Answered step by step

Verified Expert Solution

Question

1 Approved Answer

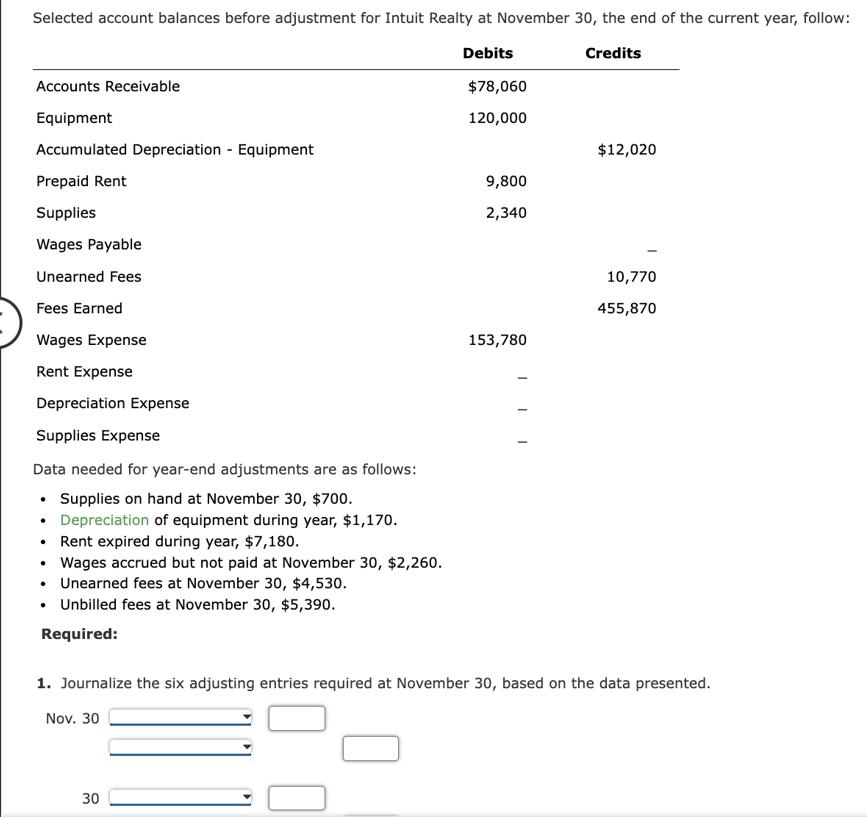

Selected account balances before adjustment for Intuit Realty at November 30, the end of the current year, follow: Debits Credits Accounts Receivable $78,060 Equipment

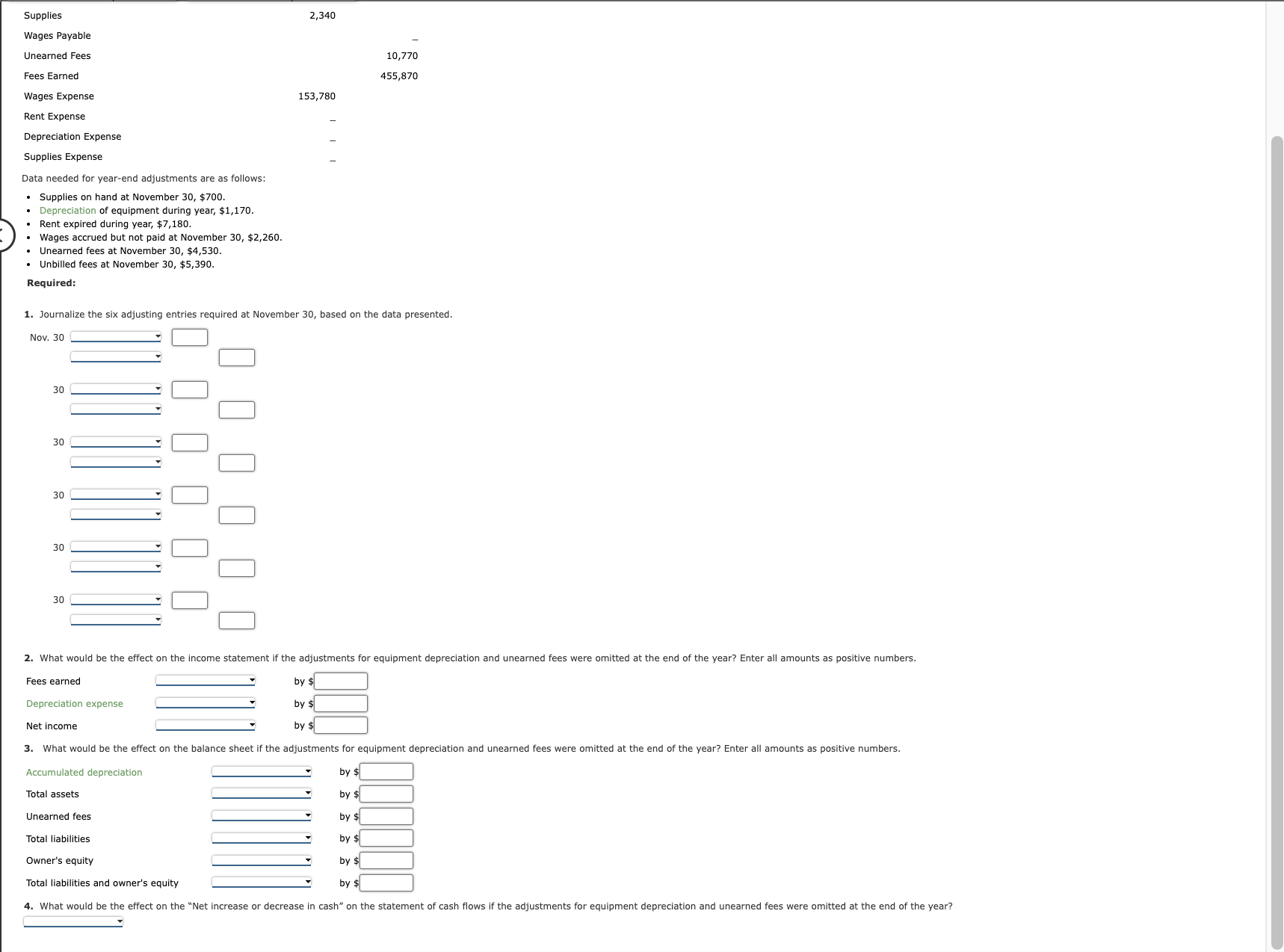

Selected account balances before adjustment for Intuit Realty at November 30, the end of the current year, follow: Debits Credits Accounts Receivable $78,060 Equipment 120,000 Accumulated Depreciation Equipment - $12,020 Prepaid Rent 9,800 Supplies 2,340 Wages Payable Unearned Fees Fees Earned Wages Expense Rent Expense Depreciation Expense Supplies Expense Data needed for year-end adjustments are as follows: Supplies on hand at November 30, $700. Depreciation of equipment during year, $1,170. Rent expired during year, $7,180. Wages accrued but not paid at November 30, $2,260. Unearned fees at November 30, $4,530. . Unbilled fees at November 30, $5,390. 10,770 455,870 153,780 Required: 1. Journalize the six adjusting entries required at November 30, based on the data presented. Nov. 30 30 Supplies Wages Payable Unearned Fees Fees Earned Wages Expense Rent Expense Depreciation Expense Supplies Expense Data needed for year-end adjustments are as follows: Supplies on hand at November 30, $700. Depreciation of equipment during year, $1,170. Rent expired during year, $7,180. Wages accrued but not paid at November 30, $2,260. Unearned fees at November 30, $4,530. Unbilled fees at November 30, $5,390. Required: 2.340 10,770 455,870 153,780 1. Journalize the six adjusting entries required at November 30, based on the data presented. Nov. 30 30 30 30 30 30 2. What would be the effect on the income statement if the adjustments for equipment depreciation and unearned fees were omitted at the end of the year? Enter all amounts as positive numbers. Fees earned Depreciation expense Net income by by $ by $ 3. What would be the effect on the balance sheet if the adjustments for equipment depreciation and unearned fees were omitted at the end of the year? Enter all amounts as positive numbers. Accumulated depreciation Total assets Unearned fees Total liabilities Owner's equity Total liabilities and owner's equity by $ by $ by $ by $ by $ by $ 4. What would be the effect on the "Net increase or decrease in cash" on the statement of cash flows if the adjustments for equipment depreciation and unearned fees were omitted at the end of the year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To journalize the six adjusting entries required at November 30 based on the given da...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e6b346d6ee_956618.pdf

180 KBs PDF File

663e6b346d6ee_956618.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started