Answered step by step

Verified Expert Solution

Question

1 Approved Answer

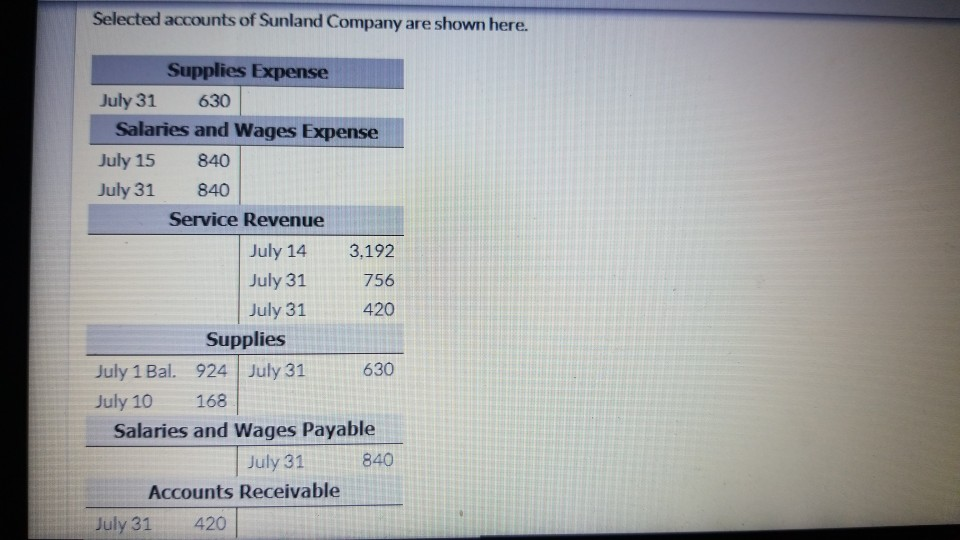

Selected accounts of Sunland Company are shown here. July 15 Supplies Expense July 31 630 Salaries and Wages Expense 840 July 31 840 Service Revenue

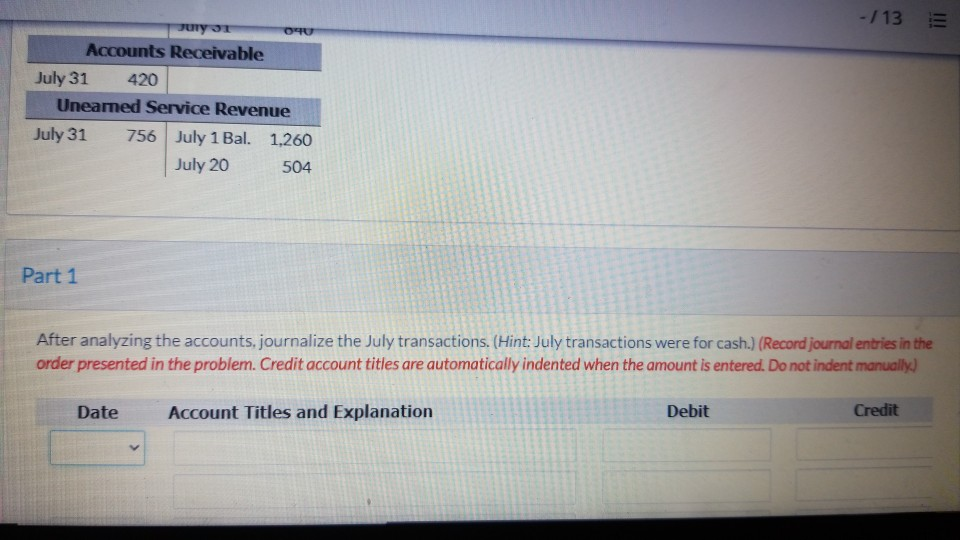

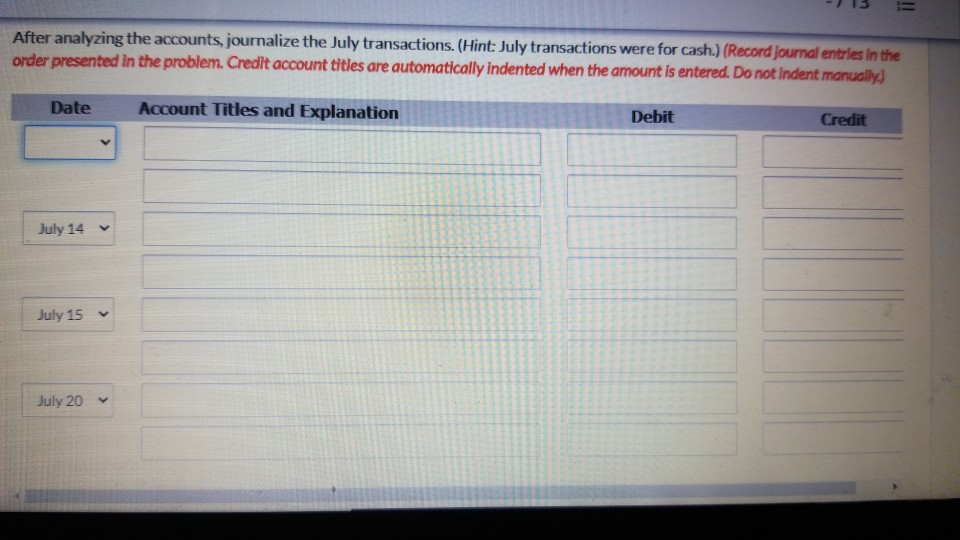

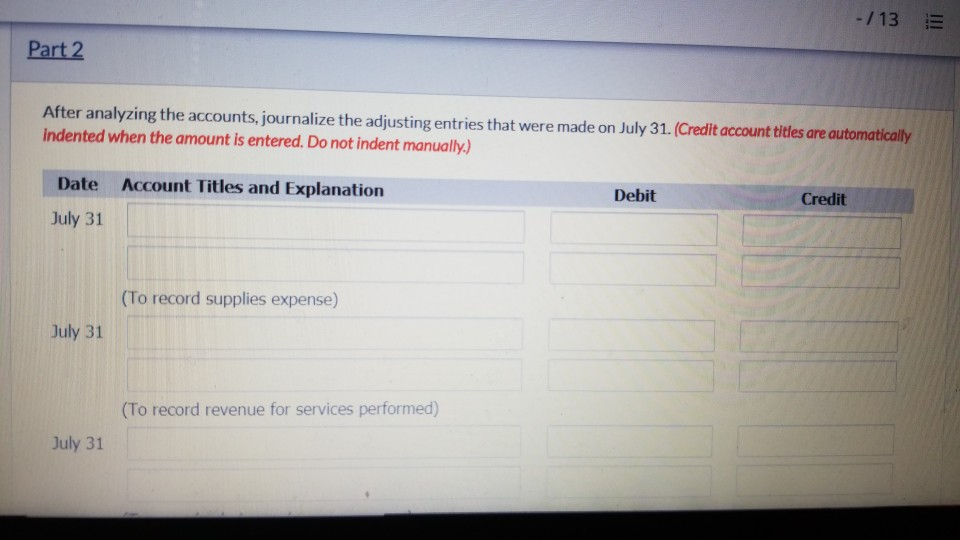

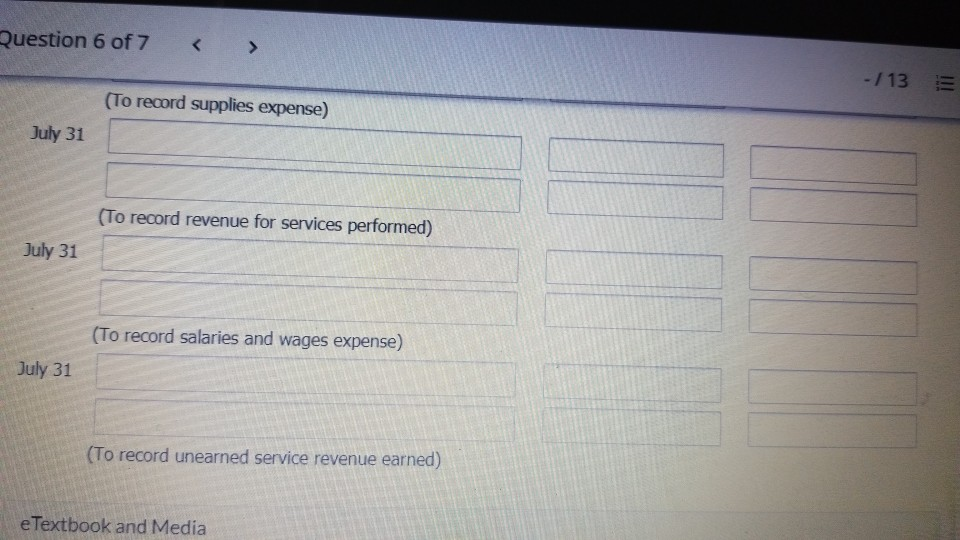

Selected accounts of Sunland Company are shown here. July 15 Supplies Expense July 31 630 Salaries and Wages Expense 840 July 31 840 Service Revenue July 14 3,192 July 31 756 July 31 420 Supplies July 1 Bal. 924 July 31 630 July 10 168 Salaries and Wages Payable July 31 840 Accounts Receivable July 31 420 -/13 3 O' unyo Accounts Receivable July 31 420 Uneamed Service Revenue July 31 756 July 1 Bal. 1,260 July 20 504 Part 1 After analyzing the accounts, journalize the July transactions. (Hint: July transactions were for cash.) (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit = After analyzing the accounts, journalize the July transactions. (Hint: July transactions were for cash.) (Record Journal entries in the order presented in the problem. Credit account titles are automatically indented when the amount is entered. Do not Indent manually) Date Account Titles and Explanation Debit Credit July 14 July 15 July 20 - / 13 5 Part 2 After analyzing the accounts, journalize the adjusting entries that were made on July 31. (Credit account titles are automatically Indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit July 31 (To record supplies expense) July 31 (To record revenue for services performed) July 31 Question 6 of 7 -/13 3 (To record supplies expense) July 31 (To record revenue for services performed) July 31 (To record salaries and wages expense) July 31 (To record unearned service revenue earned) e Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started