Answered step by step

Verified Expert Solution

Question

1 Approved Answer

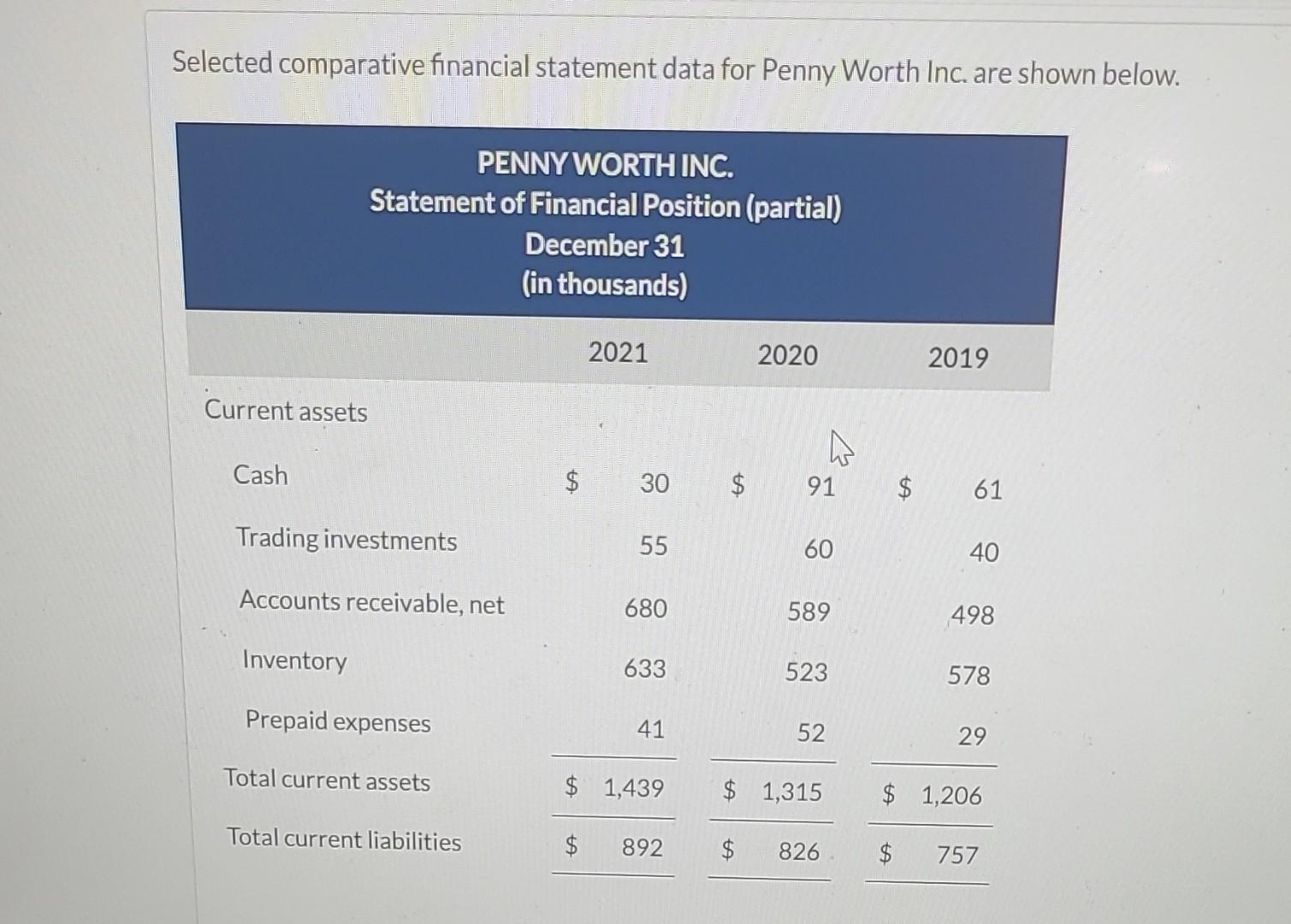

Selected comparative financial statement data for Penny Worth Inc. are shown below. Current assets Cash PENNY WORTH INC. Statement of Financial Position (partial) December

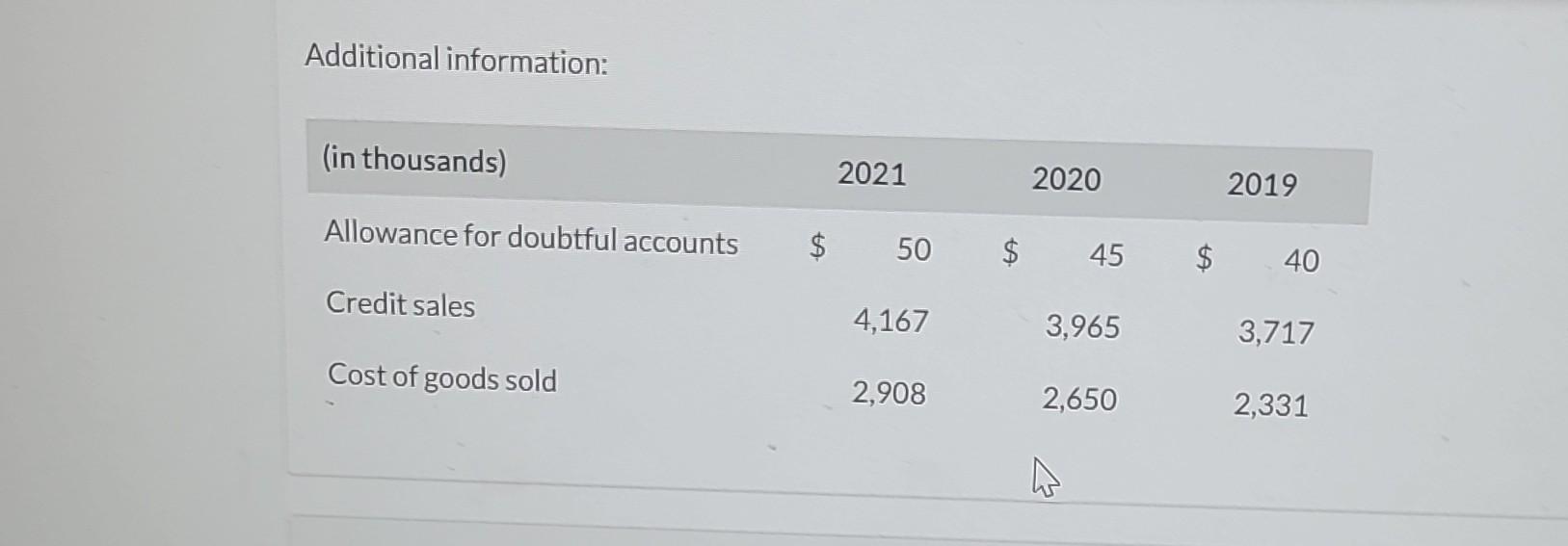

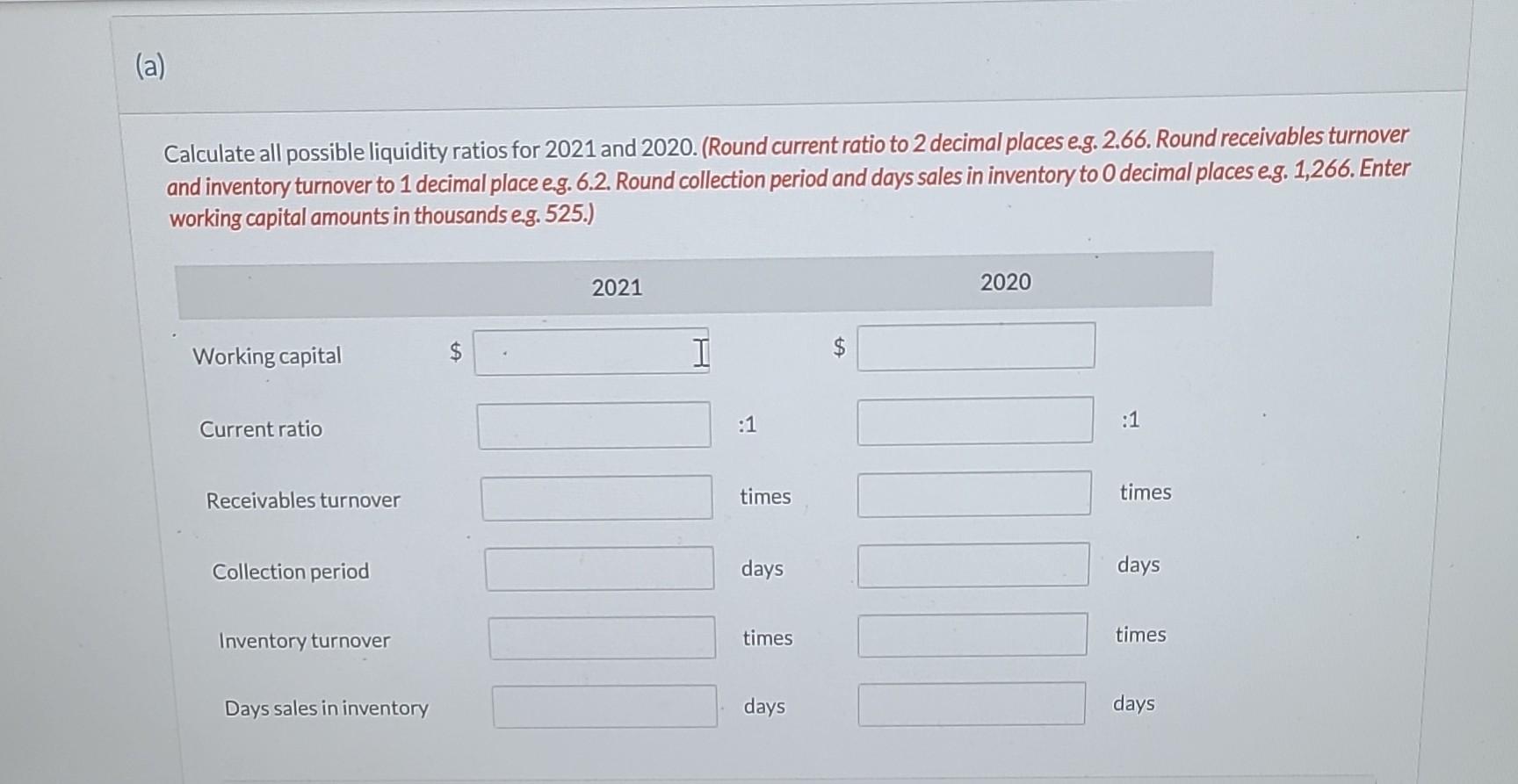

Selected comparative financial statement data for Penny Worth Inc. are shown below. Current assets Cash PENNY WORTH INC. Statement of Financial Position (partial) December 31 (in thousands) Trading investments Accounts receivable, net Inventory Prepaid expenses Total current assets Total current liabilities 2021 $ 30 55 680 633 41 $ 1,439 892 $ 2020 91 60 589 523 B 52 $ 1,315 $ 826 2019 $ $ 61 40 498 578 29 $ 1,206 757 Additional information: (in thousands) Allowance for doubtful accounts Credit sales Cost of goods sold $ 2021 4,167 2020 50 $ 45 $ 40 3,717 2,908 3,965 2019 2,650 2,331 (a) Calculate all possible liquidity ratios for 2021 and 2020. (Round current ratio to 2 decimal places e.g. 2.66. Round receivables turnover and inventory turnover to 1 decimal place e.g. 6.2. Round collection period and days sales in inventory to 0 decimal places e.g. 1,266. Enter working capital amounts in thousands e.g. 525.) Working capital Current ratio Receivables turnover Collection period Inventory turnover Days sales in inventory 2021 I :1 times days times days 2020 :1 times days times days

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Q Calculate all possible liquidity ratios for 2021 and 2020 Solution Working capital Working capital is computed as follows Working capital Total curr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started