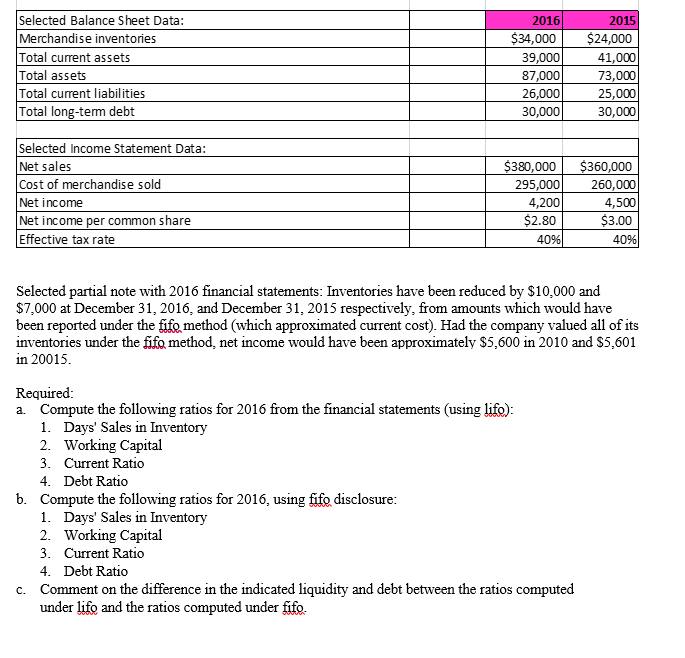

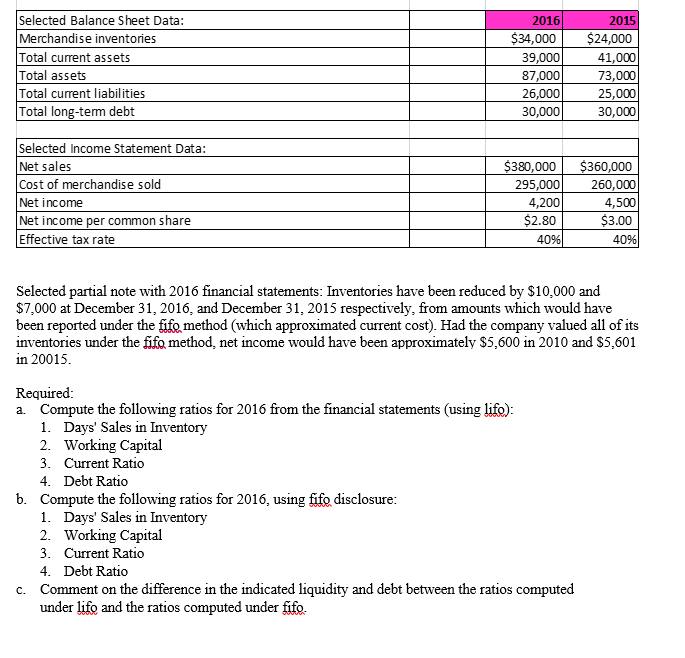

Selected Balance Sheet Data: Merchandise inventories Total current assets Total assets Total current liabilities Total long-term debt 2016 2015 $34,000$24,000 41,000 73,000 25,000 30,000 39,000 87,000 26,000 30,000 Selected Income Statement Data: Net sales Cost of merchandise sold Net income Net income per common share Effective tax rate 80,000360,000 295,000260,000 4,500 3.00 4,200 $2.80 40% 40% Selected partial note with 2016 financial statements: Inventories have been reduced by $10,000 and $7,000 at December 31, 2016, and December 31, 2015 respectively, from amounts which would have been reported under the fifo method (which approximated current cost). Had the company valued all of its inventories under the fiifo method, net income would have been approximately $5,600 in 2010 and S5,601 in 20015 Required a. Compute the following ratios for 2016 from the financial statements (using lifo) 1. Days' Sales in Inventory 2. Working Capital 3. Current Ratio 4. Debt Ratio Compute the following ratios for 2016, using fifo disclosure 1. Days' Sales in Inventory 2. Working Capital 3. Current Ratio 4. Debt Ratio b. c. Comment on the difference in the indicated liquidity and debt between the ratios computed under lifo and the ratios computed under fifo. Selected Balance Sheet Data: Merchandise inventories Total current assets Total assets Total current liabilities Total long-term debt 2016 2015 $34,000$24,000 41,000 73,000 25,000 30,000 39,000 87,000 26,000 30,000 Selected Income Statement Data: Net sales Cost of merchandise sold Net income Net income per common share Effective tax rate 80,000360,000 295,000260,000 4,500 3.00 4,200 $2.80 40% 40% Selected partial note with 2016 financial statements: Inventories have been reduced by $10,000 and $7,000 at December 31, 2016, and December 31, 2015 respectively, from amounts which would have been reported under the fifo method (which approximated current cost). Had the company valued all of its inventories under the fiifo method, net income would have been approximately $5,600 in 2010 and S5,601 in 20015 Required a. Compute the following ratios for 2016 from the financial statements (using lifo) 1. Days' Sales in Inventory 2. Working Capital 3. Current Ratio 4. Debt Ratio Compute the following ratios for 2016, using fifo disclosure 1. Days' Sales in Inventory 2. Working Capital 3. Current Ratio 4. Debt Ratio b. c. Comment on the difference in the indicated liquidity and debt between the ratios computed under lifo and the ratios computed under fifo