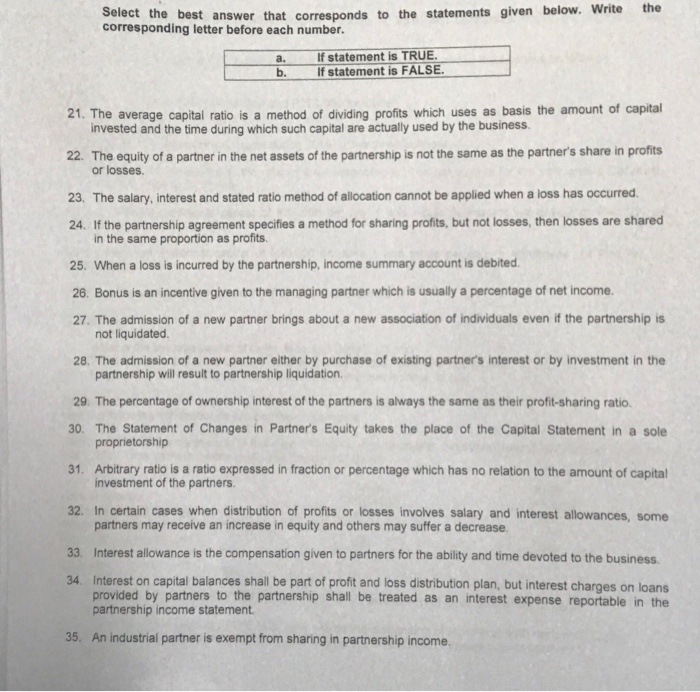

Select the best answer that corresponds to the statements given below. Write corresponding letter before each number. the If statement is TRUE If statement is FALSE a. b. 21. The average capital ratio is a method of dividing profits which uses as basis the amount of capital invested and the time during which such capital are actually used by the business 22. The equity of a partner in the net assets of the partnership is not the same as the partner's share in profits or losses. The salary, interest and stated ratio method of allocation cannot be applied when a loss has occurred 23, 24. If the partnership agreement specifies a method for sharing profits, but not losses, then losses are shared in the same proportion as profits. 25. When a loss is incurred by the partnership, income summary account is debited 26. Bonus is an incentive given to the managing partner which is usually a percentage of net income. 27. The admission of a new partner brings about a new association of individuals even if the partnership is not liquidated. 28. The admission of a new partner either by purchase of existing partner's interest or by investment in the partnership will result to partnership liquidation 29. The percentage of ownership interest of the partners is always the same as their profit-sharing ratio 30. The Statement of Changes in Partner's Equity takes the place of the Capital Statement in a sole proprietorship 31. Arbitrary ratio is a ratio expressed in fraction or percentage which has no relation to the amount of capital investment of the partners 32. In certain cases when distribution of profits or losses involves salary and interest allowances, some partners may receive an increase in equity and others may suffer a decrease. 33. Interest allowance is the compensation given to partners for the ability and time devoted to the business 34 Interest on capital balances shall be part of profit and loss distribution plan, but interest charges on loans provided by partners to the partnership shall be treated as an interest expense reportable in the partnership income statement. 35. An industrial partner is exempt from sharing in partnership income