Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Select two different corporations ( from the same industry ) publicly traded in the US Stock Exchange Markets . ( NYSE , NASDAQ ) Make

Select two different corporations

from the same industry

publicly traded in the US Stock Exchange Markets

NYSE

NASDAQ

Make sure the companies you select are traded in same currency

USD

EuroGBP

Please get the approval for the names of the firm before you start your work

The analysis of same company by different students will not be graded

Download the necessary financial statements for the companies for

and

For data collection you can use:

finance.yahoo.com or

finance.google.com

Part

: Apply the financial analysis for the last two years using ratios covered in Chapter

Use excel formulas for calculation of the ratios on a separate sheet

manual calculations will not be graded

You are not responsible for Part

V

Market Value

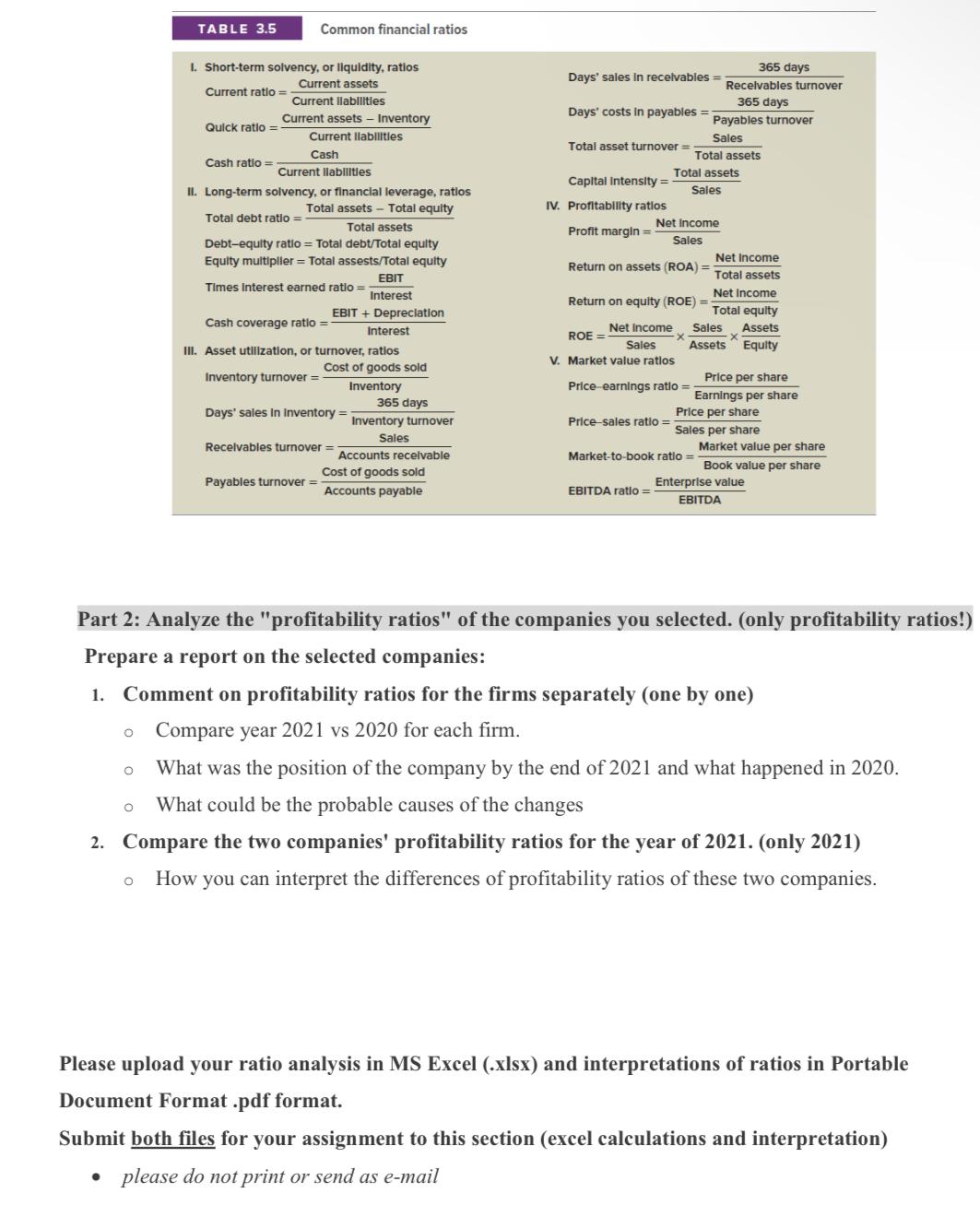

TABLE

Common financial ratios

I. Shortterm solvency, or llquidity, ratios

Current ratio

Quick ratio

Cash ratio

II Longterm solvency, or financlal leverage, ratios

Total debt ratio

Debtequity ratio Total debtTotal equity

Equity multipller Total assestsTotal equity

Times interest earned ratio

Cash coverage ratio

III. Asset utilization, or turnover, ratios

Inventory turnover

Days' sales in inventory

Recelvables turnover

Payables turnover

Days' sales In recelvables

Days' costs in payables

Total asset turnover

Capital Intensity

IV Profitability ratios

Profit margin

Return on assets ROA

Return on equity

ROE

V Market value ratios

Price earnings ratio

Pricesales ratio

Markettobook ratio

EBITDA ratio

Part : Analyze the "profitability ratios" of the companies you selected. only profitability ratios!

Prepare a report on the selected companies:

Comment on profitability ratios for the firms separately one by one

Compare year vs for each firm.

What was the position of the company by the end of and what happened in

What could be the probable causes of the changes

Compare the two companies' profitability ratios for the year of only

How you can interpret the differences of profitability ratios of these two companies.

Please upload your ratio analysis in MS Excel xlsx and interpretations of ratios in Portable Document Format pdf format.

Submit both files for your assignment to this section excel calculations and interpretation

please do not print or send as emailSelect two different corporations from the same industry publicly traded in the US Stock Exchange Markets. NYSE NASDAQ

Make sure the companies you select are traded in same currency USD Euro, GBP

Please get the approval for the names of the firm before you start your work.

The analysis of same company by different students will not be graded

Download the necessary financial statements for the companies for and

For data collection you can use:

finance.yahoo.com or

finance.google.com

Part : Apply the financial analysis for the last two years using ratios covered in Chapter

Use excel formulas for calculation of the ratios on a separate sheet manual calculations will not be graded!

You are not responsible for Part V Market Value ratios

Some companies may not have all the data due to their variations in industries.

If you face missing data just skip that ratio mention as no available data"

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started