Answered step by step

Verified Expert Solution

Question

1 Approved Answer

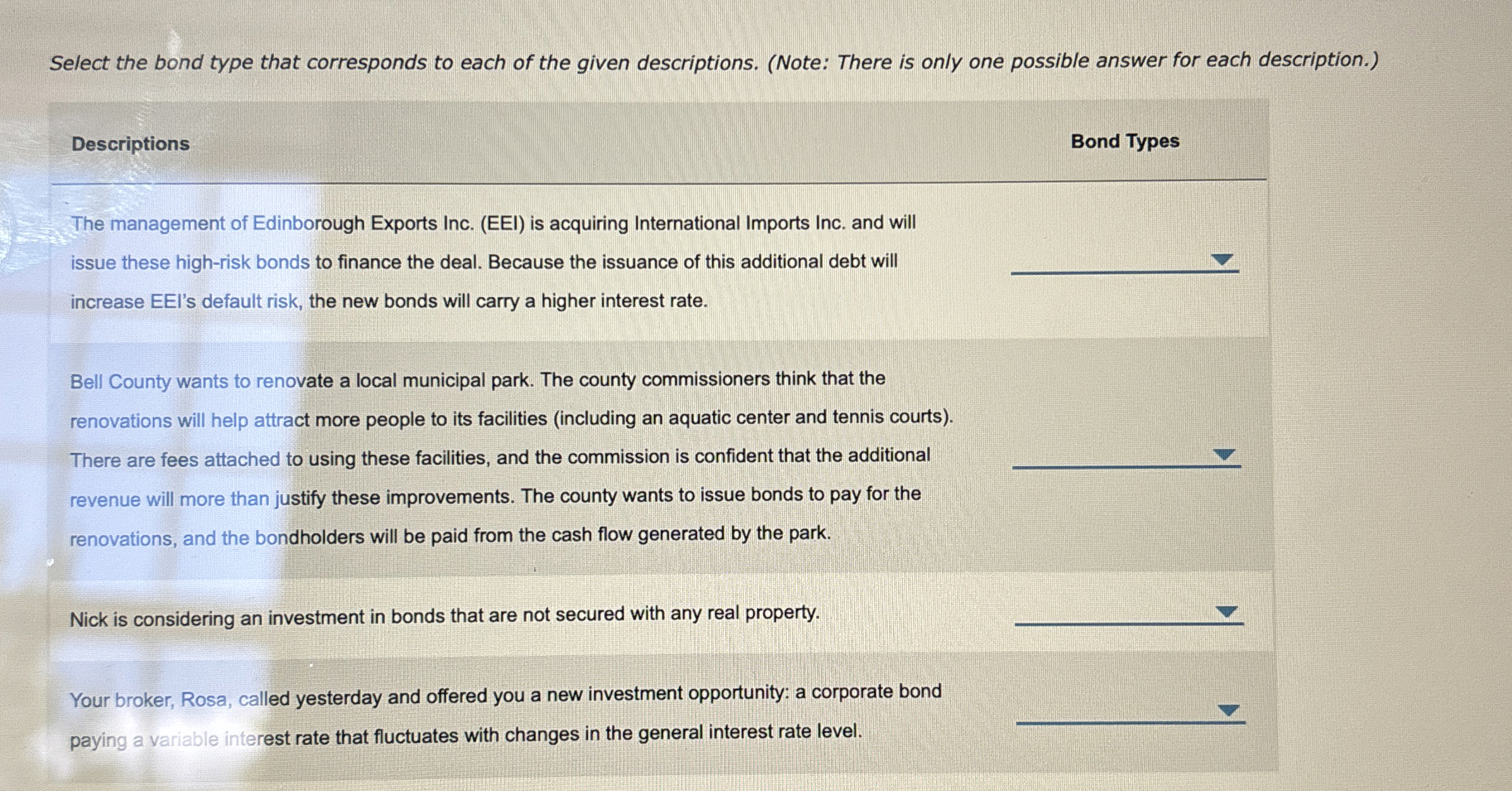

Select the bond type that corresponds to each of the given descriptions. ( Note: There is only one possible answer for each description. ) Descriptions

Select the bond type that corresponds to each of the given descriptions. Note: There is only one possible answer for each description.

Descriptions

Bond Types

The management of Edinborough Exports Inc. EEI is acquiring International Imports Inc. and will

issue these highrisk bonds to finance the deal. Because the issuance of this additional debt will

increase EEl's default risk, the new bonds will carry a higher interest rate.

Bell County wants to renovate a local municipal park. The county commissioners think that the

renovations will help attract more people to its facilities including an aquatic center and tennis courts

There are fees attached to using these facilities, and the commission is confident that the additional

revenue will more than justify these improvements. The county wants to issue bonds to pay for the

renovations, and the bondholders will be paid from the cash flow generated by the park.

Nick is considering an investment in bonds that are not secured with any real property.

Your broker, Rosa, called yesterday and offered you a new investment opportunity: a corporate bond

paying a variable interest rate that fluctuates with changes in the general interest rate level.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started