Question

Select the best answer for each of the following and explain fully the reason for your selection. a. Which of the following is not typically

Select the best answer for each of the following and explain fully the reason for your selection.

a. Which of the following is not typically performed when the auditors are performing a review of client financial statements?

(1) Analytical procedures applied to financial data.

(2) Inquiries about significant subsequent events.

(3) Confirmation of accounts receivable.

(4) Obtaining an understanding of accounting principles followed in the client’s industry.

b. Which of the following must be obtained in a review of a nonpublic company?

c. A CPA who is not independent may perform which of the following services for a non-public company?

d. When performing a review of a nonpublic company, which is least likely to be included in auditor inquiries of management members with responsibility for financial and accounting matters?

(1) Subsequent events.

(2) Significant journal entries and other adjustments.

(3) Communications with related parties.

(4) Unusual or complex situations affecting the financial statements.

e. The proper report by an auditor relating to summarized financial statements includes:

(1) A statement about the type of opinion expressed in the prior year.

(2) An adverse opinion.

(3) An opinion on whether the summarized information is fairly stated in all material respects in relation to the basic financial statements.

(4) No assurance on the information.

f. Concerning interim quarterly financial statements, management of public companies:

(1) Must engage CPAs to audit the statements.

(2) Must engage CPAs to review the statements.

(3) May choose to engage CPAs to review the statements.

(4) May not engage CPAs to become associated with the statements.

g. A proper compilation report on financial statements that omit note disclosures:

(1) Includes an adverse opinion.

(2) Includes a disclaimer of opinion on the accuracy of such note disclosures.

(3) Indicates that management has omitted such information.

(4) Indicates that note disclosures are not necessary for those not informed about such matters.

h. Which of the following forms of accountant association is least likely to result in issuance of an accountant’s report on financial statements or financial information?

(1) Compilation.

(2) Review.

(3) Preparation.

(4) Agreed-upon procedures.

i. Which assertion is generally most difficult to attest to with respect to personal financial statements?

(1) Existence and occurrence.

(2) Rights and obligations.

(3) Completeness.

(4) Valuation.

j. Financial statements prepared following which of the following are most likely to be considered a special-purpose financial reporting framework?

(1) Generally accepted accounting principles.

(2) International Financial Reporting Standards.

(3) Financial reporting standards of a foreign nation.

(4) The cash basis of accounting.

k. In which of the following reports should a CPA not express negative (limited) assurance?

(1) A standard compilation report on financial statements of a nonpublic entity.

(2) A standard review report on interim financial statements of a public entity.

(3) A standard review report on financial statements of a nonpublic entity.

(4) A comfort letter on financial information is included in a registration statement filed with the Securities and Exchange Commission.

l. Comfort letters to underwriters are normally signed by the:

(1) Independent auditor.

(2) Underwriter.

(3) Client’s lawyer.

(4) Chief executive officer.

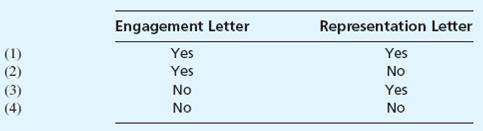

Engagement Letter Representation Letter (1) Yes Yes (2) Yes No (3) (4) No Yes No No

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution a 3 Audit of finan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started