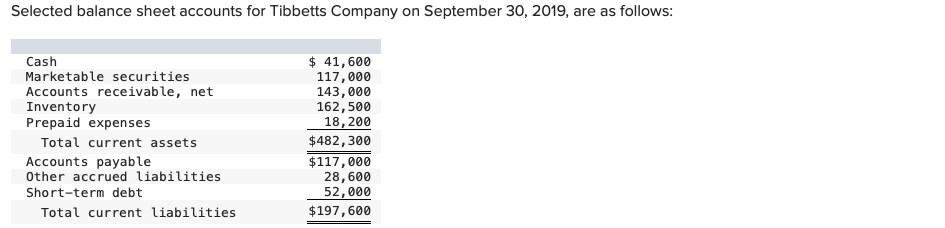

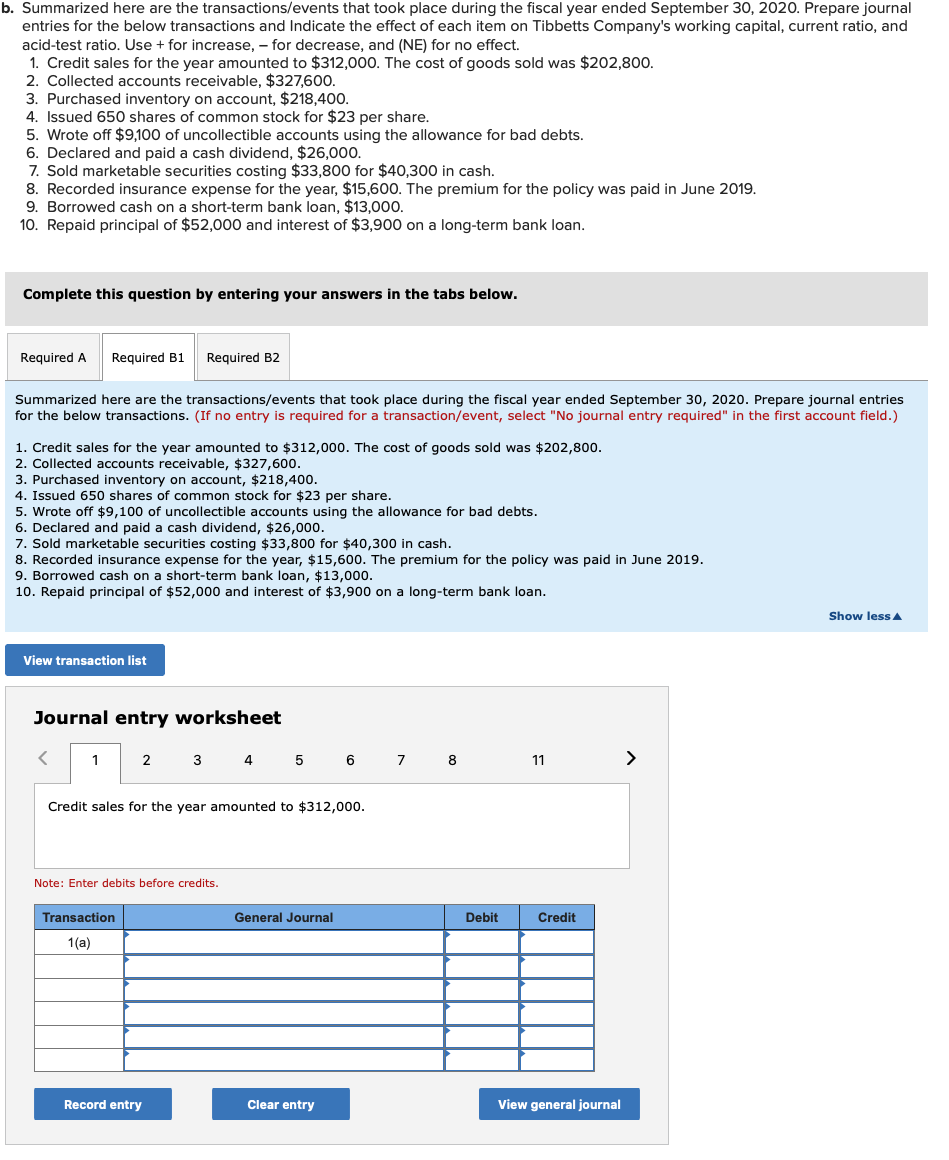

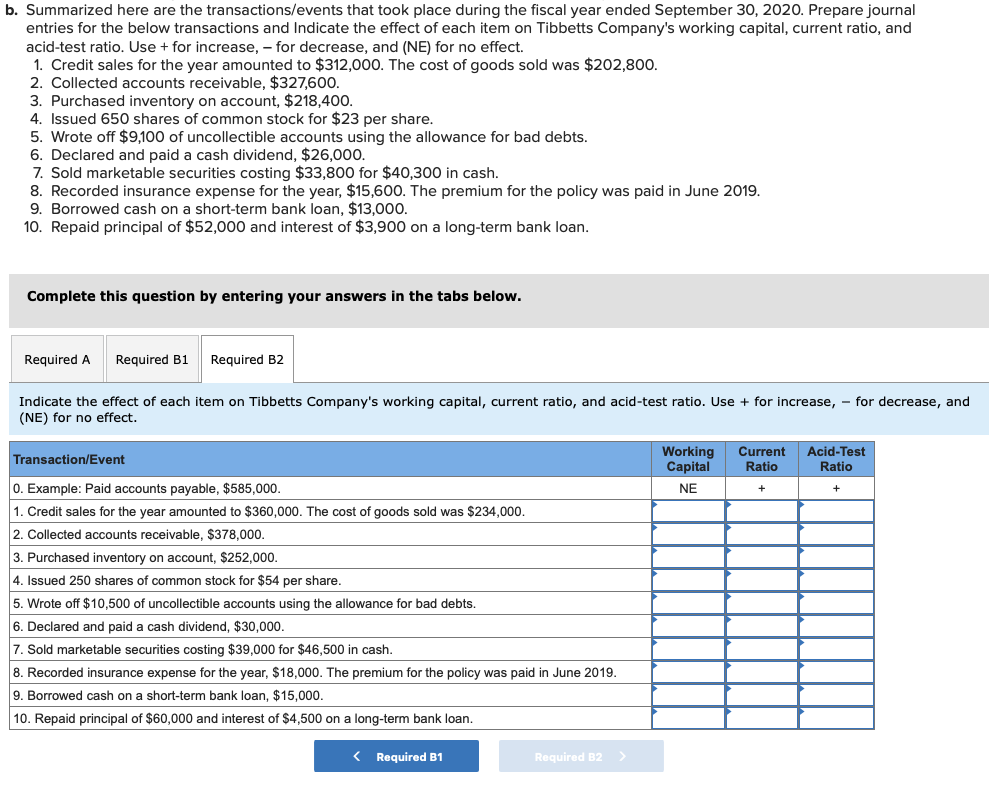

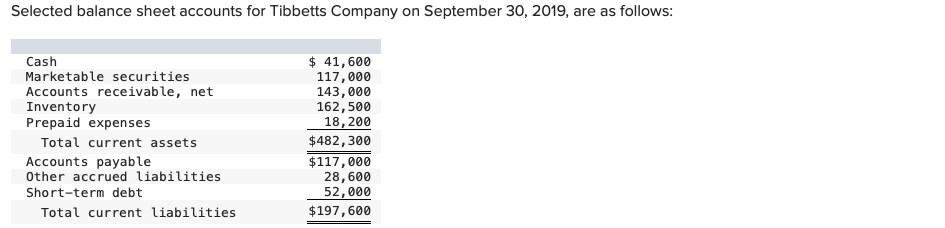

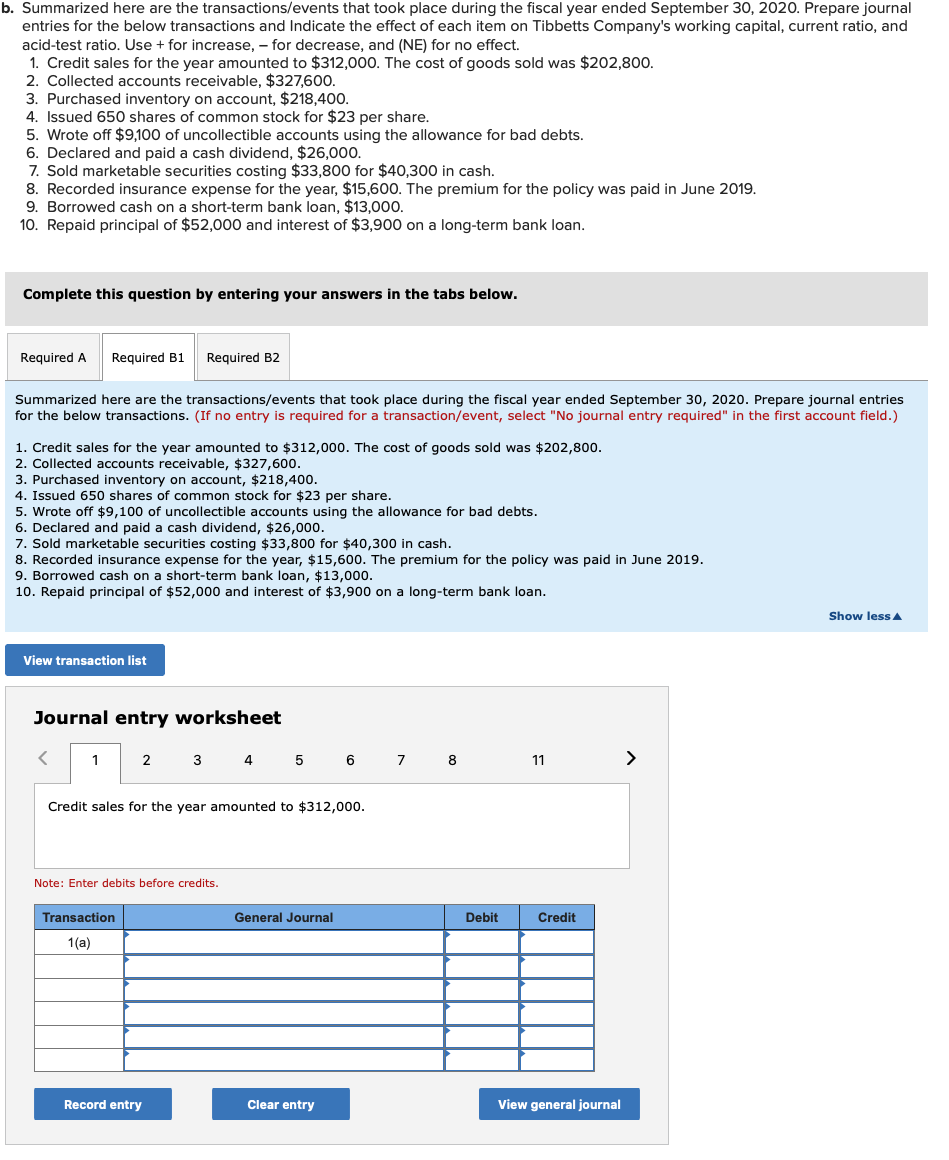

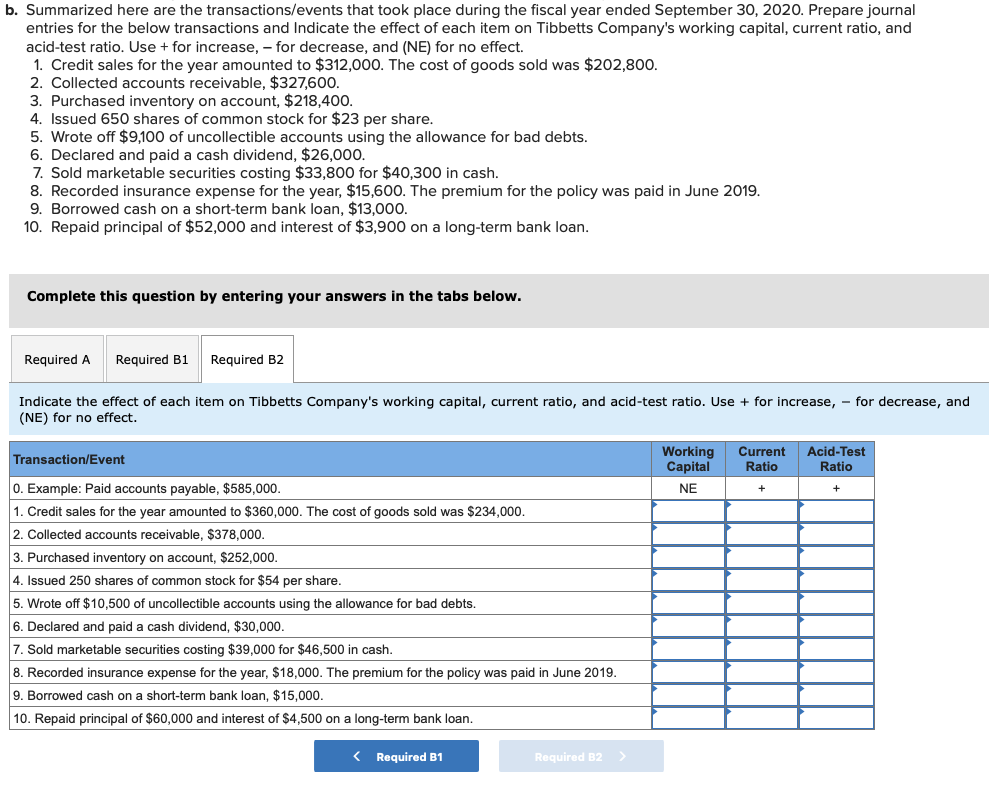

Selected balance sheet accounts for Tibbetts Company on September 30,2019 , are as follows: \begin{tabular}{lr} Cash & $41,600 \\ Marketable securities & 117,000 \\ Accounts receivable, net & 143,000 \\ Inventory & 162,500 \\ Prepaid expenses & 18,200 \\ Total current assets & $482,300 \\ Accounts payable & $117,000 \\ Other accrued liabilities & 28,600 \\ Short-term debt & 52,000 \\ Total current liabilities & $197,600 \\ \hline \hline \end{tabular} b. Summarized here are the transactions/events that took place during the fiscal year ended September 30,2020 . Prepare journal entries for the below transactions and Indicate the effect of each item on Tibbetts Company's working capital, current ratio, and acid-test ratio. Use + for increase, - for decrease, and (NE) for no effect. 1. Credit sales for the year amounted to $312,000. The cost of goods sold was $202,800. 2. Collected accounts receivable, $327,600. 3. Purchased inventory on account, $218,400. 4. Issued 650 shares of common stock for $23 per share. 5. Wrote off $9,100 of uncollectible accounts using the allowance for bad debts. 6. Declared and paid a cash dividend, $26,000. 7. Sold marketable securities costing $33,800 for $40,300 in cash. 8. Recorded insurance expense for the year, $15,600. The premium for the policy was paid in June 2019. 9. Borrowed cash on a short-term bank loan, $13,000. 10. Repaid principal of $52,000 and interest of $3,900 on a long-term bank loan. Complete this question by entering your answers in the tabs below. Summarized here are the transactions/events that took place during the fiscal year ended September 30, 2020. Prepare journal entries for the below transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1. Credit sales for the year amounted to $312,000. The cost of goods sold was $202,800. 2. Collected accounts receivable, $327,600. 3. Purchased inventory on account, $218,400. 4. Issued 650 shares of common stock for $23 per share. 5. Wrote off $9,100 of uncollectible accounts using the allowance for bad debts. 6. Declared and paid a cash dividend, $26,000. 7. Sold marketable securities costing $33,800 for $40,300 in cash. 8. Recorded insurance expense for the year, $15,600. The premium for the policy was paid in June 2019. 9. Borrowed cash on a short-term bank loan, $13,000. 10. Repaid principal of $52,000 and interest of $3,900 on a long-term bank loan. Journal entry worksheet IvULe. LIlet ueuIL VeIUIE LeUILS. b. Summarized here are the transactions/events that took place during the fiscal year ended September 30 , 2020. Prepare journal entries for the below transactions and Indicate the effect of each item on Tibbetts Company's working capital, current ratio, and acid-test ratio. Use + for increase, - for decrease, and (NE) for no effect. 1. Credit sales for the year amounted to $312,000. The cost of goods sold was $202,800. 2. Collected accounts receivable, $327,600. 3. Purchased inventory on account, $218,400. 4. Issued 650 shares of common stock for $23 per share. 5. Wrote off $9,100 of uncollectible accounts using the allowance for bad debts. 6. Declared and paid a cash dividend, $26,000. 7. Sold marketable securities costing $33,800 for $40,300 in cash. 8. Recorded insurance expense for the year, $15,600. The premium for the policy was paid in June 2019. 9. Borrowed cash on a short-term bank loan, $13,000. 10. Repaid principal of $52,000 and interest of $3,900 on a long-term bank loan. Complete this question by entering your answers in the tabs below. Indicate the effect of each item on Tibbetts Company's working capital, current ratio, and acid-test ratio. Use + for increase, - for decrease, (NE) for no effect