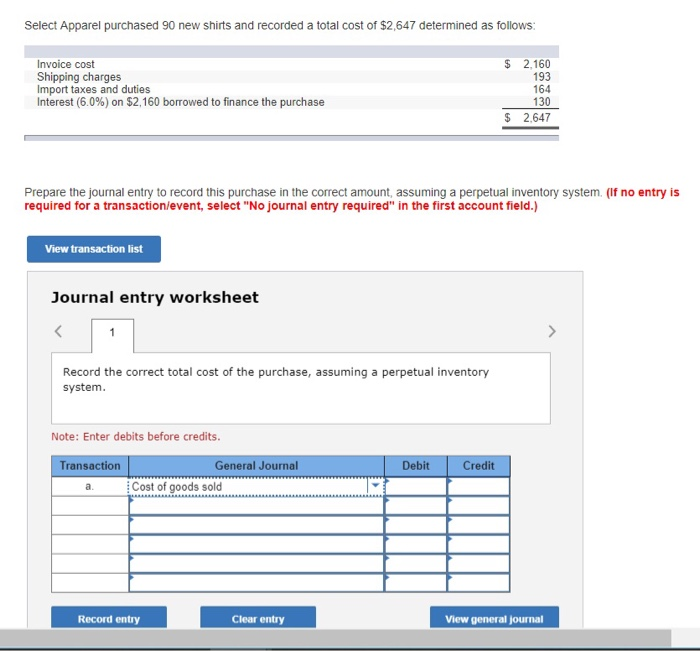

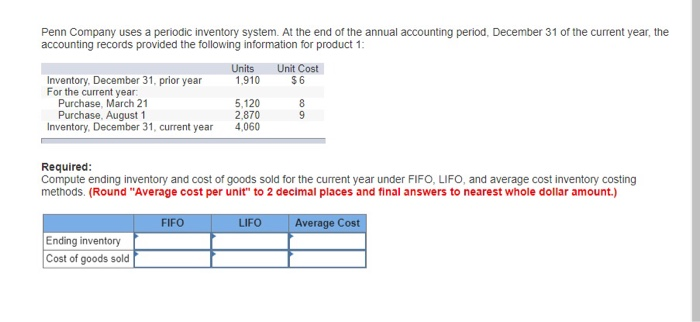

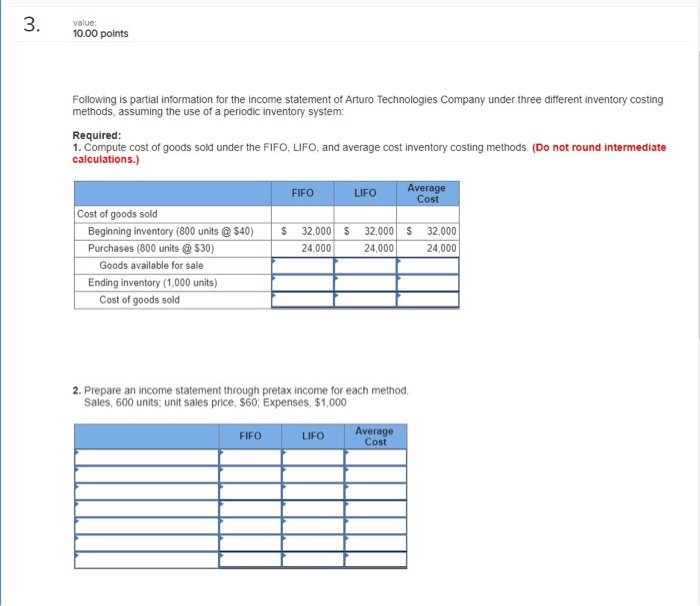

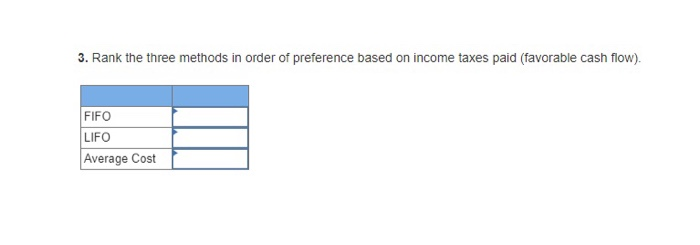

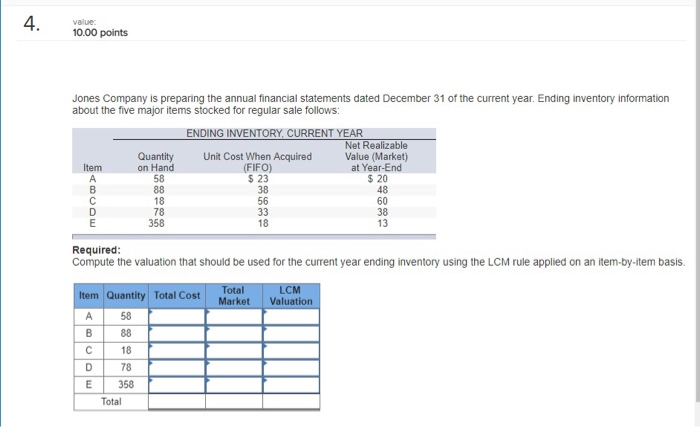

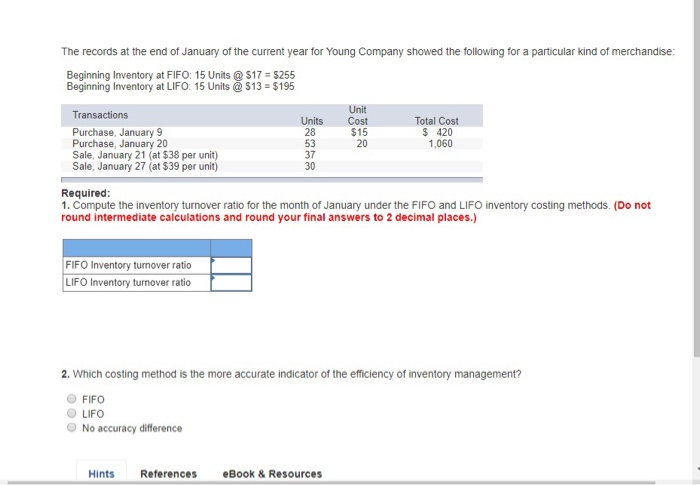

Select Apparel purchased 90 new shirts and recorded a total cost of $2,647 determined as follows: Invoice cost $ 2,160 193 164 130 Shipping charges Import taxes and duties Interest (6.0%) on $2,160 borrowed to finance the purchase 2,647 Prepare the journal entry to record this purchase in the correct amount, assuming a perpetual inventory system. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 Record the correct total cost of the purchase, assuming a perpetual inventory system. Note: Enter debits before credits. Transaction General Journal Debit Credit Cost of goods sold a. Record entry Clear entry View general journal Penn Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 1: Units 1,910 Unit Cost Inventory, December 31, prior year For the current year Purchase, March 21 Purchase, August 1 Inventory, December 31, current year $ 6 5,120 2,870 4,060 8 Required: Compute ending inventory and cost of goods sold for the current year under FIFO, LIFO, and average cost inventory costing methods. (Round "Average cost per unit" to 2 decimal places and final answers to nearest whole dollar amount.) FIFO LIFO Average Cost Ending inventory Cost of goods sold 3. value: 10.00 points Following is partial information for the income statement of Arturo Technologies Company under three different inventory costing methods, assuming the use of a periodic inventory system: Required: 1. Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. (Do not round intermediate calculations.) Average Cost FIFO LIFO Cost of goods sold Beginning inventory (800 units@ 32,000 32,000 S 40) 32,000 24,000 Purchases (800 units@$30) 24,000 24,000 Goods available for sale Ending inventory (1,000 units) Cost of goods sold 2. Prepare an income statement through pretax income for each method. Sales, 600 units; unit sales price, $60; Expenses, $1,000 Average Cost FIFO LIFO 3. Rank the three methods in order of preference based on income taxes paid (favorable cash flow). FIFQ LIFO Average Cost 4. value: 10.00 points Jones Company is preparing the annual financial statements dated December 31 of the current year. Ending inventory information about the five major items stocked for regular sale follows: ENDING INVENTORY, CURRENT YEAR Net Realizable Value (Market) at Year-End $20 48 60 38 13 Quantity on Hand 58 88 18 78 358 Unit Cost When Acquired (FIFO) S 23 38 56 33 18 Item E Required: Compute the valuation that should be used for the current year ending inventory using the LCM rule applied on an item-by-item basis. Total Market LCM Valuation Item Quantity Total Cost 58 A 88 B C 18 78 E 358 Total ABCD w The records at the end of January of the current year for Young Company showed the following for a particular kind of merchandise: Beginning Inventory at FIFO: 15 Units @ $17 = $255 Beginning Inventory at LIFO: 15 Units@$13 $195 Unit Cost $15 20 Transactions Units 28 53 37 30 Total Cost S 420 1,060 Purchase, January 9 Purchase, January 20 Sale, January 21 (at $38 per unit) Sale, January 27 (at $39 per unit) Required: 1. Compute the inventory turnover ratio for the month of January under the FIFO and LIFO inventory costing methods. (Do not round intermediate calculations and round your final answers to 2 decimal places.) FIFO Inventory turnover ratio LIFO Inventory turnover ratio 2. Which costing method is the more accurate indicator of the efficiency of inventory management? FIFO O LIFO No accuracy difference eBook & Resources Hints References