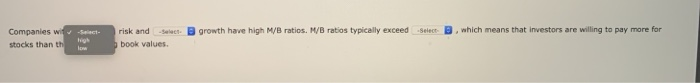

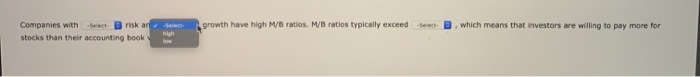

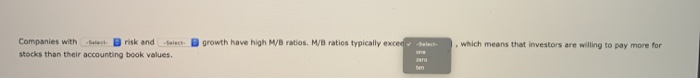

Select Market value ratios give management an indication of what investors think of the company Price/Earnings ratio, (2) Market/Book ratio, and (3) Price/Cash flow ratio. The Price/Earnings Select D. Its equation is: and future prospects. The market value ratios include: (1) w much investors are willing to pay per dollar of current past performance Market value ratios give management an indication of what investors think of the company's Select and future prospects. The market value ratios include: (1) Price/Earnings ratio, (2) Market/Book ratio, and (3) Price/Cash flow ratio. The Price/Earnings (P/E) ratio shows how much investors are willing to pay per dollar of current -Select- .Its equation is: Operations tet for slowly growing and risky firms. The Market/Book (M/B) ratio is another P/E ratios are Select for firms with strong growth prospects and relatively little risk but Indication of how Investors regard a firm. Its equation is: growth have high M/B ratios. M/B ratios typically exceed e B, which means that investors are willing to pay more for Companies with Select risk and select stocks than their accounting book values lot P/E ratios a indication of for firms with strong growth prospects and relatively little risk but regard a firm. Its equation is: Set for slowly growing and risky firms. The Market/Book (M/B) ratio is another select for slowly growing and risky firms. The Market/Book (M/B) ratio is another P/E ratios are select for firms with strong growth prospects and relatively little risk be indication of how investors regard a firm. Its equation is: growth have high M/B ratios. M/B ratios typically exceed -Select B, which means that investors are willing to pay more for Companies wit Select- stocks than the risk and Select book values. Select growth have high M/B ratios. M/B ratios typically exceed S D , which means that investors are willing to pay more for Companies with cert risk an stocks than their accounting book growth have high M/B ratios. M/B ratios typically exced it . which means that investors are willing to pay more for Companies with risk and select stocks than their accounting book values