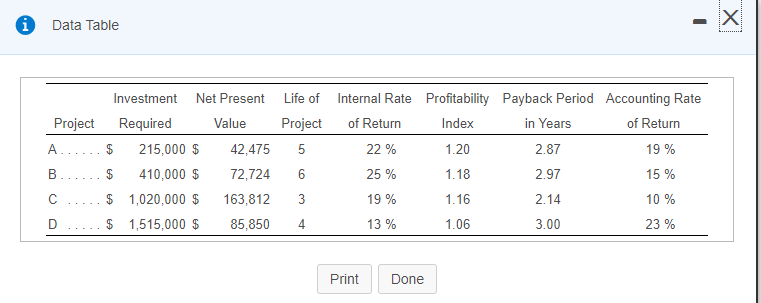

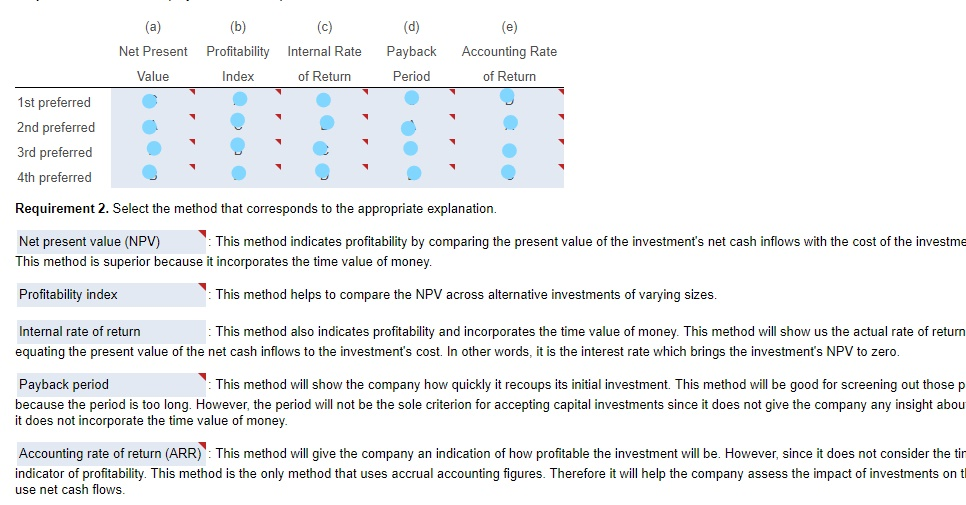

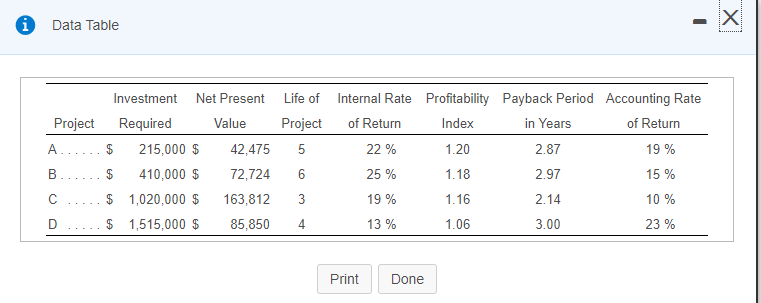

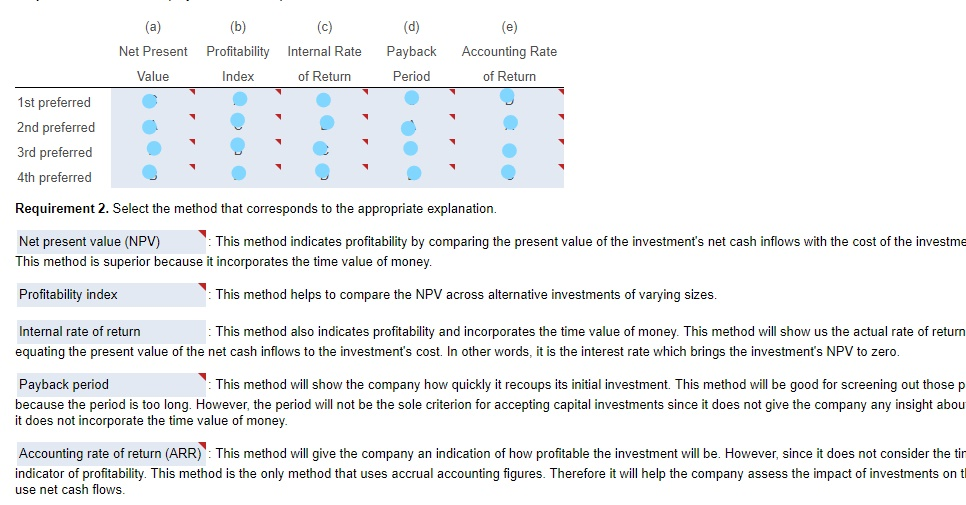

Select the method that corresponds to the appropriate explanation. Net present value (NPV): This method indicates profitability by comparing the present value of the investment's net cash inflows with the cost of the This method is superior because it incorporates the time value of money. Profitability index: This method helps to compare the NPV across alternative investments of varying sizes. Internal rate of return: This method also indicates profitability and incorporates the time value of money. This method will show us the actual rate of return equating the present value of the net cash inflows to the investment's cost. In other words. it is the interest rate which brings the investment's NPV to zero. Payback period: This method will show the company how quickly it recoups its initial investment. This method will be good for screening out those because the period is too long. However, the period will not be the sole criterion for accepting capital investments since it does not give the company any insight about it does not incorporate the time value of money. Accounting rate of return (ARR): This method will give the company an indication of how profitable the investment will be. However, since it does not consider the time indicator of profitability. This method is the only method that uses accrual accounting figures. Therefore it will help the company assess the impact of investments on use net cash flows. Select the method that corresponds to the appropriate explanation. Net present value (NPV): This method indicates profitability by comparing the present value of the investment's net cash inflows with the cost of the This method is superior because it incorporates the time value of money. Profitability index: This method helps to compare the NPV across alternative investments of varying sizes. Internal rate of return: This method also indicates profitability and incorporates the time value of money. This method will show us the actual rate of return equating the present value of the net cash inflows to the investment's cost. In other words. it is the interest rate which brings the investment's NPV to zero. Payback period: This method will show the company how quickly it recoups its initial investment. This method will be good for screening out those because the period is too long. However, the period will not be the sole criterion for accepting capital investments since it does not give the company any insight about it does not incorporate the time value of money. Accounting rate of return (ARR): This method will give the company an indication of how profitable the investment will be. However, since it does not consider the time indicator of profitability. This method is the only method that uses accrual accounting figures. Therefore it will help the company assess the impact of investments on use net cash flows