Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Select the best answer. Which of the following is correct regarding bonus depreciation under the TCJA? A. Bonus depreciation is 100% for 2018 and subject

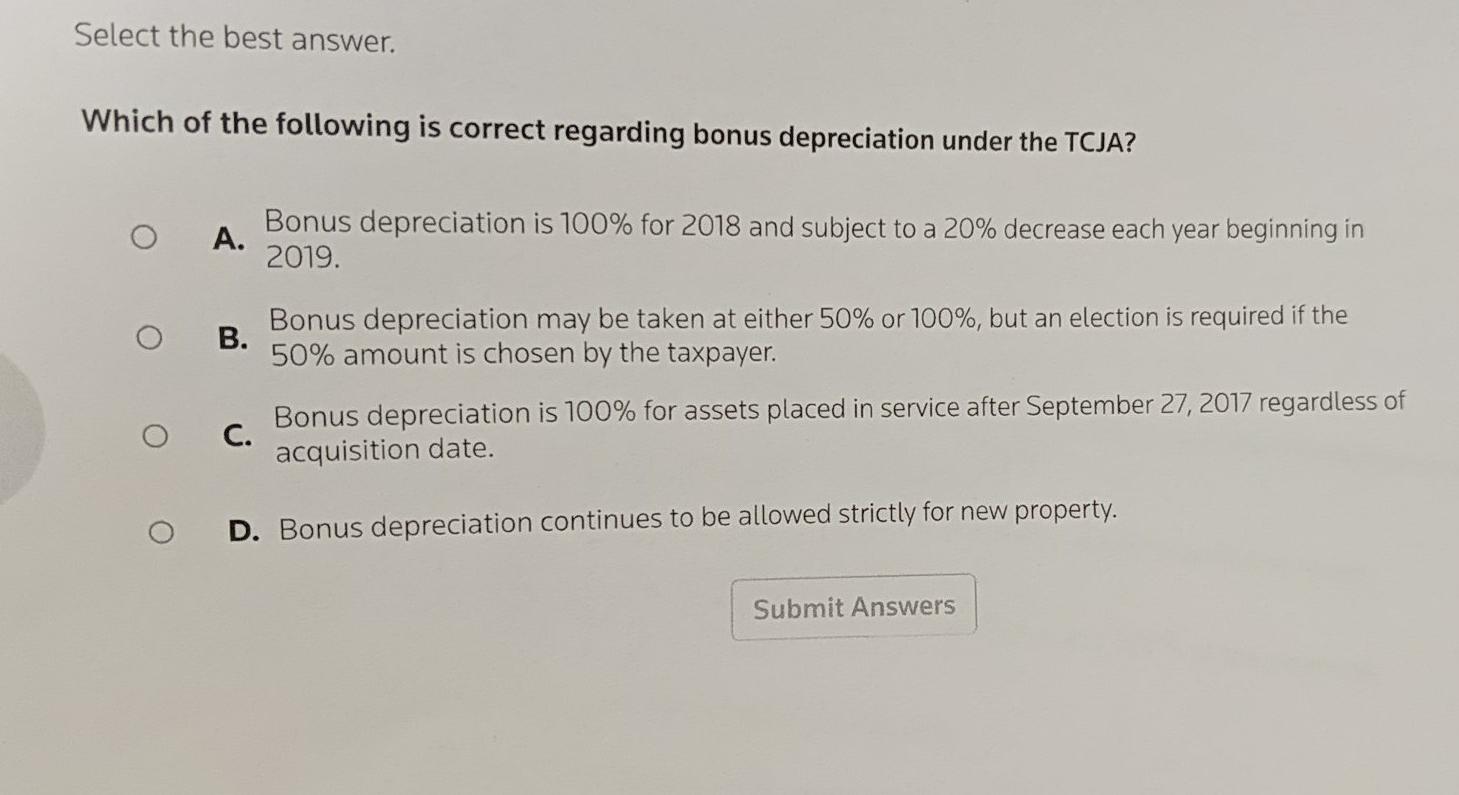

Select the best answer. Which of the following is correct regarding bonus depreciation under the TCJA? A. Bonus depreciation is 100% for 2018 and subject to a 20% decrease each year beginning in 2019. B. Bonus depreciation may be taken at either 50% or 100%, but an election is required if the 50% amount is chosen by the taxpayer. C. Bonus depreciation is 100% for assets placed in service after September 27, 2017 regardless of acquisition date. D. Bonus depreciation continues to be allowed strictly for new property. Submit Answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started