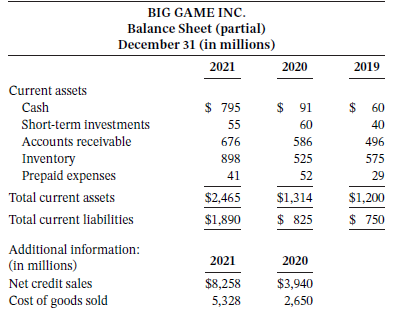

Big Game Inc. operates gaming stores across the country. Selected comparative financial statement data are shown below.

Question:

Big Game Inc. operates gaming stores across the country. Selected comparative financial statement data are shown below.

Instructions

a. Calculate the following liquidity ratios for 2021 and 2020.

1. Current ratio 5. Inventory turnover

2. Acid-test ratio 6. Days sales in inventory

3. Receivables turnover 7. Operating cycle

4. Collection period

b. Indicate whether each of the liquidity ratios calculated in part (a) is better or worse in 2021.

BIG GAME INC. Balance Sheet (partial) December 31 (in millions) 2021 2020 2019 Current assets $ 795 $ 60 $ 91 Cash Short-term investments 55 40 Accounts receivable 676 586 496 Inventory Prepaid expenses 898 525 575 41 52 29 $2,465 Total current assets $1,314 $1,200 $ 825 $ 750 Total current liabilities $1,890 Additional information: 2020 2021 (in millions) Net credit sales $8,258 $3,940 Cost of goods sold 5,328 2,650

Step by Step Answer:

a b 1 Current ratio Worse 2 Acidtest ratio Worse 3 Receivables turnover ...View the full answer

Accounting Principles Volume 2

ISBN: 978-1119502555

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Related Video

Days sales outstanding (DSO) is a measure of the average number of days that it takes a company to collect payment for a sale. DSO is often determined on a monthly, quarterly, or annual basis. To compute DSO, divide the average accounts receivable during a given period by the total value of credit sales during the same period and multiply the result by the number of days in the period being measured.

Students also viewed these Business questions

-

Comparative financial statement data of Tanfield, Inc., follow: 1. Market price of Tanfields common stock : $59.36 at December 31, 2012, and $46.65 at December 31, 2011. 2. Common shares outstanding:...

-

Comparative financial statement data of Bloomfield Optical Mart follow: Other information: 1. Market price of Bloomfield common stock: $82.20 at December 31, 2010, and $52.96 at December 31, 2009. 2....

-

Comparative financial statement data of Hamden Optical Mart follow: Other information: 1. Market price of Hamden common stock: $102.17 at December 31, 2012, and $77.01 at December 31, 2011 2. Common...

-

Your organisation requires all new business documents be scanned and saved electronically once they are checked for accuracy. They also require that you update the database system with the new...

-

(a) is an unbiased estimator of Y. Is 2 an unbiased estimator of 2Y? (b) is a consistent estimator of Y. Is 2 a consistent estimator of 2Y?

-

List the steps that may be taken to get a new internal audit shop up and running and discuss the issues that need to be considered when developing the new audit service for an organization.

-

P5-19 (Appendix 5B: Taccounts analysis) Mayberry Enterprises has two sources of revenue. It sells advertising displays to retail firms and provides a consulting service on how to mount and use these...

-

Pierre Corporation acquired 75 percent of Selene Corporation's common stock for $20,100,000 on January 2, 2011. The estimated fair value of the noncontrolling interest was $5,900,000. Selene's book...

-

Where has the Tax Act created jobs

-

Which series has the highest beta. BraveNewCoin Liquid Index for Bitcoin 1D BNC Trading Brave Ne Yellow Green Blue Orange

-

Comparative financial statements for Click and Clack Ltd. are shown below Additional information: 1. Seventy-five percent of the sales were on account. 2. The allowance for doubtful accounts was...

-

Comparative financial statements for Track Ltd. are shown below. Additional information: 1. All sales were on account. 2. The allowance for doubtful accounts was $5,000 in 2021, $4,000 in 2020, and...

-

What is the client-server model?

-

Is classroom management something you worry about? If so, you are in good company. Many teachers worry about this topic. The teacher in this video shows many great classroom management strategies....

-

ProForm acquired 60 percent of ClipRite on June 30, 2020, for $780,000 in cash. Based on ClipRite's acquisition-date fair value, an unrecorded intangible of $560,000 was recognized and is being...

-

During 2022, Jason and Vicki Hurting, who are married with two children, had the following tax information. Jason owns a landscaping business, and Vicki works as a sales executive for a manufacturing...

-

Which statement about environmental theory is true? It sees health as a social issue. It is reductionistic It states that there is a specific cause for every disease. It defines solutions in terms of...

-

Tracing Data Analytics Red Flags Back to Source Documents Using Subpoenas 5-1 ANDERSON INTERNAL MEDICINE AND LARSEN CONVENIENCE STORE (CONSPIRACY AND LOAN FRAUD): TRACE TRANSACTIONS DISCOVERED DURING...

-

Hawthorne Golf, the maker of a sought-after set of golf clubs, was formed in 2015. The selling price for each golf club set is $1,700, variable production costs are $900 per unit, fixed production...

-

What are the before image (BFIM) and after image (AFIM) of a data item? What is the difference between in-place updating and shadowing, with respect to their handling of BFIM and AFIM?

-

Comparative financial statements for The Rose Packing Corporation are shown below. Additional information: 1. All sales were on account. 2. The allowance for doubtful accounts was $5,500 in 2017 and...

-

Comparative financial statements for Track Ltd. are shown below. Additional information: 1. All sales were on account. 2. The allowance for doubtful accounts was $5,000 in 2017, $4,000 in 2016, and...

-

Early in 2014, Nordstrom, Inc. began opening stores across Canada to compete against Hudson's Bay Company and other higher-end retailers. Selected financial data (in millions) for the two companies...

-

Chapter 26, Problem 17E Highmoor, a public listed company, acquired 80% of Slowmoors ordinary shares on 1 October 20x2. Highmoor paid an immediate $2 per share in cash and agreed to pay a further...

-

A company has EBIT of $250,000 in perpetuity. Its cost of debt and equity at different levels of debt is given below. The tax rate is 35%. Calculate the values of A, B, C, and D. Debt Kd Ke...

-

solve full question please EX-9B On February 1, 2011. Giant Corp. issued an 5800,000, 5%, two-year bond. Interest is payable quarterly each May 1, August 1, November 1, and February 1. Required Part...

Study smarter with the SolutionInn App