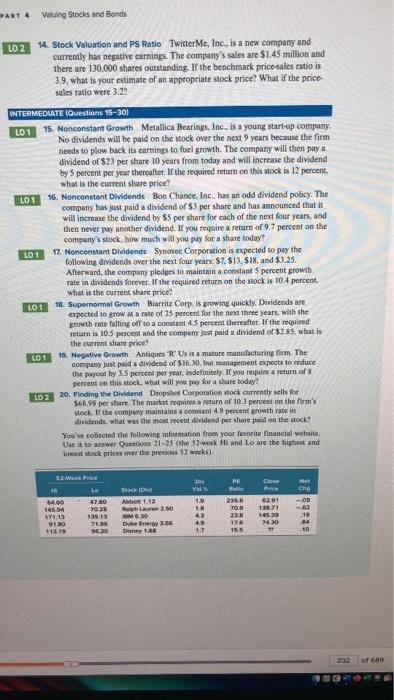

Chapter 7 - End of Chapter Questions and Problems - Question 3 (Capital Gains Yield) O 3.02% 3.71% 04.50% 5.13% 6.22% LO1 15. Nonconstant Growth Metallica Bearings, Inc., is a young start-up company. No dividends will be paid on the stock over the next 9 years because the firm needs to plow back its earnings to fuel growth. The company will then pay a dividend of $23 per share 10 years from today and will increase the dividend by 5 percent per year thereafter. If the required return on this stock is 12 percent, what is the current share price? PART 4 Voluing Stocks and Bonds LO 2 14. Stock Valuation and PS Ratio Twitter Me, Inc. is a new company and currently has negative earnings. The company's sales are $1.45 million and there are 130,000 shares outstanding. If the benchmark price sales ratio is 3.9, what is your estimate of an appropriate stock price? What if the price sales ratio were 3.22 INTERMEDIATE (Questions 15-30) L01 15. Nonconstant Growth Metallica Bearings, Inc., is a young start-up company No dividends will be paid on the stock over the next 9 years because the firm needs to plow back its earnings to fuel growth. The company will then paya dividend of $23 per share 10 years from today and will increase the dividend by 5 percent per year thereafter. In the required return on this stock is 12 percent what is the current share price L01 1. Nonconstant Dividends Bon Chance, Inc., has an odd dividend policy. The company has just paid a dividend of Sper share and has announced that it will increase the dividend by $5 per share for each of the next four years, and then nevet pay another dividend. If you require a return of 9.7 percent on the company's stock, how much will you pay for a share today? LO1 17. Nonconstant Dividends Synovec Corporation is expected to pay the following dividends over the next four years $7. $13.518, and $2.25 Afterward, the company pledges to maintain a constant 5 percent growth rate in dividends forever. If the required return on the stock is 10.4 percent what is the current share price! LO1 18. Supernormal Growth Barri Corp is growing quickly. Dividends are expected to grow a rate of 25 percent for the next three years, with the growth rate falling off to a constant 45 percent thereafter. If the required return is 105 percent and the company at paid a dividend or $2.85. what is the current share price! 19. Negative Growth Antiques 'R' Us is a mature manufacturing firm. The company just paid a dividend of $16.30, but management expects to reduce the payout by 3.5 percent per year, indefinitely. If you require a return of percent on this stock, what will you pay for a share today! LO 2 20. Finding the Dividend Dropshot Corporation stock currently sells for $68.98 per share. The market requires a return of 10 percent on the firm's stock. If the company maintains a constant 4.9 percent growth rate in dividends. what was the most recent dividend per share peld on the stock You've collected the following information from your favorite financial website Uses to answer Questions 21-25 (the 52. Hi and Lo are the highest and lowest stock prices over the previous 52 weeks). 101 52 Wocus ON PE Close Net LO . 145.94 Abb. ht. 12 13 47.30 70.30 139.13 75.00 9620 11.15 256 TOS 22 176 155 62.01 139.71 1453 7430 -OS - 10 34 to 9130 19 Due Enero 3.56 Disney 1.68 1.7 232 of 689