Answered step by step

Verified Expert Solution

Question

1 Approved Answer

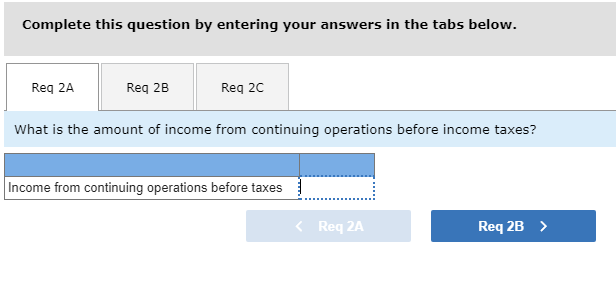

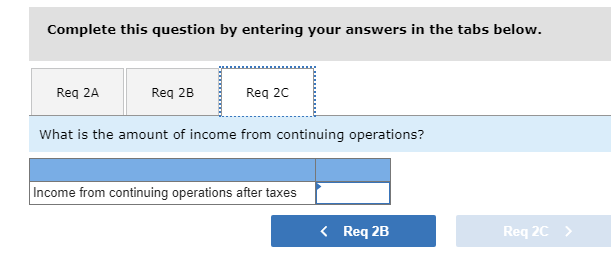

Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31, 2017, follow. Debit Credit a. Interest revenue

Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31, 2017, follow.

| Debit | Credit | ||||||

| a. | Interest revenue | $ | 15,600 | ||||

| b. | Depreciation expenseEquipment. | $ | 35,600 | ||||

| c. | Loss on sale of equipment | 27,450 | |||||

| d. | Accounts payable | 45,600 | |||||

| e. | Other operating expenses | 108,000 | |||||

| f. | Accumulated depreciationEquipment | 73,200 | |||||

| g. | Gain from settlement of lawsuit | 45,600 | |||||

| h. | Accumulated depreciationBuildings | 177,700 | |||||

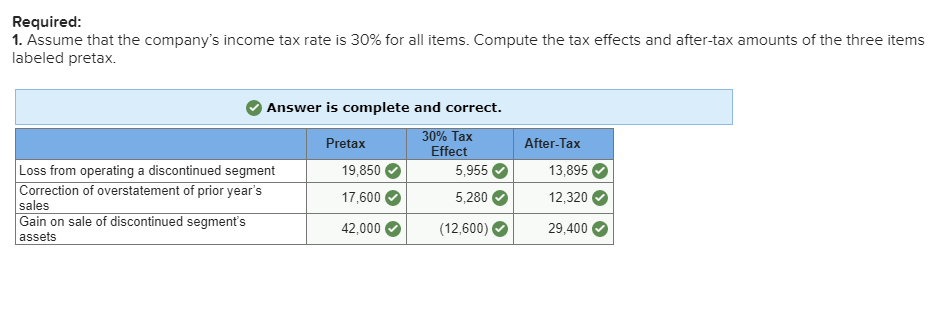

| i. | Loss from operating a discontinued segment (pretax) | 19,850 | |||||

| j. | Gain on insurance recovery of tornado damage | 30,720 | |||||

| k. | Net sales | 1,014,500 | |||||

| l. | Depreciation expenseBuildings | 53,600 | |||||

| m. | Correction of overstatement of prior years sales (pretax) | 17,600 | |||||

| n. | Gain on sale of discontinued segments assets (pretax) | 42,000 | |||||

| o. | Loss from settlement of lawsuit | 25,350 | |||||

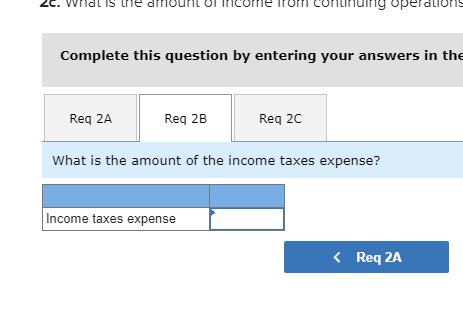

| p. | Income taxes expense | ? | |||||

| q. | Cost of goods sold | 498,500 | |||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started