Answered step by step

Verified Expert Solution

Question

1 Approved Answer

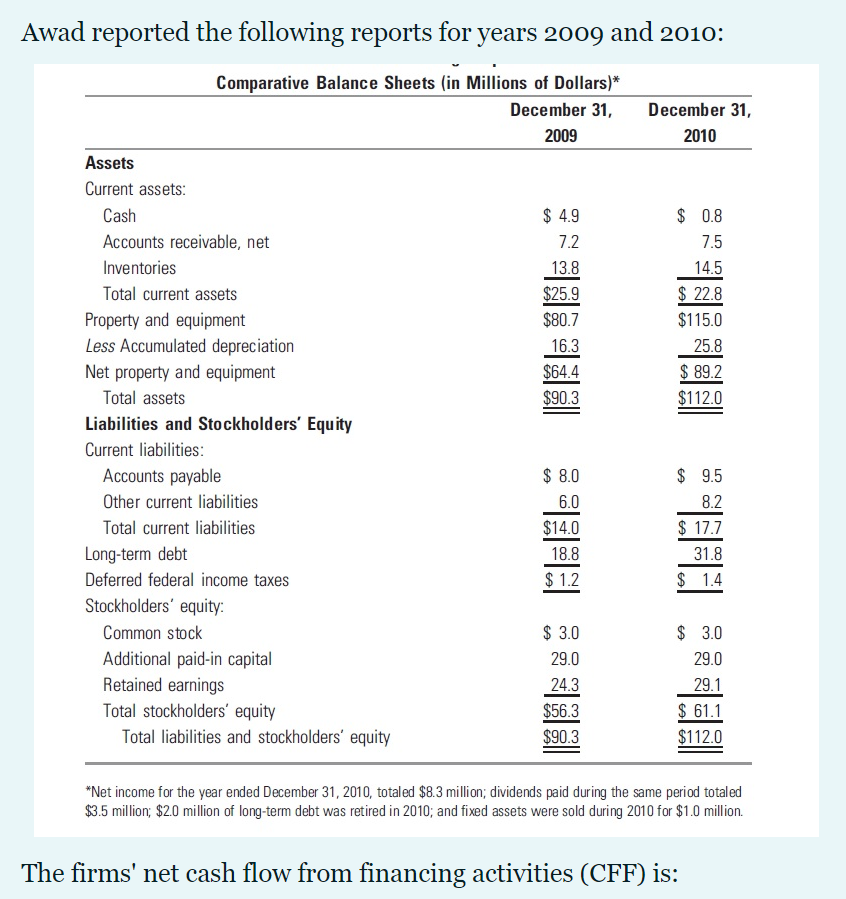

Select one: a. ($2M) b. ($9.5M) c. $9.5M d. None of the choices e. ($5.5M) Awad reported the following reports for years 2009 and 2010:

Select one:

a.

($2M)

b.

($9.5M)

c.

$9.5M

d.

None of the choices

e.

($5.5M)

Awad reported the following reports for years 2009 and 2010: Comparative Balance Sheets (in Millions of Dollars)* December 31, 2009 December 31, 2010 Assets Current assets: Cash $ 4.9 $ 0.8 Accounts receivable, net 7.2 7.5 Inventories 13.8 14.5 Total current assets Property and equipment Less Accumulated depreciation Net property and equipment Total assets Liabilities and Stockholders' Equity Current liabilities: $25.9 $80.7 16.3 $64.4 $90.3 $ 22.8 $115.0 25.8 $ 89.2 $112.0 $ 8.0 $ 9.5 Accounts payable Other current liabilities 6.0 8.2 Total current liabilities $14.0 $ 17.7 Long-term debt 18.8 31.8 Deferred federal income taxes $ 1.2 $ 1.4 Stockholders' equity: Common stock $ 3.0 $ 3.0 29.0 29.0 24.3 Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $56.3 $90.3 29.1 $ 61.1 $112.0 *Net income for the year ended December 31, 2010, totaled $8.3 million; dividends paid during the same period totaled $3.5 million; $2.0 million of long-term debt was retired in 2010; and fixed assets were sold during 2010 for $1.0 million. The firms' net cash flow from financing activities (CFF) isStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started